The post Shiba Inu Rally Imminent? 1.23 Trillion SHIB Moves into Wallet appeared first on Coinpedia Fintech News

Amid ongoing market uncertainty, Shiba Inu (SHIB), the popular and second-largest crypto meme coin, has gained attention from crypto enthusiasts and made a big move. Today, February 6, 2024, blockchain-based transaction tracker Whale Alert posted on X (formerly Twitter) that a crypto whale transferred 1.239 trillion SHIB tokens, worth $20.136 million, from the Kraken cryptocurrency exchange.

Whale Moves 1.23 Trillion SHIB

However, the wallet address for this transaction remains unknown, and such significant transactions following a massive price decline suggest potential accumulation. The current market sentiment appears bearish, as SHIB, along with major cryptocurrencies, has experienced significant price drops in recent days.

Shiba Inu (SHIB) Technical Analysis and Upcoming Level

Amid this market crash, SHIB has witnessed a price drop of over 35% and has reached the crucial support level of $0.000015, which has a history of price reversal.

Based on recent price action and historical momentum, if SHIB holds this support level, there is a strong possibility it could soar by 30% to reach the $0.000020 level in the coming days. However, the current sentiment seems unfavorable for the predicted level due to the ongoing economic tensions between the US, China, Canada, and Mexico.

Nevertheless, this level appears to be an ideal buying opportunity. SHIB is currently trading below the 200 Exponential Moving Average (EMA) on the daily time frame, indicating that it is in a downtrend.

Major Liquidation Levels

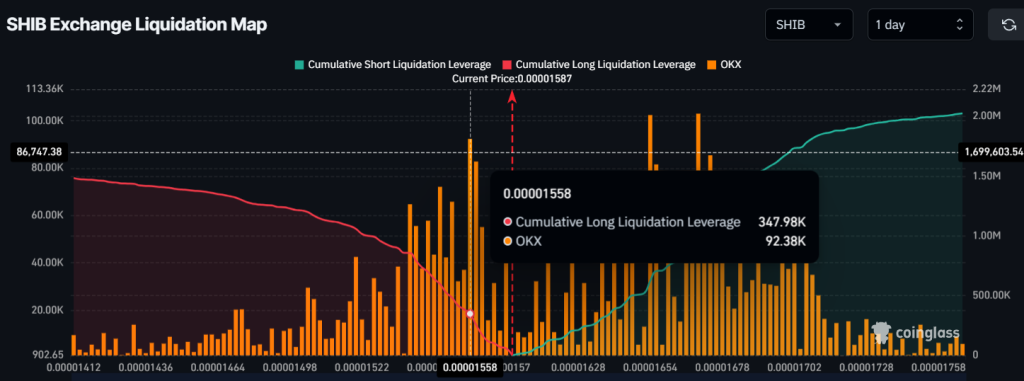

With this price action, traders are over-leveraged at the $0.0000155 level on the lower side and the $0.0000165 level on the upper side, according to Coinglass data.

If the market sentiment remains unchanged and the price falls below the $0.0000155 level, nearly $350k worth of long positions will be liquidated. Conversely, if the sentiment shifts and the price rises to the $0.0000165 level, approximately $625k worth of short positions will be liquidated.

When combining these on-chain metrics with the technical analysis it appears that traders holding short positions are dominating the asset.

Current Price Momentum

As of now, the meme coin is trading near $0.0000158 and has experienced a price surge of over 2.80% in the past 24 hours. However, during the same period, its trading volume dropped by 25%, indicating lower participation from traders and investors compared to previous days.

1,239,940,928,235

1,239,940,928,235