The cryptocurrency community is speculating about a potential Solana (SOL) price explosion. Adding to this speculation? Recent large-scale SOL purchases by affluent investors, or “whales,” and market analysts’ optimistic forecasts.

Whales Spring Back To Life: Bullish Sign?

The lifeblood of crypto analysis, on-chain data shows an interesting tendency: Two once dormant “smart money” addresses have sprung alive and each is grabbing large amounts of SOL.

Identified as “GJwCU,” one of these whales re-emerged to collect 30,901 SOL tokens, a cool $6.24 million, following a year in slumber.

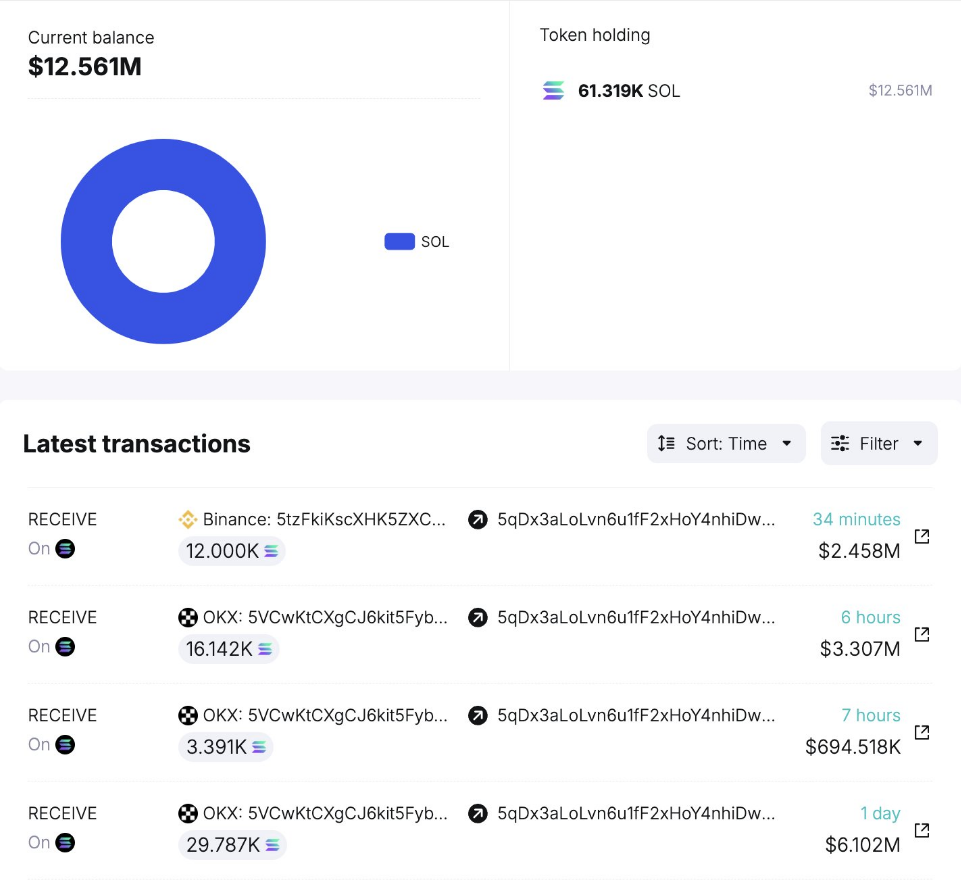

This particular whale has made money dealing in the past; it once made a $8.15 million profit. Their increased interest says a lot. At an average price of $202, another wallet called “5qDx” also broke its two-month silence by taking out 61,319 SOL tokens, which are worth a good $12.4 million. It’s hard to miss these huge purchases, which usually mean that people have a lot of faith in the future of a coin.

A smart whale resurfaced after 2 months and withdrew 61,319 $SOL ($12.4M) from #Binance and #OKX at ~$202.53 today!

Previously, this whale had completed 2 $SOL trades between Dec 27, 2023, and Nov 30, 2024, earning an estimated total profit of $8.47M (+38.9%) with a 100% win… pic.twitter.com/2XNJok4bvA

— Spot On Chain (@spotonchain) February 10, 2025

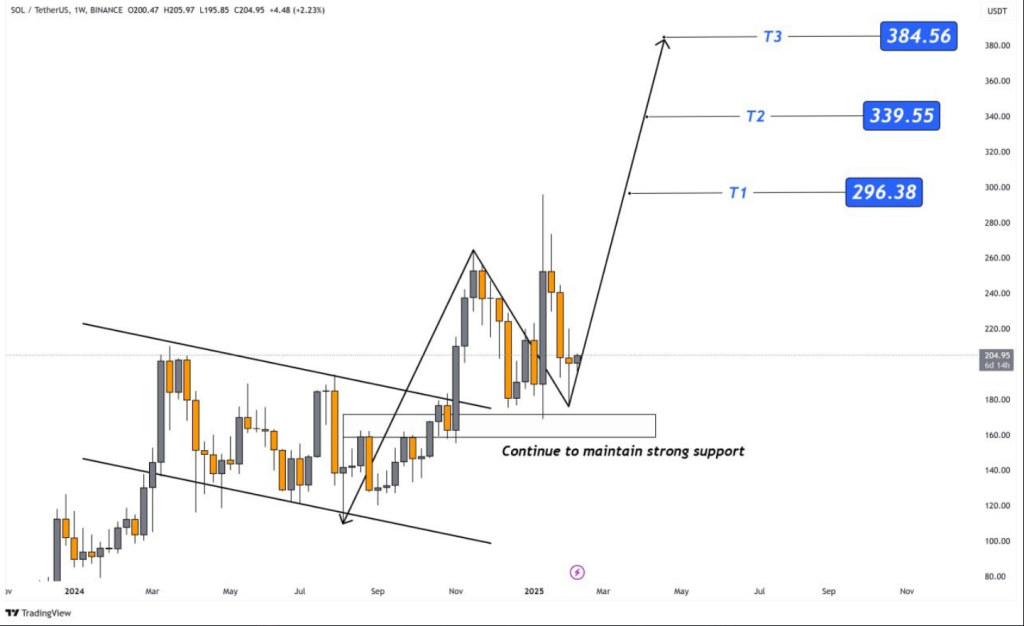

Analyst Eyes $296 Target

Market analyst VipRoseTr has added fuel to the fire by voicing their opinion, predicting a potential price hike of $296. There is nothing magical about this forecast. Keeping strong support levels and recovering from important technical zones are two of Solana’s strengths, according to VipRoseTr.

This suggests underlying strength and a most likely increasing breakout probability. Analyst forecasts influence market sentiment and investing behavior even if they should always be taken with a grain of salt.

$SOL Price Targets & Bullish Structure

#Solana ($SOL) is maintaining strong support and bouncing from key levels, signaling potential for further upside.

Key Targets:

T1: $296.38

T2: $339.55

T3: $384.56

Technical Outlook:

A breakout above recent highs could push… pic.twitter.com/GJSlHW48MZ

— Rose Premium Signals

(@VipRoseTr) February 10, 2025

Solana’s Ecosystem: The Long Game

Beyond the whale activity and price forecasts, Solana’s fast growing ecosystem is another important element at work. Long-term survival of a cryptocurrency depends on a dynamic ecosystem bursting with decentralized apps (dApps) and projects.

Market Sentiment: A Cautious Optimism

Right now, the price of Solana is around $204, which is a small drop of 0.06% in the last 24 hours. But the bigger story is more important than this small difference. Over the past week, SOL has only slightly gone up by about 2%, which suggests that the market has been pretty stable despite its normal fluctuations.

With 490 million SOL in circulation, the value of the SOL market is close to $97 billion. In general, people seem to be feeling cautiously optimistic. Expert predictions and whale activity are mostly good, but the crypto market is known for being very unstable.

Featured image from Medium, chart from TradingView