The post Ethereum Whales Buy the Dip, Withdraw 1M ETH from Exchanges appeared first on Coinpedia Fintech News

The overall cryptocurrency market is causing confusion due to heavy volatility. Amid this, whales and investors seem to be adding valuable tokens as they trade at discounted levels.

Today, February 11, 2025, a prominent crypto expert posted on X (formerly Twitter) that whales have picked Ethereum (ETH) as the best investment opportunity, having added millions of dollars worth of ETH in the past week.

1 Million Ethereum (ETH) Withdrawn From Exchanges

In a post on X, the expert noted that more than 1 million Ethereum (ETH) have been withdrawn from exchanges in the past week. Such a notable outflow or token withdrawal from exchanges appears to indicate potential accumulation, which can create buying pressure and drive further upside momentum.

Additionally, this outflow suggests an ideal buying opportunity. However, the current market sentiment seems bearish, with a strong possibility that this substantial accumulation could reduce selling pressure.

ETH Traders’ Bearish Approach

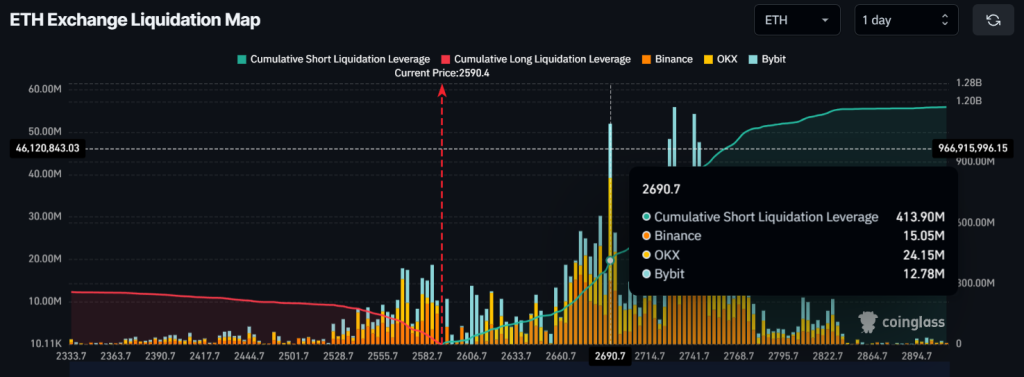

Despite the bullish perspective from investors and long-term holders, intraday traders seem to be taking the opposite approach, as reported by the on-chain analytics firm Coinglass.

At press time, traders betting on the long side appear to be exhausted, while those taking short positions are currently dominating the asset.

According to the data, traders holding long positions are over-leveraged at the $2,568 level, with $108 million worth of long positions. Conversely, traders betting on short positions are over-leveraged at the $2,690 level, where they hold $415 million worth of short positions.

This liquidation data clearly defines the current market sentiment, where short positions are four times stronger than long positions. Additionally, short traders have the potential to easily liquidate long positions.

Current Price Momentum

Ethereum is currently trading near $2,588 and has experienced a price drop of over 4.10% in the past 24 hours. However, during the same period, due to massive volatility and substantial price fluctuations, its trading volume declined by 17%, indicating lower participation from traders and investors compared to the previous day.