Major fluctuations in the Ethereum (ETH) market yesterday triggered a wave of reactions across social media, with one Ethereum co-founder claiming that certain large holders—or “whales”—were deliberately pushing the asset’s price downward.

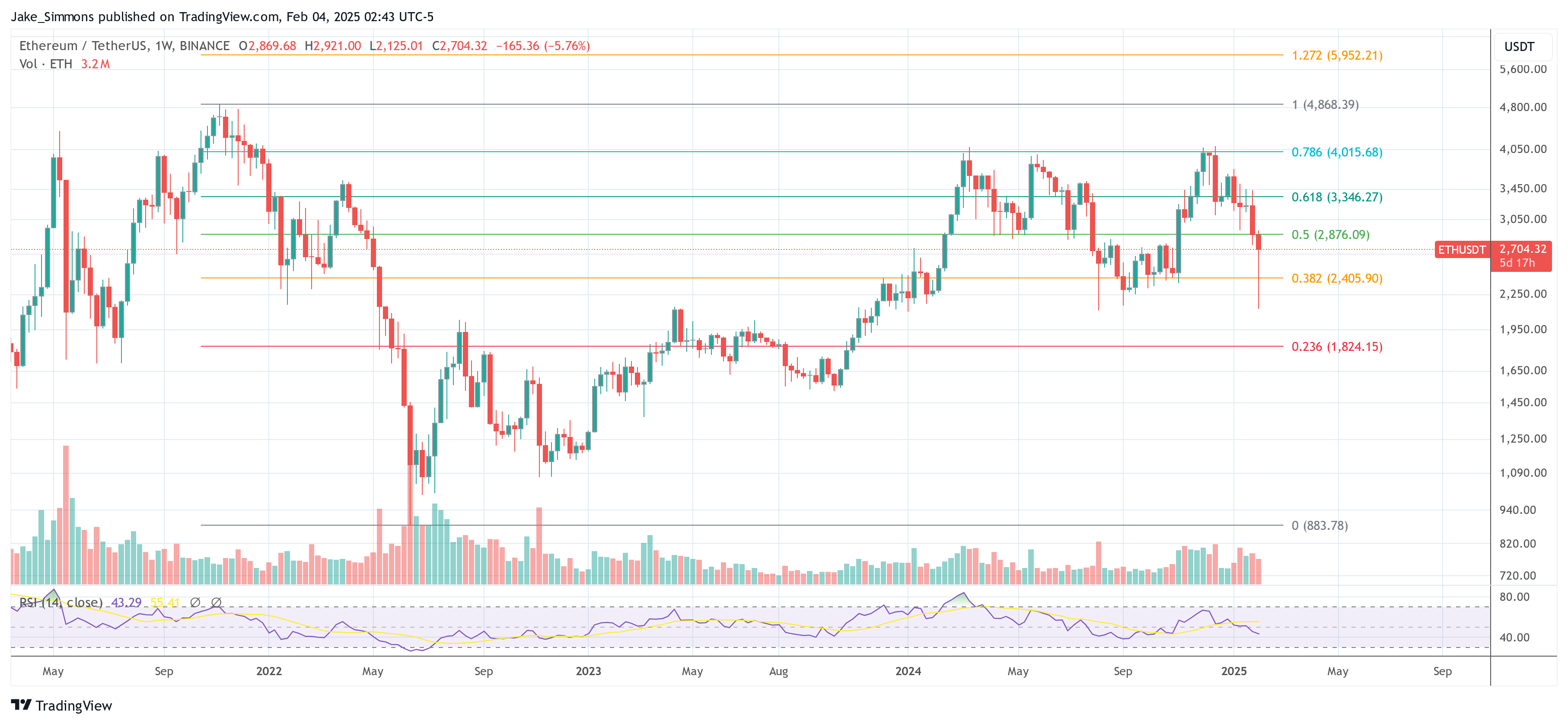

The activity reached a fever pitch on Monday, February 4, when the ETH price swung from around $2,900 to as low as $2,120 before bouncing back sharply. Despite the intraday plunge, Ether ultimately closed the day sporting a 26% green wick—an uncommon price rebound in such a short window.

Ethereum Price Manipulated By Whales?

Analysts attributed the dramatic movement to external macroeconomic forces, most notably the US trade war under President Donald Trump. After imposing tariffs on Mexico and Canada early in the day, the president later struck an arrangement that spurred a rapid recovery across global markets, including cryptocurrency.

The turbulence led one observer, identified simply as “intern” (@intern), the director of growth at Monad, to post a stark sentiment on X: “ETH is dying right in front of us. honestly never thought this would happen.”

In response, Ethereum co-founder and ConsenSys CEO Joseph Lubin offered a composed outlook, underscoring that these types of price swings are not unusual for the digital asset: “It happens regularly. Then it surges. What we are seeing is whales taking advantage of economic turmoil and negative sentiment to shake out weak hands, run stops, and then buy back when they can run that same playbook in reverse.”

Lubin’s statement presents a cyclical understanding of crypto volatility, implying that larger players capitalize on market anxiety—often exacerbated by macro developments—to pressure less resilient investors into selling.

Several prominent crypto traders also commented on the events, specifically on accusations of whale-led manipulation.

One well-known figure, Hsaka (@HsakaTrades), advised newcomers not to assume ETH’s decline was driven purely by organic market sentiment: “Dear noobs, Ethereum is NOT naturally going down. It is being pushed down via whales placing spoofy sell orders on exchanges to make noobs and risk managers sell to ‘buy back lower’. They are stealing your bags and will make you buy back at a higher price.”

The notion of a concerted “spoofing” strategy—where large sell orders are placed and then canceled or only partially filled—has long circulated within crypto communities. The tactic reportedly aims to trigger panic sells, thereby letting so-called whales accumulate positions at more favorable price levels.

Prominent trader Pentoshi (@Pentosh1) offered a brief but pointed reaction, highlighting how ETH has underperformed relative to Bitcoin (BTC) over the past three years: “3 year shake out so far. Hope you’re right.”

The question of why whales would single out Ether in particular was raised by community member EVMaverick392.eth (@EVMaverick392): “Maybe I’ll sound naive, but why do whales perform this maneuver exclusively on ether?”

Lubin responded by drawing a parallel to conventional bank robberies and suggesting that the recent wave of unease surrounding the Ethereum ecosystem has made the asset a prime target: “Why do bank robbers rob banks— or used to? The (unjustified) FUD toward the Ethereum ecosystem is currently most pronounced.”

At press time, ETH traded at $2,704.