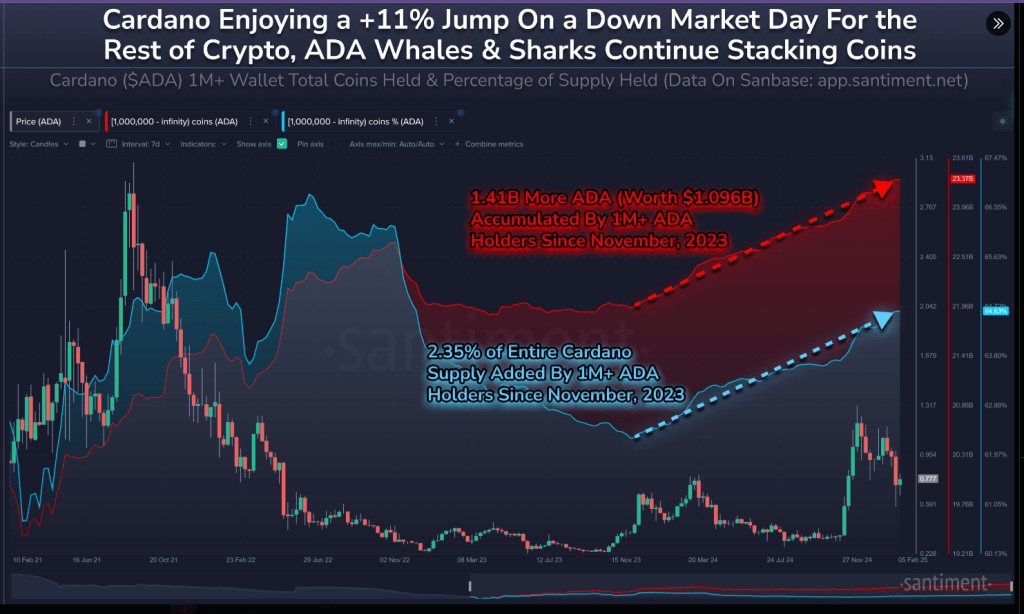

As large companies increase their engagement in the cryptocurrency sector, the Cardano ecology is changing dramatically. According to recent data, wallets holding over a million ADA have been rapidly growing since November 2023, amassing an additional 1.41 billion ADA tokens. This significant accumulation, which accounts for 2.35% of Cardano’s total supply, conveys a clear statement about the project’s institutional support.

Cardano: Whale Activities Signal Market Confidence

Whale movements have had nothing less than a remarkable outcome: Santiment’s research reveals a solid 107% price increase since these wallets started their accumulation spree.

Market watchers point out this isn’t only another pump-and-dump situation. Rather, it marks a basic change in the way big investors view Cardano’s long-term possibilities in the brodaer cryptocurrency scene.

Cardano’s market cap has recovered by +11% on a day where most cryptocurrencies have retraced. One thing to continue watching is the continued behavior of whales and sharks.

Wallets holding at least 1M $ADA have been consistently accumulating since late November of 2023,… pic.twitter.com/pTHCqRCRC7

— Santiment (@santimentfeed) February 11, 2025

Long-Term Holders Display Unwavering Faith

Examining IntoThe Block’s statistics closer reveals an interesting picture of changing investment behavior.

Long-term ADA holders have raised their positions by 1.81%, exhibiting a wise investment strategy. The most notable change comes from the mid-term investors, sometimes known as “cruisers,” who have raised their holdings by a decent 7.65%.

This increase points to a maturing market in which investors are choosing steady expansion above short gains. Short-term traders, meantime, have clearly turned away from speculative trading by cutting their exposure by 11.75%.

Technical Indicators Point To Possible Price Discovery

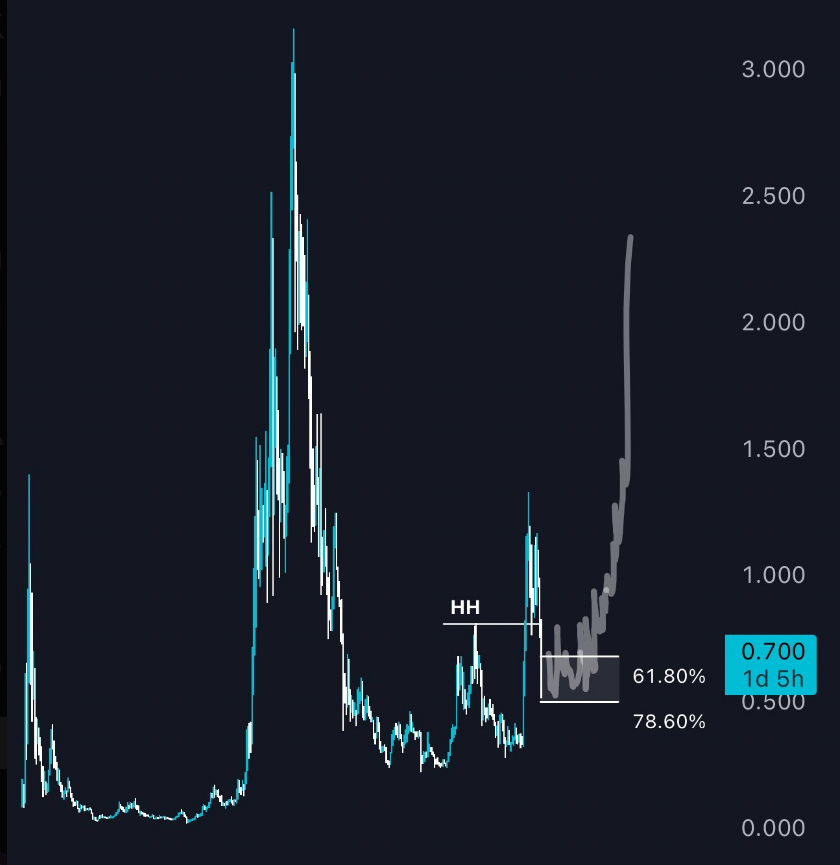

For Cardano, the challenging terrain is opening doors for opportunity. Crypto guru Trader Steve has made striking comparisons between XRP’s recent price movement and ADA’s present market structure.

I have a gut feeling this is ready to pull an $XRP and i’m bidding the fibonacci..

Is anyone even still holding this? pic.twitter.com/ew2G7q1QmF

— TraderSteve_ (@TraderSteve_) February 8, 2025

Key support levels in the 62% and 78% Fibonacci retrace zones give the price a strong base for an eventual rise. Even though ADA hasn’t gotten back to its all-time high of $1.32 in December 2024, many experts are still optimistic about its future. An esteemed member of the cryptocurrency community, Yoel Jr., stresses the importance of the $0.81 level as a stopping point for confirming positive progress.

Price Targets And Entry Opportunities Ahead

Based on Jonathan Carter’s study of the daily chart, ADA may be getting ready for its next significant action with a promising bull flag formation. A retest of the $0.60 level, according to Carter, would offer investors wishing to create positions strategic points of access.

The road ahead consists of three important pricing targets: $0.845, $1, and $1.325. These tiers mark potential pause points in what might be Cardano’s path to unprecedented success.

Although the crypto market is always erratic, the combination of whale accumulation, strong holder faith, and good technical setups points to Cardano positioning itself for a big market movement in the next months.

Featured image from DALL-E, chart from TradingView