The post Coinbase vs. SEC: Senator Cynthia Lummis Fights Back Against Regulatory Overreach appeared first on Coinpedia Fintech News

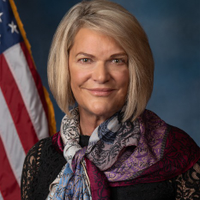

The ongoing legal battle between Coinbase and the U.S. Securities and Exchange Commission (SEC) has taken a new turn as Senator cynthia lummis

cynthia lummis

Cynthia Lummis is a senator from Wyoming, United States. She has a net worth ranging from $20 million and $75 million. On her son-in-law's advice, she purchased Bitcoin and became the first U.S senator to possess cryptocurrency. She possesses no less than $230,000 worth of Bitcoin. She adopted office on January 3, 2021, the term terminates on January 3, 2027. She has always been focused on advocating for Wyoming's future. She struggled her entire career fighting for Wyoming families, communities, businesses, and values. Beginning at the halls of the Wyoming House to the Halls of the U.S. House.

Lummis was born on September 10, 1954, and graduated from the University of Wyoming, earning a bachelor's degree in animal science, and biology. She also achieved a Juris Doctor from the University of Wyoming College of Law. Her career experience comprises working as general counsel to previous Wyoming Governor Jim Geringer, Wyoming House of Representatives, as a treasure of Wyoming, and in the United States House of Representatives from Wyoming's at-large congressional district.

In 1990, she also worked as the chair of Mary Mead's gubernatorial campaign and Ray Hunkins's gubernatorial campaign, in 2006, also served on Bob Dole's presidential steering committee in Wyoming. Through her firmly beneficial crypto position, she developed the reception and fair guidelines of computerized resources in the United States. She voluntarily organized a great foundation for herself as a significant Bitcoin financial backer. She is professed to continue encouraging the developing cryptocurrencies industry in the United States and all over the world in 2022. Her urge for transparency on cryptographic forms of money and stable coins in U.S. regulation will maintain on becoming tremendous. She had been always looking for a store of value, and she believes bitcoin specifically is a great store of value and knew that scarcity will protect its value going into the future, unlike the U.S. dollar that they are printing more of every single day.

Investor

has stepped in to support the crypto exchange. She has filed an amicus brief, accusing the SEC of abusing its power and bypassing Congress to impose unclear rules on digital assets.

Lummis Challenges SEC’s Regulatory Tactics

On January 24, Senator Cynthia Lummis submitted an amicus brief to the U.S. Court of Appeals for the Second Circuit, siding with Coinbase in its legal dispute with the SEC.

In her filing, Lummis criticized the regulatory approach taken by the agency under former Chair gary gensler

gary gensler

Gary Gensler is a pioneer and the current chair of the U.S. Securities and Exchange Commission. He has extensive experience that spans Wall Street, government regulation, and an angel teaching about cryptocurrencies and blockchain at MIT. Gary S. Gensler was on born October 18, 1957, in Baltimore, Maryland.He graduated from Pikesville High School in 1975, where he was later given a Distinguished Alumnus award. He also earned a degree in economics.Gensler served in the United States Department of the Treasury as Assistant Secretary for Financial Markets from 1997 to 1999, then as Undersecretary for Domestic Finance from 1999 to 2001He has expressed his desire to present crypto-related approach changes later on that include token commitments, decentralized finance, stablecoins, guardianship, exchange-traded resources, and advancing stages.

Chairman

stating that it lacks transparency and undermines the separation of powers.

Lummis argues that the SEC has been unfairly reinterpreting existing securities laws without clear guidelines and imposing those rules on crypto firms without prior notice.

Meanwhile, Lummis’s filing strengthens Coinbase’s case, noting that the SEC has misapplied the Howey Test, which determines whether an asset is a security. She believes Congress, not the SEC, should decide how digital assets are classified and regulated.

SEC’s Leadership Change Could Alter Its Stance?

The timing of Lummis’ intervention is significant, as the SEC is experiencing a leadership shift. With Mark Uyeda now serving as Acting Chair, there is speculation that the agency might take a more balanced approach.

Uyeda has already introduced a dedicated crypto task force to develop a clearer regulatory framework, signaling a potential change in direction.

Coinbase’s Fight Continues Amid Global Expansion

The SEC first sued Coinbase in 2023, accusing the company of operating as an unregistered broker, exchange, and clearinghouse. Coinbase has fought back, arguing that the agency’s rules were never designed for digital assets and that its enforcement actions are inconsistent.

Despite its legal battle in the U.S., Coinbase continues to expand globally. Recently Coinpedia news reported that the exchange secured a Virtual Asset Service Provider (VASP) license in Argentina, allowing it to legally operate and grow its presence in the region.

Under the leadership of Matías Alberti, Coinbase aims to build a stronger foothold in the Latin American crypto market.