Peter Brandt, a seasoned trader, has dismissed optimistic predictions in the wake of Bitcoin’s recent increase to $97,000+.

His latest technical analysis indicates that the most prominent cryptocurrency may encounter difficulty in surpassing the coveted $200,000 threshold prior to 2030.

Bitcoin has demonstrated a mixed performance, with a daily gain of 0.17% and a 2.85% decline over the course of the week, prompting the forecast.

The Protracted Path To Six Figures

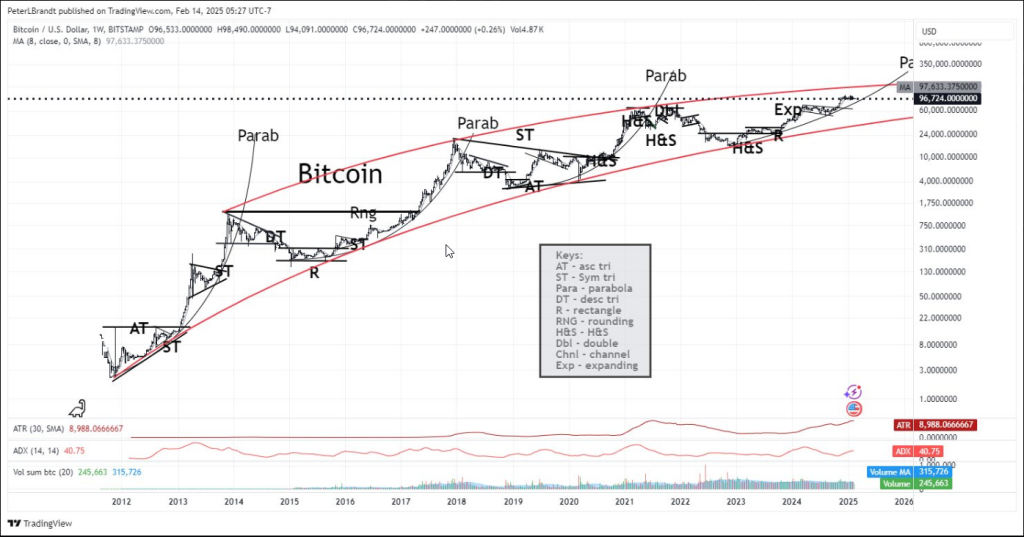

Bitcoin will face significant challenges in breaching the psychological barrier of $100,000. The 8-week moving average of $97,633, which has consistently rejected upward movements, presents the cryptocurrency with significant resistance.

From the world of crazy ideas comes this thought – a thought, not a trade

Unless Bitcoin has escape velocity through upper parabolic resistance line it’s very unlikely that BTC will be trading above $200k at the end of this decade. Onlycan reply. No interest in non-

replies pic.twitter.com/7a5N7Gliw8

— Peter Brandt (@PeterLBrandt) February 14, 2025

The Average True Range (ATR) of 8,988 and the Average Directional Index (ADI) of 40.75, which both support a strong trend, show increased volatility in the current market conditions.

Historical Patterns Paint A Cautionary Tale

Since 2012, Bitcoin has developed a distinctive pattern that has captured the interest of technical experts. Within a red rising channel, the cryptocurrency has been bouncing between two crucial trendlines that serve as price barriers.

Particularly intriguing is Bitcoin’s tendency toward both sharp corrections and parabolic movements. Market veterans have raised their antennae due to the striking similarities between the present rally and these previous cycles.

Trading Volume Raises Red Flags

The numbers tell an interesting story about how people participate in the market. There is a chance that the current rally isn’t stable because Bitcoin’s 20-period volume total of 245,600 is low compared to other breakout stages.

Maintaining a long-term upward trend could be challenging in the absence of a notable increase in trade volume. For analysts watching Bitcoin’s next major move, this weak volume has been a growing concern.

Support And Resistance: The Drawing Of Battle Lines

The future of Bitcoin is contingent upon critical price levels that could determine its fate. Strong support is present in the $60,000 to $70,000 range, while a solid resistance zone looms between $100,000 and $120,000.

If the situation worsens, Bitcoin may revisit the lower boundary of its long-term channel, which is approximately $40,000 to $50,000.

Brandt’s analysis indicates that Bitcoin’s trajectory to $200,000 by 2030 is dubious in the absence of a significant break above the upper boundary of its parabolic trajectory.

The veteran trader underscores the necessity of sustained momentum and the ability to surpass critical resistance levels in order to achieve such elevated valuations.

Featured image from Pixabay, chart from TradingView