The post WIF Rally Imminent? Whale Buys 9.50 Million Meme Coin appeared first on Coinpedia Fintech News

Despite the continuous price decline in Dogwifhat (WIF), the popular Solana-based meme coin is gaining significant attention from crypto enthusiasts. Recently, the popular blockchain-based transaction tracker Onchain Lens shared a post on X (formerly Twitter), revealing that a newly created wallet withdrew 9.47 million WIF tokens worth $6.90 million from Binance.

Whale Buys 9.50 Million WIF Meme Coin

Such a substantial WIF withdrawal suggests that this whale might have known something about the meme coin, especially as its price continues to fall and this newly created wallet made such transactions.

$6.60 Million Worth WIF Outflow

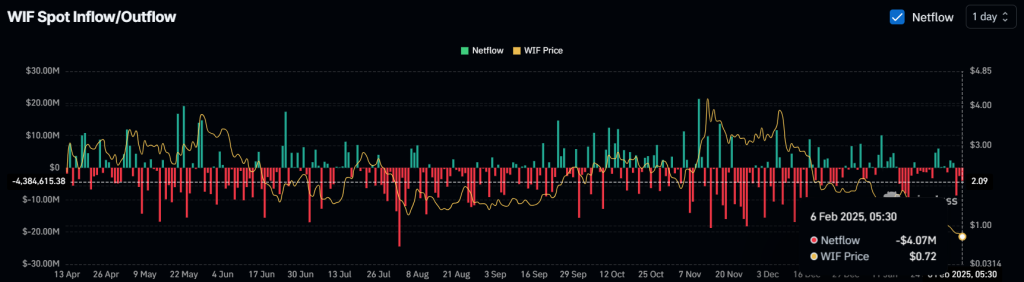

Besides this, some long-term holders and investors have also been accumulating the meme coin, as reported by Coinglass. Data from the spot inflow/outflow metrics revealed that exchanges have been witnessing continuous WIF outflows for the last three days after a period of inflows. However, in the past 48 hours, exchanges have seen an outflow of $6.60 million worth of WIF meme coins.

This massive outflow from exchanges indicates potential accumulation by whales and long-term holders, suggesting they might be seizing the current market sentiment and price drop to buy a significant amount of WIF meme coins. This accumulation could create potential buying pressure once the sentiment shifts.

Current Price Momentum

Despite these transactions and recent whale activity, WIF’s price remains unchanged. Currently, the meme coin is trading near $0.72 and has dropped over 8% in the past 24 hours. During the same period, its trading volume declined by 8%, indicating lower participation from traders and investors compared to previous days.

Traders Strong Interest in Short Positions

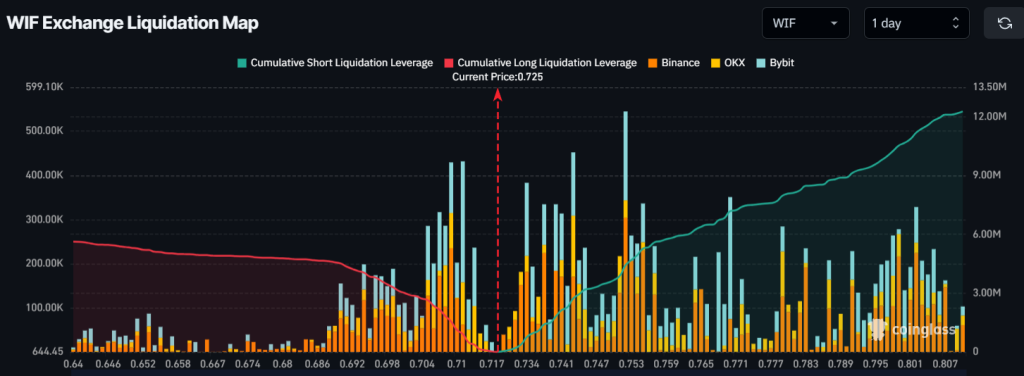

This bearish market sentiment and continuous price decline have been attracting notable interest from traders in short positions. At press time, traders holding short positions are dominating the market.

Data shows that traders holding long positions are over-leveraged at $0.709, with $1.55 million worth of long positions. Conversely, at $0.752, traders holding short positions are over-leveraged, holding $4.45 million worth of short positions.

This massive short position suggests that short sellers are capitalizing on the current market sentiment to liquidate long positions.