The post Lost Crypto? How Blockchain Investigation Helped Trace 180,000 USDT appeared first on Coinpedia Fintech News

The Growing Threat of Crypto Scams

The prevalence of cryptocurrency scams has risen sharply, creating challenges for victims and investigators alike. Sophisticated fraud techniques have left individuals and institutions struggling to recover stolen funds.

This article highlights a recent case where a victim lost 230,000 USDT in a crypto scam. Using blockchain analytics, 180,000 USDT was successfully traced.

How the Scam Happened

Unregulated Crypto Dealers

The victim was introduced to unregulated cryptocurrency dealers through a social media contact. These dealers facilitated the exchange of local currency to USDT, bypassing traditional financial channels.

Fake Trading Platform

The scam involved a fraudulent trading app designed to imitate a legitimate platform. The victim was tricked into believing they were investing in high-return assets. Payment screenshots were manipulated to create a false sense of security.

Direct Transfers to Scammers

Instead of being held on the trading platform, the victim’s funds were sent directly to scammer-controlled wallets. The same destination address was provided through both the fake platform and direct messages.

Money Laundering Techniques

Once received, the funds were quickly dispersed through multiple wallets using a peel chain method. This technique fragmented transactions, making it harder to track and recover the stolen USDT.

Challenges in Recovering Stolen Crypto

Technical Complexities

Scammers often employ advanced techniques such as peel chains—a method of fragmenting transactions into multiple smaller ones to obscure the trail of stolen funds. This is particularly common on low-fee networks like Tron, making it cost-effective for criminals to execute complex laundering schemes.

Additionally, extensive movement of funds across multiple wallets and chains adds layers of complexity, testing the limits of blockchain tracing tools and investigative efforts.

Legal and Law Enforcement Barriers

Investigative agencies often face limited familiarity with blockchain technology, which hampers their ability to handle crypto-related cases effectively. This knowledge gap can delay recovery efforts and make it harder to interpret blockchain evidence.

Furthermore, cases involving unnamed defendants and cross-border jurisdictions pose significant challenges. Coordinating with international agencies and navigating diverse legal frameworks requires significant resources and expertise.

Bitquery’s Contribution to the Case

Tracing the Funds

Bitquery’s advanced blockchain analytics capabilities played a central role in this case. By generating a detailed blockchain analysis report, Bitquery traced the stolen 180,000 USDT. This included identifying transaction flows, exchange accounts, and potential leads for law enforcement.

How Bitquery achieves this:

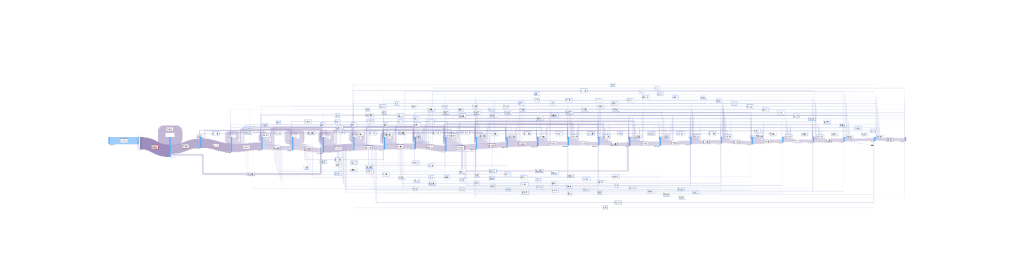

- Tracking Specific Funds: Bitquery’s Coinpath MoneyFlow tracks specific transfers across multiple crypto addresses and blockchains.

- Automated Tracing & Clustering: Proprietary automated clustering helps navigate complex money flows efficiently, minimizing manual intervention and errors.

- Intuitive Visualization Tools: Investigators can leverage clear visual representations of fund movements, add notes/tags, and share reports easily.

- Tracing Commingled Funds: Advanced accounting techniques like FIFO, FILO, LIFO, and PIFO allow for effective tracking of intermingled assets.

Supporting Victims and Law Enforcement

Bitquery’s scam reports have proven critical in assisting victims and investigators. These reports streamline the process of engaging exchanges like Binance and OKX to access KYC details and freeze illicit funds.

For victims seeking to report crypto scams, region-specific resources can offer direct support and enhance the chances of recovery:

- India: Victims can report crypto scams through this guide, which outlines India’s appropriate channels and procedures.

- USA: The USA reporting guide details steps to report crypto-related frauds and scams in the United States.

- Europe: For European victims, this resource provides information on where to report crypto scams across various jurisdictions.

- China: Victims in China can report cryptocurrency fraud to the Ministry of Public Security’s Economic Crime Investigation Department or through local Public Security Bureaus. You can also report the crime to China’s National Anti-Fraud Center. Most interaction with the anti-fraud center occurs through their dedicated “National Anti-Fraud Center” app. You can use anti-fraud hotline 110 to report fraud crimes.

- Taiwan: In Taiwan, victims can file complaints with the Criminal Investigation Bureau’s Anti-Fraud Center or report directly to the Financial Supervisory Commission for financial fraud cases. You can use anti-fraud hotline 165 to report fraud crimes.

These resources empower victims to act promptly while aiding law enforcement and regulatory authorities in effectively combating crypto fraud. By submitting detailed reports, exchanges can be engaged to trace illicit transactions and assist in recovering funds where possible.

Lessons and Recommendations

For Law Enforcement

- Enhancing blockchain proficiency through specialized training programs to effectively investigate and prosecute cryptocurrency-related crimes.

- Developing standardized protocols and best practices to streamline the handling, reporting, and recovery of digital assets linked to criminal activities.

For Victims of Crypto Scams

- Immediate action is crucial. Victims should report incidents to authorities and use blockchain tools like the Bitquery Investigations Team to track down hacker addresses, transaction hashes, and other vital details.

- Presenting a full investigation report to law enforcement can significantly improve the chances of fund recovery.

- Engage crypto-savvy legal experts to navigate the complexities of international and local regulations.

- Exercise patience and persistence throughout the recovery process, as these cases often take time to resolve.