After a year of explosive price growth, the Solana based meme coin, BONK, has wiped out all of its 2024 gains, retracing approximately 76% from its peak. Despite this dramatic decline, a crypto analyst has suggested that this dip could be a strategic buying opportunity for investors rather than a cause for concern.

Solana‘s BONK Retraces 2024 Gains

The broader meme coin market has been experiencing a severe downturn, driven by the volatility and market changes caused by the recent Bitcoin price decline. Following United States (US) President Donald Trump’s trade war, meme coins like BONK, Dogecoin, Shiba Inu, and others crashed severely.

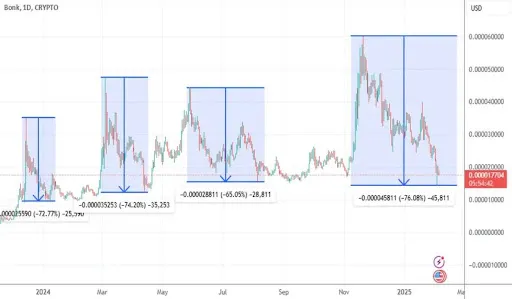

A recent chart analysis by a TradingView expert identified as ‘Cusdridge19523’ sheds light on the extent of Bonk’s severe decline. According to the analyst, Bonk has round-tripped virtually all of its gains from 2024, dropping over 76% from its most recent market peak.

This massive price crash marks the fourth major correction in the meme coin’s history. In 2024, Bonk experienced three significant price pullbacks that saw its price drop by more than 60%. At the beginning of the previous year, the meme coin fell 72.77% after reaching a local peak. Similarly, during the second quarter of 2024, BONK experienced a 74.2% price drop and declined again by 65.05% around the third quarter.

Its recent 76.08% in 2025 marks its highest crash compared to previous corrections in 2024. CoinMarketCap also reports that Bonks’ total gains for 2025 are about 78.82%. The meme coin experienced a gradual price drop to its current low, plummeting by 48.02% in one month and another 28.46% in the past week.

Currently, the BONK price is still in the red zone, having fallen by 1.28% in the last 24 hours. Its current price is $0.000018, aligning with past support levels and consolidation areas that triggered strong rebounds. The TradingView analyst has also revealed that the market may have to wait between 7 and 90 days for BONK to make a round trip and experience a potential price rebound.

Why Now Might Be A Good Time To Buy

As BONK reaches consolidation lows similar to past trends, the TradingView analyst believes its current price level presents an attractive buying opportunity for investors looking to take advantage of market dips. Historically, Bonk has shown a clear pattern of strong price reversals after sharp market corrections, giving investors more reason to believe that the token could once again deliver strong returns from market lows.

Additionally, the TradingView expert revealed that the broader crypto market outlook for 2025 is bullish, with speculation growing around Solana-based Exchange Traded Funds (ETFs). The introduction of a Solana ETF could also drive institutional interest, indirectly benefiting meme coins like BONK. The analyst has also highlighted the possibility of a BONK ETF, adding to the bullish fire and potentially driving demand.