An analyst has pointed out how Solana (SOL) has just seen a buy signal on the same indicator that earlier called for selling XRP (XRP).

Solana Has Seen A Buy Signal On The TD Sequential

In a new post on X, analyst Ali Martinez has discussed about a Tom Demark (TD) Sequential signal that Solana has displayed on its daily price chart. The “TD Sequential” here refers to an indicator from technical analysis (TA) that’s used for locating probable points of reversal in an asset’s price.

The TD Sequential involves two phases: setup and countdown. In the first of these, the setup, candles in the chart of the same color are counted up to nine (with it not mattering whether the candles are consecutive or not). Once the candles are in, the setup is to be complete and the asset could be assumed to have reached a potential location of turnaround.

As soon as the setup is done with, the second phase, the countdown, kicks off. In this phase, too, candles of the same polarity are counted up, but this time, the phase doesn’t end until thirteen of them are in. When the countdown ends, the coin could be considered to have arrived at another possible reversal.

Naturally, where the cryptocurrency heads off after a TD Sequential phase depends on the candles that led to the phase’s completion. Red candles imply a reversal to the upside, while green candles indicate a potential top has been reached.

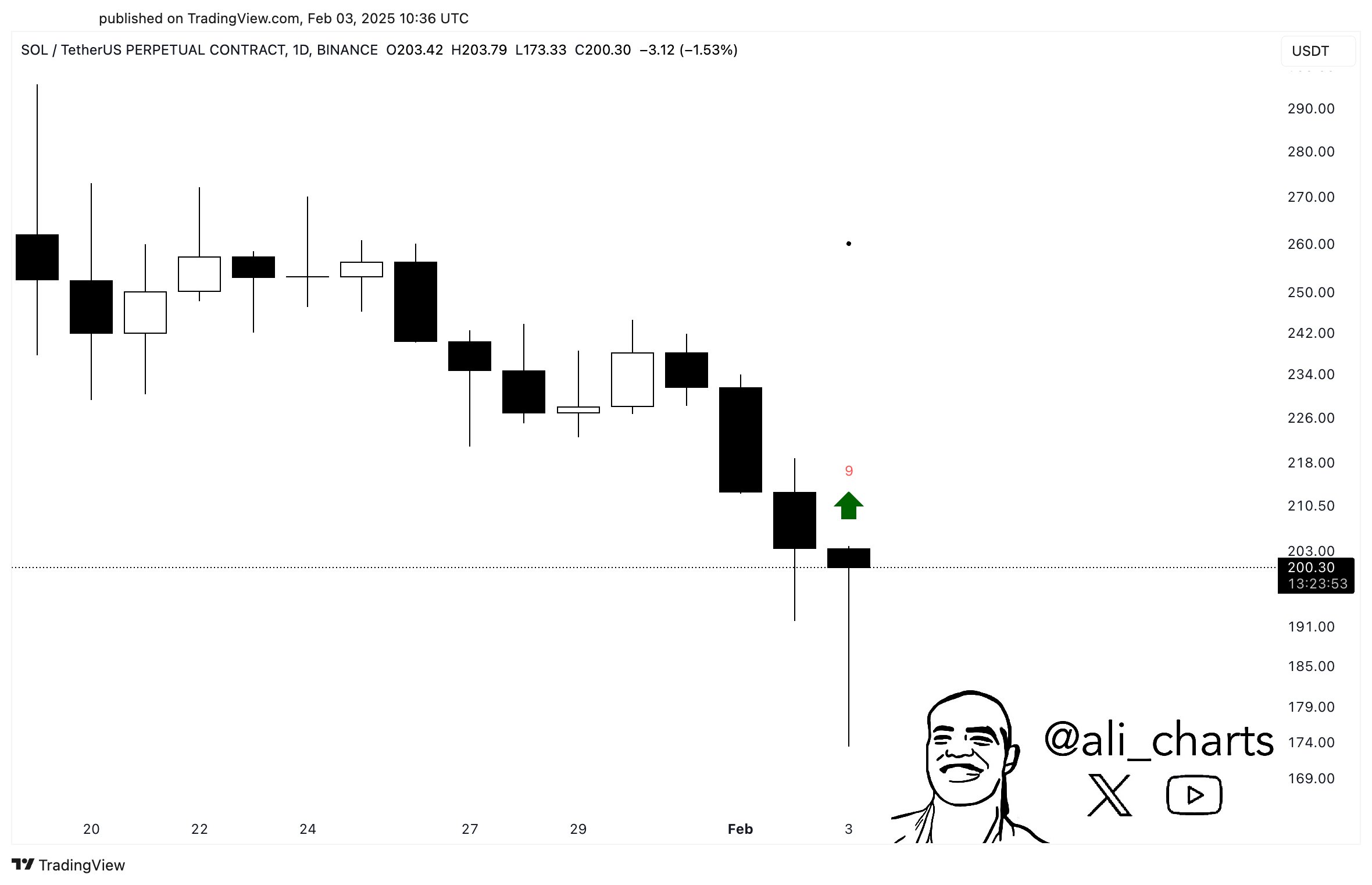

Solana has recently completed a TD Sequential phase of the first type on its 1-day price chart. Below is the chart shared by the analyst, that shows this pattern for the asset.

As is visible in the graph, Solana has finished a TD Sequential setup with nine red candles recently, which implies that the asset could have arrived at a bottom.

A week ago, XRP also witnessed a signal in the indicator, as Martinez has pointed out in another X post. Here is the chart for the setup that the coin formed:

From the graph, it’s apparent that XRP saw a sell signal on the TD Sequential last week. The pattern appears to have held for the cryptocurrency, as its price has crashed since the signal has emerged.

It now remains to be seen whether the TD Sequential would hold for Solana as well and result in a fresh rally for the asset. So far, signs are looking in the right direction as SOL has seen a bit of a rebound from its lows.

SOL Price

Solana briefly went under the $180 mark during the crash, but the asset has since bounced back to $207.