The post 410% Jump in Whale Transactions, Buy Signal? appeared first on Coinpedia Fintech News

ARB, the native token of Arbitrum, seems to be struggling but is currently at a make-or-break point due to rising investor attention and bearish market sentiment. Today, January 28, 2025, the overall cryptocurrency market has been facing notable challenges and is struggling to gain momentum.

410% Surge in ARB’s Large Transaction Volume

Amid this struggle, whales and long-term holders have shown strong interest and confidence in the asset, as revealed by the on-chain analytics firm IntoTheBlock. According to recent data, ARB has experienced a 410% surge in large transaction volumes, indicating that crypto giants are participating in the asset and potentially taking advantage of the current price decline.

However, ARB has attracted notable attention from whales after breaching the crucial support level of $0.65 during this bearish market sentiment. The substantial jump in large transaction volume suggests the recent support breakdown could be a fakeout.

$5 Million Worth of ARB Outflow

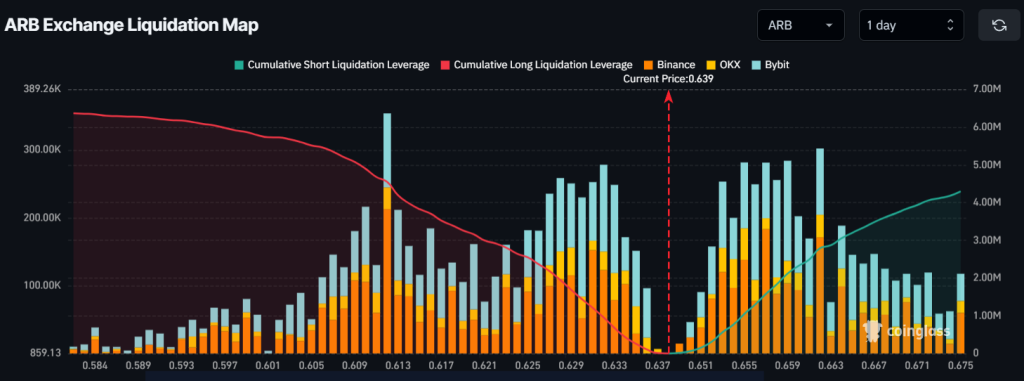

In addition to the notable participation of whales, investors and long-term holders are also found to be accumulating the tokens, as reported by the on-chain analytics firm Coinglass.

Data from spot inflow/outflow reveals that exchanges have witnessed a significant outflow of $5.05 million worth of ARB tokens in the past 48 hours. This substantial outflow from exchanges indicates potential accumulation, which could create buying pressure and fuel a further upside rally.

Current Price and Crucial Support

ARB is currently trading near $0.625 and has experienced a modest price decline of 0.25% in the past 24 hours. However, data from Coinglass reveals that the $0.61 level serves as a strong support zone, with traders holding $4.60 million worth of long positions.

If the current market sentiment remains unchanged and ARB fails to hold the $0.61 support level, there is a strong possibility that the $4.60 million in long positions could be liquidated, potentially leading to a 25% price decline toward the next support level at $0.47.