The latest on-chain data shows that the Bitcoin network activity has been waning over the past few months, with the blockchain metric reaching a new low recently.

Why Is The Bitcoin Network Activity Falling?

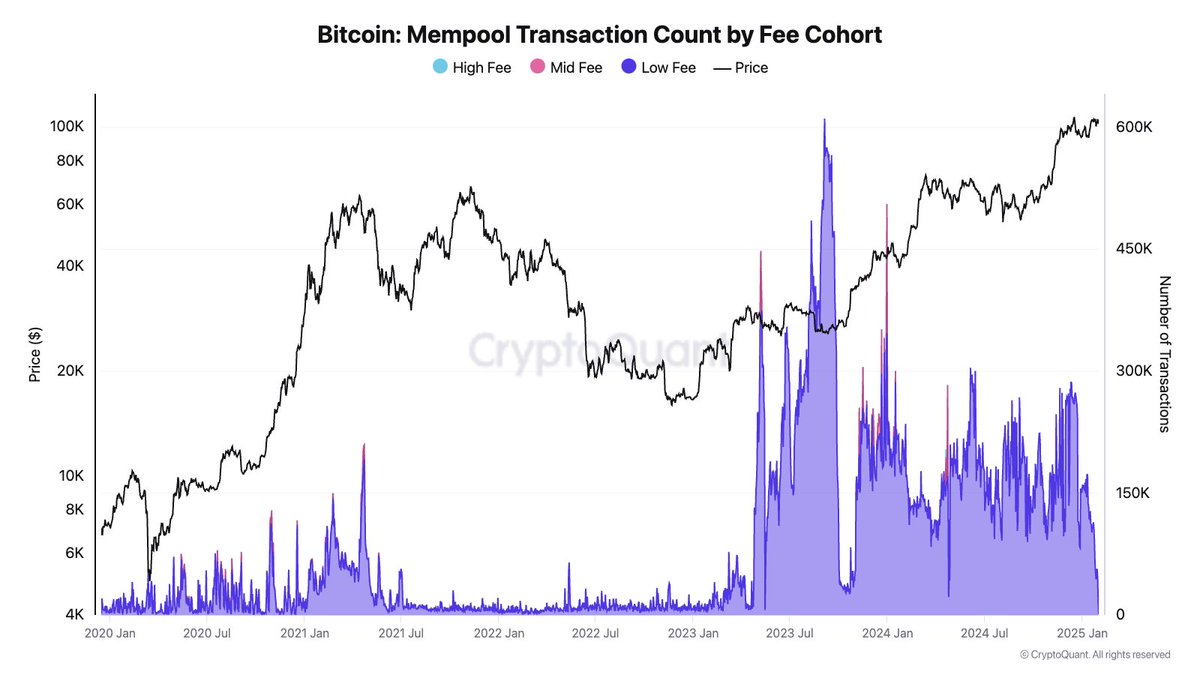

In a new post on the X platform, CryptoQuant head of research Julio Moreno discussed how Bitcoin is witnessing an unusual period of low transaction activity, with the mempool almost empty and transaction fees falling to 1 sat/vB. This represents the lowest level of network activity since March 2024, indicating a notable decline in on-chain demand.

For context, the mempool refers to a temporary storage area where pending Bitcoin transactions await processing. The mempool usually remains congested during periods of elevated on-chain demand and network activity. However, new on-chain data shows that most transactions have been confirmed, leaving the mempool nearly empty.

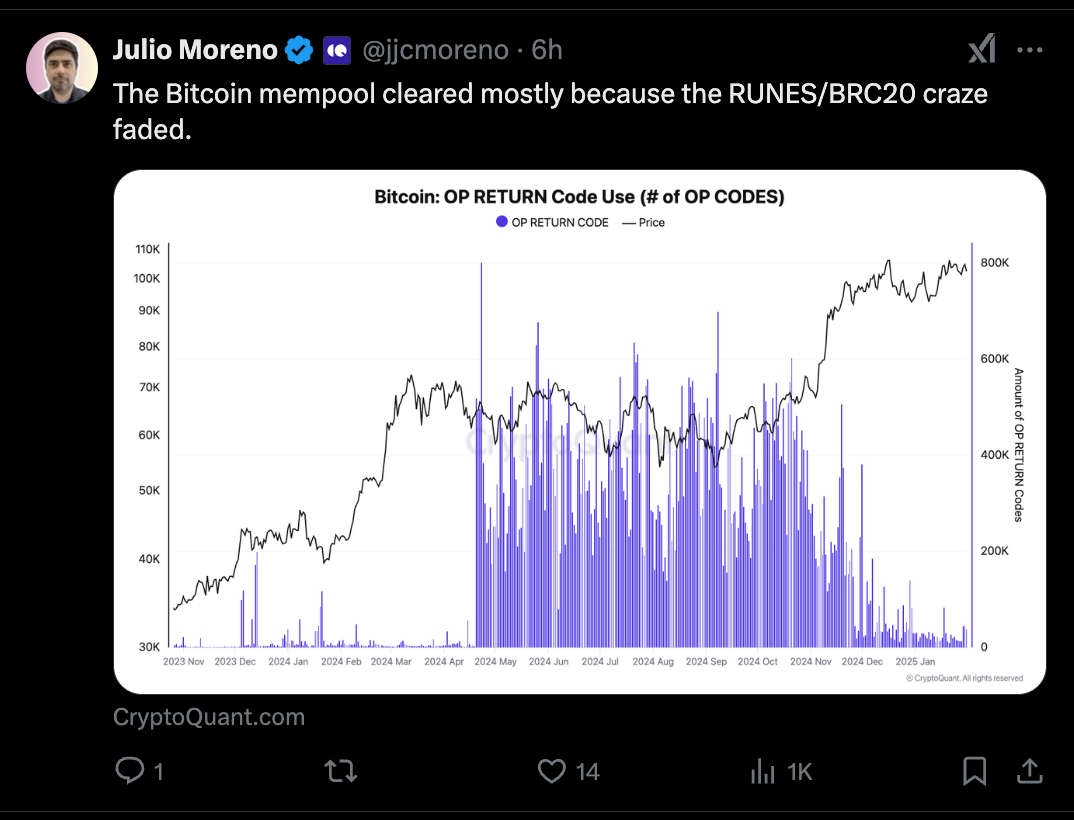

A nearly empty mempool is a rare phenomenon often associated with waning on-chain activity or shifting market dynamics. According to Moreno, the major contributor to this decline is the fading excitement around Runes and BRC-20 tokens.

Runes and the BRC-20 token standard are protocols that enabled the creation and minting of fungible and non-fungible tokens on the Bitcoin blockchain. While these protocols were met with significant hype upon launch, the initial excitement didn’t translate to sustained use.

However, at the peak of the Runes and BRC-20 frenzy, the number of confirmed transactions on the Bitcoin network crossed the 1.5 million milestone in a single day. Specifically, the pioneer blockchain processed over 1.6 million unique transactions between sender and receivers on April 23, 2024, with the launch of Bitcoin Runes playing a pivotal role.

The decline in transaction count has broader implications for various components of the pioneer blockchain, including miner revenues. Miners rely on transaction fees as another source of income, especially as block rewards have been further slashed since the recent halving event. Hence, an extended period of low fees could impact mining profitability, potentially influencing network hash rate distribution.

Implications On BTC Price

An almost-empty mempool and low transaction activity are not exactly the best combinations for positive price action. Specifically, it could suggest low speculative interest and reduced investor enthusiasm, leading to a consolidation of the Bitcoin price.

As of this writing, BTC is valued at around $100,450, with a nearly 2% decline in the past 24 hours. According to CoinGeko data, the premier cryptocurrency has lost roughly 3.5% of its value in the last seven days.