The Bitcoin (BTC) market recorded more losses than gains in the past week resulting in a net price decline of 2.37%. Nevertheless, investors and market experts alike remain highly bullish on the premier cryptocurrency’s potential for substantial gains amidst the current bull run.

Bitcoin Ready For $150,000 Price Target – Analyst

In a Quicktake post on CryptoQuant, an analyst with username Percival has touted Bitcoin to achieve a $150,000 price in the current bull cycle. Commenting on the present market state which might be unsettling to certain investors, Percival states that Bitcoin’s price trajectory, marked by sharp upward spikes and periods of consolidation, resembles the structural dynamics of any mature financial asset.

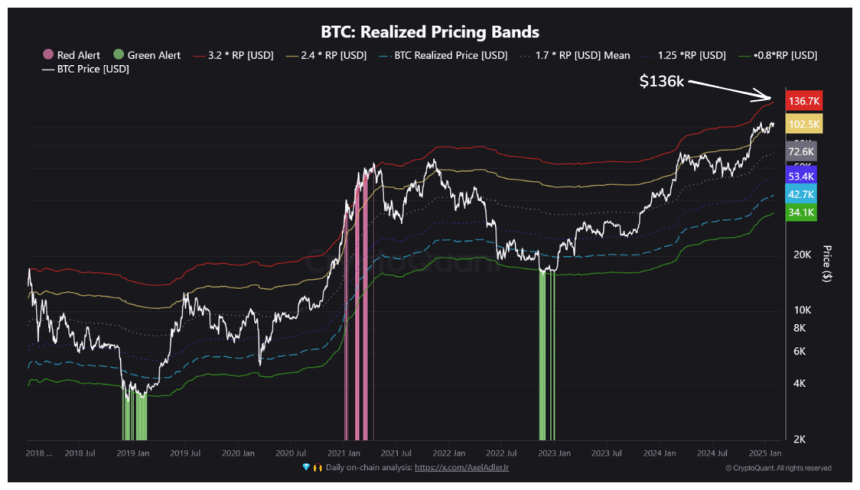

In regards to future price movement, the analyst references a Fibonacci expansion from Bitcoin’s cycle low at $15,450 in November 2022 to the consolidation at $48,934 in 2024. In translating this historical data to the current market, Percival identifies a Bitcoin price target between $136,000 – $150,000 which is further supported by data from Bitcoin Realized Price Bands – a market metric that analyses supply based on different buying levels.

However, for Bitcoin to trade at $150,000, the asset must attain a total market cap of $3 trillion. Currently, there is strong historical data in support of this postulation. For context, Percival explains that Bitcoin Realized Cap rose by 470% in the previous bearish cycle in 2021. Presently, the realized Cap has only grown by 111% suggesting more potential for market growth.

Furthermore, the analyst identifies possible sources of demand to drive up the projected $3 trillion market expansion, one of which is the US Bitcoin Spot ETFs.

Notably, these investment funds registered nearly $40 billion in inflow during their debut trading year in 2024. With the US expected to adopt a pro-crypto stance in the Donald Trump administration, institutional demand is also likely to surge stronger through these ETFs. In addition, Percival includes the Bitcoin Futures market which is currently valued at $95 billion as another potential bullish driver for the projected market expansion

BTC Price Overview

At the time of writing, Bitcoin trades at 102,334 reflecting a 1.66% decline over the last day. However, the flagship cryptocurrency is up by 7.93% on its monthly chart after a strong positive performance in January.

According to data from the prediction site CoinCodex, market sentiments remain bullish with the Fear & Greed Index of 76 which indicates extreme greed among investors. Looking forward, the analysts at Coincodex predict Bitcoin could trade at $113, 658 and $132,823 in the next five and thirty days respectively. In particular, they project the digital asset to have crossed $150,000 in the next three months.