Amid today’s market retrace, BNB is leading the market with a 9% surge and surpassed Solana after flipping the cryptocurrency’s market cap. Some analysts suggest BNB’s breakout could attempt to reclaim the $700 level and target new highs.

BNB Leads The Crypto Market

On Wednesday, the crypto market recorded another retrace, with Bitcoin (BTC) falling to a one-week low of $94,000. The rest of the market registered red numbers, with most cryptocurrencies in the top 10 bleeding.

Meanwhile, BNB, previously known as Binance Coin, swan against the current today, jumping to a 12-day high of $689. The cryptocurrency had a strong Q4 2024 after reclaiming the $700 resistance as support and reaching an all-time high (ATH) of $750 in December.

Nonetheless, the start-of-year retraces halted BNB’s momentum, sending the cryptocurrency below the $700 mark on Inauguration Day to hover between the $680-$660 price range.

The DeepSeek correction further saw the cryptocurrency nosedive to its lowest valuation since September. BNB momentarily fell to $500, driving the market sentiment into uncertain territory.

Since then, the cryptocurrency has climbed 34% from the recent lows, steadily recovering key support zones. Today, the token jumped 9%, retesting the $660 and $670 resistance zones for the first time in 12 days.

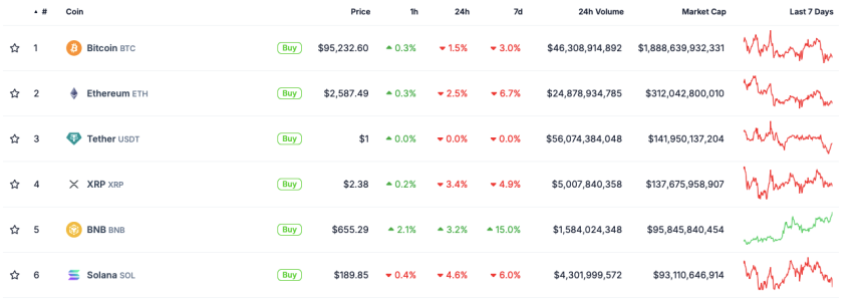

The surge saw BNB lead the crypto market, being the only token in the top 10 by market capitalization (MC) to record gains throughout Wednesday morning. Additionally, the cryptocurrency flipped Solana as the fifth-largest cryptocurrency by market cap after hitting $96 billion.

On-chain data analysis firm Lookonchain noted that the BNB chain has processed 68.3 million transactions in the past 30 days, making it the top EVM chain by 30-day transactions.

Breakout To $700 Around The Corner?

Crypto analyst Ali Martinez pointed out that BNB could be gearing up for a massive move as it approached a key resistance zone between the $660 and $680 levels.

According to the post, the cryptocurrency is facing “multiple technical hurdles” within this zone, including the 200, 100, and 50 Simple Moving Average (SMA), the 0.382 Fibonacci retracement, the TD Sequential resistance trendline, and the TD Sequential risk line.

The analyst stated that breaking through these levels could “signal the next major move.” Meanwhile, analyst Elja Boom suggested that BNB could be about to follow its 2021 playbook.

The analyst highlighted that the cryptocurrency is following the same breakout structure and trajectory as four years ago, which could indicate a potential surge to new highs is around the corner.

BNB is attempting to reclaim its monthly opening level and retest the $700 barrier. A surge above this level could send the cryptocurrency to its two-month downtrend line and “push for the bullish reversal once again.”

As of this writing, BNB is trading at $687, surging 7.2% and 21% in the daily and weekly timeframes.