On-chain data shows the retail investors have been liquidating their Bitcoin wallets recently, but buying into XRP and Ethereum.

Total Amount Of Holders Up For XRP & Ethereum, But Down For Bitcoin

In a new post on X, the on-chain analytics firm Santiment has discussed about the latest trend in the Total Amount of Holders for the top three assets in the cryptocurrency sector. The “Total Amount of Holders” here refers to a metric that measures, as its name already suggests, the total number of addresses that are carrying some non-zero balance on a given network.

When the value of this indicator goes up, it means new investors are joining the blockchain and/or old ones who had sold earlier are investing back into the asset.

The trend can also arise when existing users distribute their holdings across new addresses for a purpose like privacy. In general, all three of these can be assumed to be in action simultaneously whenever the metric registers an increase.

As such, a jump in the Total Amount of Holders can be considered as a signal that some net adoption of the cryptocurrency is taking place.

On the other hand, the metric witnessing a decline implies some of the investors have decided to clear out their wallets, potentially because they want to completely exit from the coin.

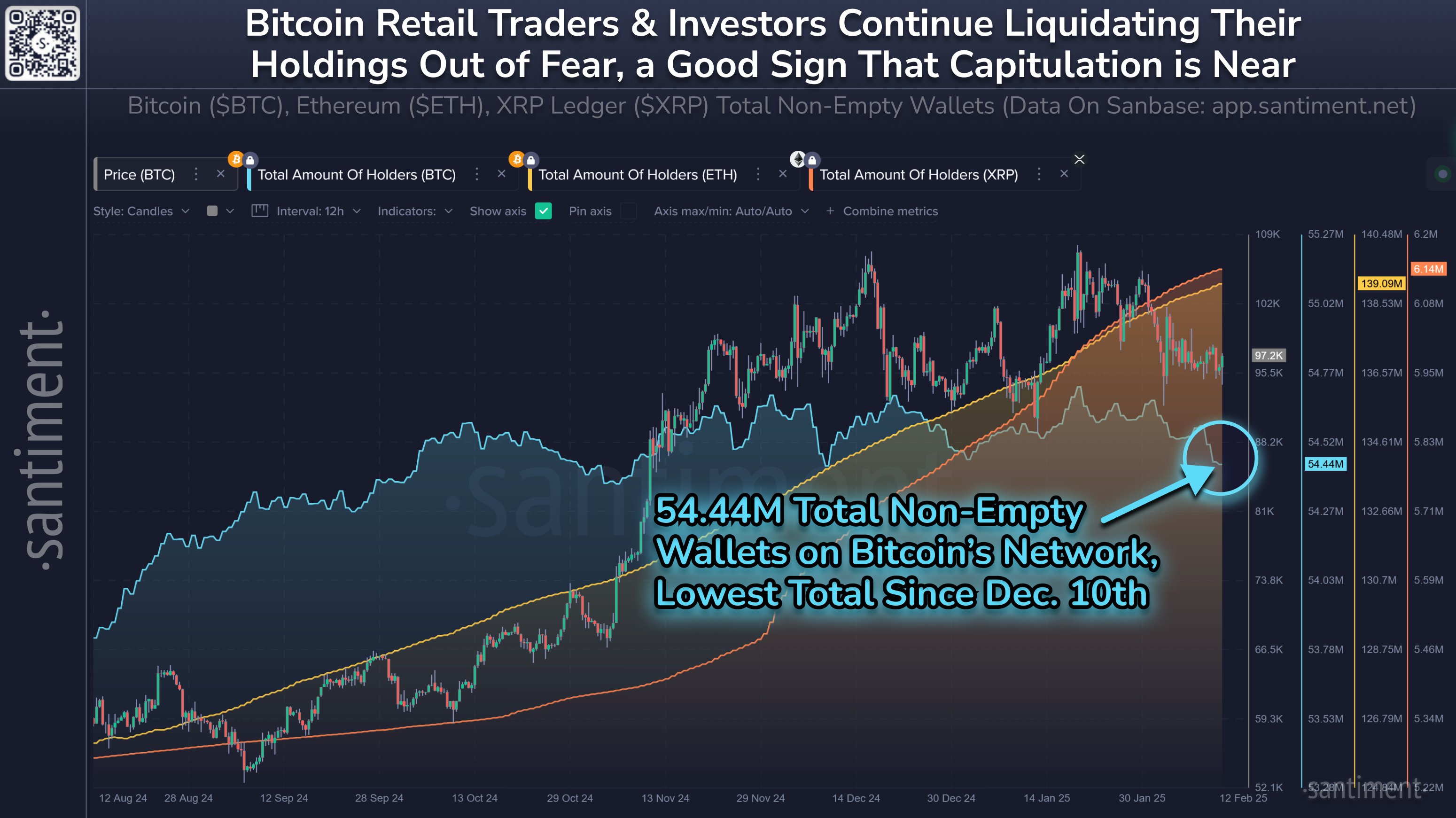

Now, here is the chart shared by the analytics firm that shows the trend in the Total Amount of Holders for Bitcoin, Ethereum, and XRP over the last few months:

As is visible in the above graph, the Total Amount of Holders for XRP has been following an upward trajectory for XRP and Ethereum for a while now, implying new investors have constantly been joining these networks. Out of the two, the former is the one currently observing adoption at a faster rate.

While these coins have been enjoying an influx of holders, Bitcoin has been different. The number one cryptocurrency was seeing its Total Amount of Holders move sideways earlier, but recently, the metric has started to see an outright decline, meaning investors are now actively exiting the network.

Compared to three weeks ago, the number of non-empty addresses on the BTC blockchain has reduced by around 277,240, which is a notable amount. Whales are generally few in number, so any large decline in the Total Amount of Holders usually reflects the outgoing of retail entities.

The exodus of retail investors may not be so bad for Bitcoin, however, as Santiment has explained,

Historically, these declines in retail belief are a positive sign for mid to long term price performances. When coins are shed by small traders, whales and sharks accumulate them and use their capital to drive up markets when crowd FUD is at its highest.

BTC Price

Bitcoin has been unable to amass together any lasting bullish momentum recently as its price has taken to sideways movement. At present, BTC is trading around $95,800.