Ethereum (ETH) has had a turbulent week, with the price dipping to tag the critical $3,000 support level before recovering to current levels around $3,200. This sharp drop sparked fear among investors, as doubts about Ethereum’s performance for this cycle intensified. Many began questioning whether ETH could regain its momentum amid the broader market’s volatility.

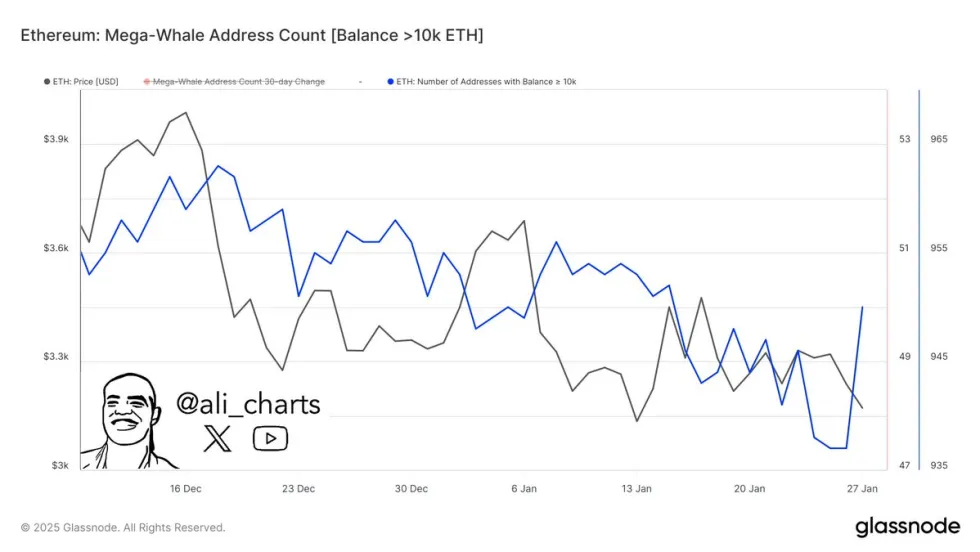

However, key on-chain metrics suggest that not all investors share this skepticism. Data reveals that major players are still accumulating ETH despite recent price action. In the past 24 hours alone, 13 new mega whales—wallets holding over 10,000 ETH each—have joined the network. This signals strong confidence among high-net-worth investors and institutional players, who appear to see the current price levels as an opportunity.

This significant accumulation activity suggests that big players are positioning themselves for a potential breakout. While smaller retail investors may be hesitant, the moves of these whales could indicate optimism for Ethereum’s long-term prospects. As ETH stabilizes around the $3,200 level, the market will be closely watching whether this accumulation trend leads to renewed bullish momentum and a stronger recovery in the weeks ahead. The coming days could be pivotal for Ethereum’s trajectory in this market cycle.

Ethereum Enters A Recovery Phase

Ethereum has faced significant selling pressure since late December, shedding over 25% in value during this period. The prolonged downturn has tested investor confidence, yet recent price action suggests that the bearish phase may be nearing its conclusion. Analysts are now optimistic about a reversal and potential recovery, with Ethereum showing signs of regaining its footing.

Top crypto analyst Ali Martinez has highlighted compelling data supporting this bullish outlook. According to his analysis shared on X, 13 mega whales—wallets holding over 10,000 ETH each—have joined the Ethereum network in the last 24 hours.

This surge in large-scale accumulation suggests that big players are taking advantage of current price levels, positioning themselves for an anticipated recovery. Significant whale activity often serves as a strong indicator of confidence among institutional and high-net-worth investors, who typically operate with a long-term perspective.

At its current levels, Ethereum appears to be building a strong base of support. This accumulation by mega whales aligns with the broader market sentiment that ETH is poised for a bullish phase once the selling pressure subsides. If ETH can hold its ground and reclaim key resistance levels, the next upward move could mark the beginning of a strong recovery and sustained bullish momentum in the months ahead.

ETH Testing Crucial Liquidity

Ethereum is trading at $3,190 after finding strong support at the $3,000 mark, which aligns with the 200-day moving average. This key level has acted as a critical long-term indicator of strength, and ETH’s ability to hold above it suggests the potential for a trend reversal. After weeks of downward pressure, the current price action indicates that ETH might finally be ready to shift from its bearish trajectory.

For a complete confirmation of a bullish reversal, Ethereum must break above and hold the $3,500 level, a significant resistance zone that has capped its upward movement in recent weeks. Reclaiming this level would likely restore investor confidence and signal the start of a new uptrend. However, market conditions remain volatile, driven by speculation and broader macroeconomic uncertainties, which may delay ETH’s breakout.

Despite the challenges, Ethereum’s recovery above the 200-day moving average is a positive sign for the long-term outlook. Investors are cautiously optimistic as ETH stabilizes at current levels. Patience may be required, but the recent price action suggests ETH is setting the stage for a potential rally once it overcomes key resistance and the broader market finds direction.

Featured image from Dall-E, chart from TradingView