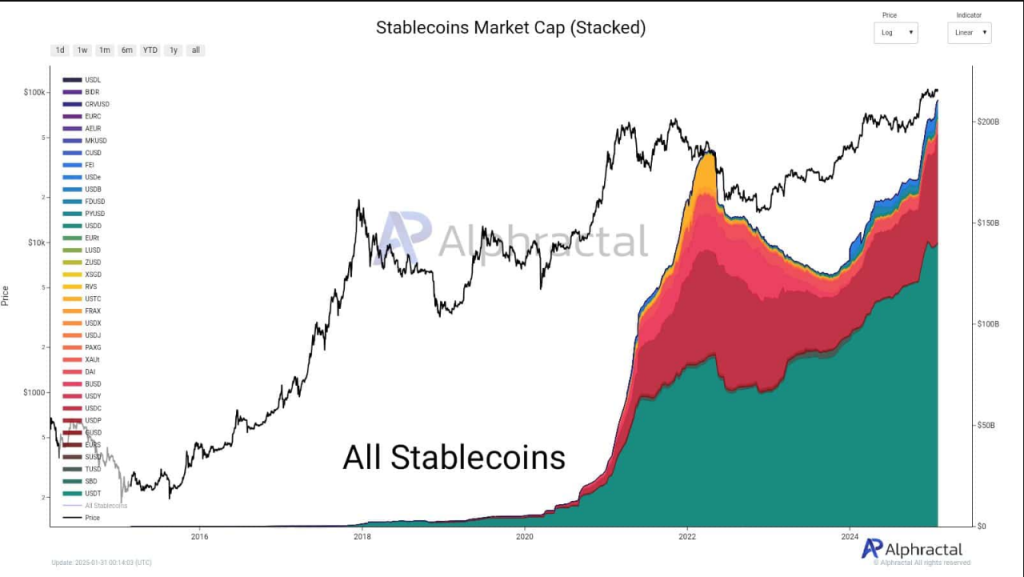

Stablecoins, often taking the backseat from Bitcoin and other top cryptocurrencies, are now in the spotlight. According to on-chain data, the stablecoins market has surged to over $200 billion, with Tether’s USDT and USDC as the main growth drivers.

Based on CryptoQuant’s data, the stablecoins market increased by $37 billion since the first week of November last year, when Donald Trump won his second presidency. The same CryptoQuant report shared that the stablecoin’s performance may spill over to Bitcoin and other cryptos.

Alphractal shared the same data; this time, it highlights the growing role of USDC in the stablecoins segment. According to Alphractal, USDC is eating up the share of USDT, and other altcoins are fueling its rise in the industry.

USDC Nearing Its Key Resistance Level: Alphractal

According to Alphractal, the stablecoins market’s steady but steady expansion, with Tether at the top, is evidence of its tenacity. According to recent market data, altcoin trades are helping USDC gain traction. The research claims that altcoin sales frequently move to USDC, boosting the market’s supply.

Stablecoin Market Cap Surpasses $211B – USDC Gains Momentum!

Since 2023, the stablecoin market has grown significantly, mainly driven by USDT (Tether). However, recently, USDC has been gaining an edge over other stablecoins.

This trend is occurring due to the recent drop in… pic.twitter.com/IRKrQErmCE

— Alphractal (@Alphractal) January 31, 2025

However, this coin is nearing its resistance level, and its replicating price movements were last seen in 2021. Unlike its rival, Tether’s USDT, USDC enjoys strong institutional backing and regulatory clarity. These are the primary reasons many investors and institutions prefer USDC over Tether’s USDT.

What About The Other Stablecoins?

USDC and USDT are still the most popular stablecoins, but smaller stablecoins have not been growing since 2023.

The total market value of these alternative stablecoins has stayed mostly the same, indicating there has been little new development or growth beyond the two main coins.

The other coins’ perceived poor adoption and popularity raise questions about the prospects of stablecoins. Like USDT, many of these “smaller stablecoin projects” face liquidity issues, lack of institutional support, and regulatory uncertainty. While it’s good that the overall stablecoin market cap is growing, it’s also alarming that it’s only dominated by two coins: USDT and USDC.

Bullish Or Bearish: USDC’s Short-Term Outlook

USDC’s current price action is nearing a critical resistance level, similar to its all-time high in 2021. If it continues to dominate and move past this resistance, this can translate to higher risk aversion, with capital moving away from meme or altcoins. In short, it’s a bearish signal since people are looking for stability.

It’s also interesting to note that USDC rose when altcoins crashed in price. This indicates that many investors are securing their gains.

Featured image from InfoMoney, chart from TradingView