Crypto analyst EXCAVO has alluded to the potential Litecoin ETFs and how they spark a massive price surge for LTC. The analyst also revealed how high LTC could rally to at the end of this bull cycle thanks to these ETFs.

How The Litecoin ETFs Could Drive LTC’s Price To $800

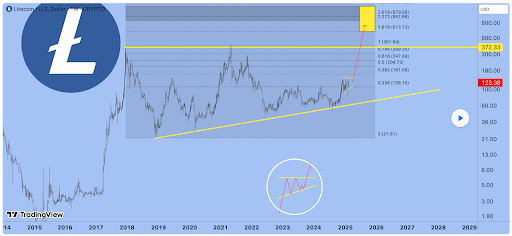

In a TradingView post, EXCAVO highlighted the Litecoin ETFs as one of the factors that could drive LTC’s price to $800 at the end of the cycle. He noted that Litecoin is just a fork of Bitcoin, and there is not much technology in it. However, he added that a decentralization and adoption issue is occurring, making LTC a suitable candidate for a potential ETF.

The analyst indicated that these Litecoin ETFs are one of the bullish fundamentals that could send LTC to this price target. Grayscale. Canary Capital and CoinShares have all applied with the SEC to offer a Litecoin ETF. According to Bloomberg analysts Eric Balchunas and James Seyffart, there is a 90% chance of the US SEC approving these funds this year.

As such, if approved this year, these Litecoin ETFs could easily send the LTC price to $800, as EXCAVO predicted. Meanwhile, from a technical analysis perspective, the analyst also stated that the crypto has a standard triangle with horizontal resistance on top. He added that such resistances tend to break out strongly. As such, the analyst is confident that LTC can reach $800 in this cycle thanks to its bullish fundamentals and technicals.

EXCAVO also alluded to the LTC/BTC pair, noting that the fall has stopped and the bottom has been minimized. In line with this, he remarked that he expects an upward jump soon enough.

LTC Is Headed To $180 In The Short Term

In an X post, crypto analyst Dom opined that the Litecoin price is headed to $180. This came as he explained why he doesn’t believe LTC has topped in this cycle. Alluding to historical patterns, the analyst asserted that Litecoin’s chart is nothing like a topping formation. He added that tops have always been put in quickly.

Dom also remarked that Litecoin’s price is bullish, above the all-time high (ATH) Volume-weighted average price (VWAP). However, he added that a full invalidation would be an acceptance below $103.

Meanwhile, crypto analyst Crypto Bullet highlighted how “LTC will fly soon.” His accompanying chart showed that the Litecoin price could reach $210 when this parabolic rally happens. Crypto analyst Charting Guy is also bullish on Litecoin, describing it as XRP 2.0, indicating that it could make a comeback like XRP did last year.

At the time of writing, the Litecoin price is trading at around $123, down almost 1% in the last 24 hours, according to data from CoinMarketCap.