The post Trump’s Pro-Crypto Policies Drive Bitcoin Adoption in Japan Metaplanet Leads the Way appeared first on Coinpedia Fintech News

The change in the political climate in the United States has transformed the way companies, even non-US companies, see the Bitcoin market. In late 2014, MicroStrategy openly called on companies to adopt its bitcoin investment policy. Metaplanet, a Japanese company that adopted a ‘Bitcoin-first’ strategy inspired by MicroStrategy, has grown by at least 3,621,52% in the last year. Here is what you should know about the development.

Metaplanet’s Stock Skyrockets After Bitcoin Pivot

Metaplanent was a hotel development organisation. It was in 2024 that it shifted its focus to Bitcoin. It was MicroStrategy’s success as a Bitcoin-first company that inspired this Japanese company to turn towards Bitcoin.

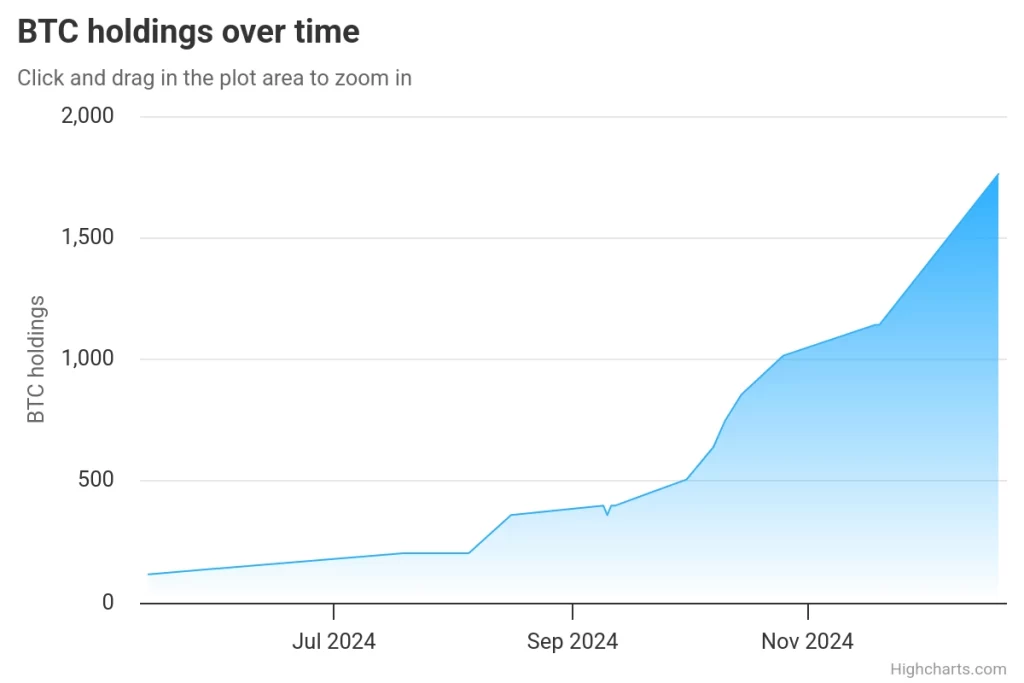

Metaplanet currently holds at least 1,762 BTC, worth at least $172,107,883.2. After the US election, the company purchased at least 619 BTC.

Notably, since November 5, the bitcoin market has surged by approximately 43.96%. Meanwhile, in the last one year, the market has increased by over 107.6%.

Trump’s Pro-Crypto Stance Fuels Bitcoin Demand in Japan

There are many reasons to assume that the victory of Donald Trump over Kamala Harris has shifted Japanese investors’ attitude toward Bitcoin.

During the election campaign itself, Trump promised to introduce crypto-friendly policies. Recently, the Trump administration announced some significant policies including the establishment of a committee to discuss the possibility of creating a clear crypto-regulation framework.

Interestingly, Metaplanet CEO Simon Gerovich was one of the business leaders who participated in the inauguration of Trump.

Metaplanet’s Rapidly Growing Shareholder Base

Lately, Metaplanet has witnessed growing retail investor interest. As per reports, the shareholders of the Japanese company surged by over 500% in 2024. The reports add that a good number of its shareholders are retail investors, though the company enjoys backing from top institutional players like Capital Group.

Bitcoin-Friendly Investment Programs in Japan

Many think that Japan’s NISA program has played a huge role in the growing retail interest in Metaplanent. The program allows tax-free investment in stocks.

It appears that many Japanese investors prefer buying Metaplanet shares instead of directly holding Bitcoin to avoid high taxes. Capital gains on Bitcoin purchases are taxed at up to 55% in Japan.

Metaplanet’s Bitcoin Expansion Plans

Metaplanet currently holds at least 1,762 BTC, worth at least $172,107,883.2. As per reports, it is preparing to increase its Bitcoin holding to at least 10,000 BTC by 2025. The reports add that it is also planning to push its BTC holdings to 21,000 BC by 2026.

It is also reported that the Japanese company will rebrand its last remaining hotel as ‘The Bitcoin Hotel.’ Those familiar with the development claim that the hotel will be used exclusively to host Bitcoin-related seminars and events.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Metaplanet holds at least 1,762 BTC, worth over $172M, with plans to increase holdings to 10,000 BTC by 2025 and 21,000 BTC by 2026.

Metaplanet plans to rebrand its last hotel as “The Bitcoin Hotel,” exclusively hosting Bitcoin-related events and seminars.