The post XRP News Today: Ripple Waits for the SEC Appeal While NovaDEX Gets Traction on Solana appeared first on Coinpedia Fintech News

There’s been minimal activity with XRP’s price over the past few days and it seems that investors are waiting for the SEC appeal before they make any bigger moves.

January 30th is the next key date that the market is closely watching, and it could dictate the short-term future of XRP.

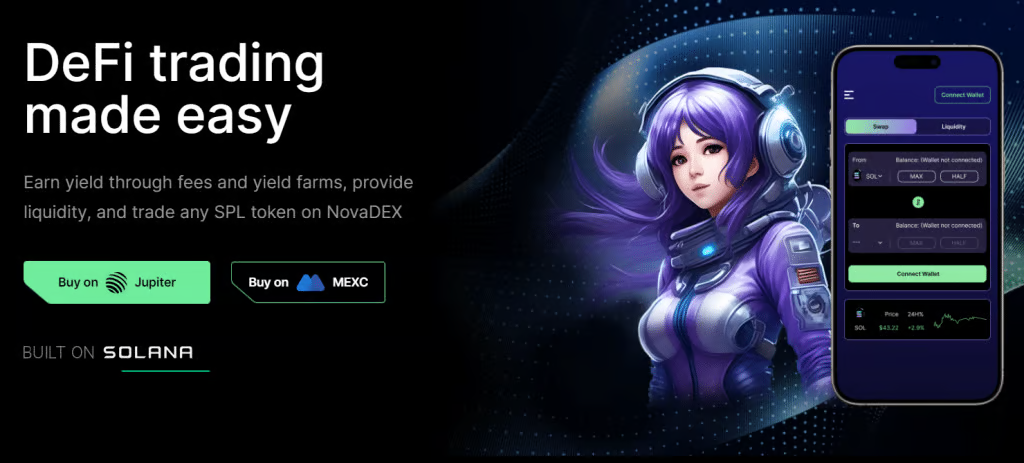

At the same time, NovaDEX, a Solana-based high-performance DEX could gain more whale attention with its robust staking pool and yield farming tools. Just recently, NovaDEX’s mainnet went live and it already reached several important milestones.

Below, we’ll check out all the latest details on both platforms.

XRP News Today: SEC Appeal Strategy and Its Ripple Effects on XRP-Spot ETFs

On January 23, the SEC held a closed meeting on enforcement cases, including Ripple’s. With Mark Uyeda as acting Chair, known for opposing non-fraud enforcement, a shift in priorities is possible.

A withdrawal of the SEC’s appeal requires a quorum vote, and the recent rollback of SAB 121 suggests procedural changes. The next closed meeting on January 30 may offer clarity on legal settlements and enforcement actions.

If the SEC drops its appeal, it could open the door for XRP-spot ETF approvals, a highly anticipated move. Meanwhile, XRP’s RSI at 65 indicates room for further gains before hitting overbought levels.

NovaDEX Might be a Promising New Decentralized Exchange with Potential DeFi Innovations and Tools

NovaDEX, a recently launched decentralized exchange (DEX), might introduce several exciting features to its users, including concentrated liquidity pools, yield farming opportunities, and staking options.

Since its mainnet launch, the platform has shown encouraging signs of adoption, with over 85,000 transactions reported across various activities.

Early traction is evident, with approximately 1,900 users engaging with the platform. This initial growth could signal increasing interest in NovaDEX’s offerings and its potential role within the broader DeFi ecosystem.

What might differentiate NovaDEX is its permissionless pool model, which could allow users to create liquidity pools for any supported token. This flexibility could provide users with more options compared to traditional DEX platforms.

Additionally, NovaDEX may offer competitive rates, including lower slippage and potentially higher APRs, which could make it an attractive option for liquidity providers seeking passive opportunities.

Designed with user-friendliness in mind, the platform might simplify complex DeFi activities like token swapping, liquidity provision, and yield farming. This ease of use could appeal to both seasoned users and those new to decentralized finance.

NovaDEX Could Create a Community-Driven Trading Ecosystem

NovaDEX wants to embrace a decentralized governance model, potentially enabling its community members to play an active role in shaping the platform’s future.

This approach could empower users to participate in key decisions and contribute to the project’s growth.

Security seems to be a top priority for NovaDEX. The platform has completed a smart contract audit through QuillAudits, which helps ensure the safety of user assets and build trust in its community.

NVX might serve as a central element, granting access to various features and benefits within the protocol. NVX has already reached significant milestones, including listings on established centralized exchanges like MEXC and decentralized platforms such as Raydium and Jupiter.

The Takeaway

While XRP awaits the SEC appeal and next regulatory steps, new projects could step in and start gaining traction.

One project that may be particularly interesting is NovaDEX. This DEX platform has already reached some important milestones and could generate substantial buzz in the upcoming weeks with its robust tools.

—-

This article is not financial advice. Past results are not indicative of future returns, and the crypto market is inherently unpredictable. Readers must conduct their own thorough research before purchasing any crypto coin or token. These forward-looking statements are subject to risks and may remain unchanged.