The post Cardano (ADA) Rally Cooling Off, Market Sentiment or What? appeared first on Coinpedia Fintech News

ADA, the native token of the Cardano blockchain, is gaining significant attention from crypto enthusiasts following an asset manager’s move to file for a Cardano Exchange-Traded Fund (ETF) in the United States. This development has sparked notable interest among traders and investors, resulting in impressive upside momentum.

Cardano (ADA) Losing its Gain

As the market surge pushes ADA near a crucial resistance level, the asset has begun experiencing massive sell-offs, causing its price to fall—another disappointment for traders and investors today.

Despite the recent fall in the ADA token price, the asset has reclaimed its uptrend as it moves above the 200 Exponential Moving Average (EMA) on the daily time frame. Additionally, today’s notable selling pressure has not had any significant impact on investor sentiment, as long-term holders appear to be accumulating the token.

Current Price Momentum

ADA is currently trading near $0.77 and has experienced a price surge of over 11% in the past 24 hours. However, the asset reached an intraday high of $0.815 with a 16% gain, but the market lost a significant portion of those gains, likely due to ongoing profit booking and the current market sentiment.

Nonetheless, participation from traders and investors has surged to the next level, increasing by more than 120% during the same period.

ADA Price Action

According to expert technical analysis, ADA is at a crucial resistance level of $0.85, where it faced resistance today.

Based on the recent price action, if ADA continues to rally and breaches the $0.85 level, closing a daily candle above it, there is a strong possibility it could soar by 32% to reach the $1.13 level in the future.

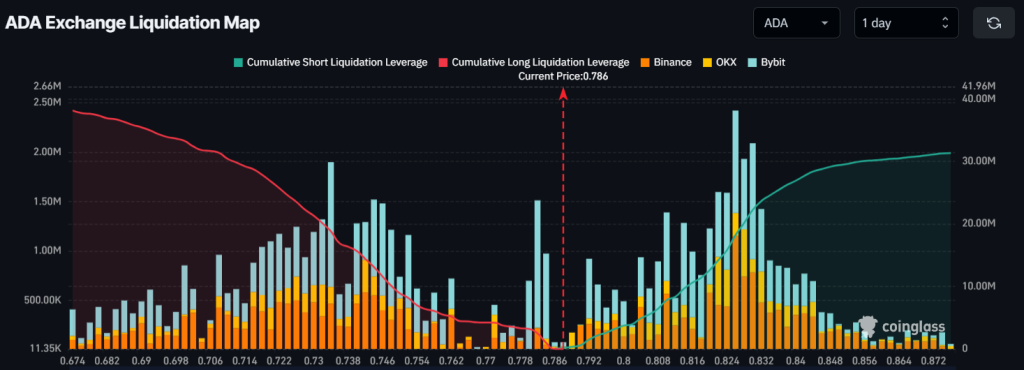

ADA’s Major Liquidation Areas

Currently, traders are taking a mixed approach. At present, the major liquidation areas are near $0.734, where traders holding long positions are over-leveraged, with $18.80 million worth of long positions. Conversely, $0.826 is another liquidation level, where traders holding short positions are over-leveraged, with $18.20 million worth of short positions.

When combining these on-chain metrics with technical analysis, it appears that long-term holders are accumulating tokens, while intraday traders are taking advantage of the current market sentiment.