Solana’s recent price behavior has sparked anxiety in the the digital currency market. The once-soaring blockchain has fallen significantly as a result of a widespread slump. Solana native token (SOL) has been down 32% in the last four weeks, trailing Bitcoin’s 10% decline and Ethereum’s 15% dip. As the network suffers with the fallout from a meme currency frenzy that left investors reeling, a sudden sell-off occurs.

Meme Coin Mania Turns Into Disaster

Solana has been the epicenter of an explosive meme coin growth. Although this initially stimulated trading volume and interest, it has since led to severe negative repercussions. Rug pulls and failed initiatives on the network have reportedly resulted in a loss of more than $26 million. Many developers abandoned projects immediately after raising funds, leaving investors with tokens that were of no value.

The issue has escalated at an alarming rate. In the span of 30 days, the Solana ecosystem has lost at least 12 meme coin initiatives. The token’s price has declined as a result of this surge of failures, which has also negatively impacted investor sentiment.

It’s over for Solana

Worse than the FTX collapse$LIBRA, #MELANIA changed everything

: Here’s what went down and what’s next… pic.twitter.com/mo6TMBpift

— Xremlin (@0x_gremlin) February 17, 2025

Is Solana In Trouble?

Crypto trader Xremlin recently declared on X that “it’s over for Solana,” comparing its decline to the FTX collapse—only worse. He pointed out that Solana’s recent surge in popularity was driven by speculation and the rise of meme coins.

Much of this activity stemmed from low transaction fees, attracting traders to platforms like Pump.fun. However, many of these tokens are seen as pump-and-dump schemes, adding to the negative sentiment around Solana’s ecosystem.

Ray Of Hope?

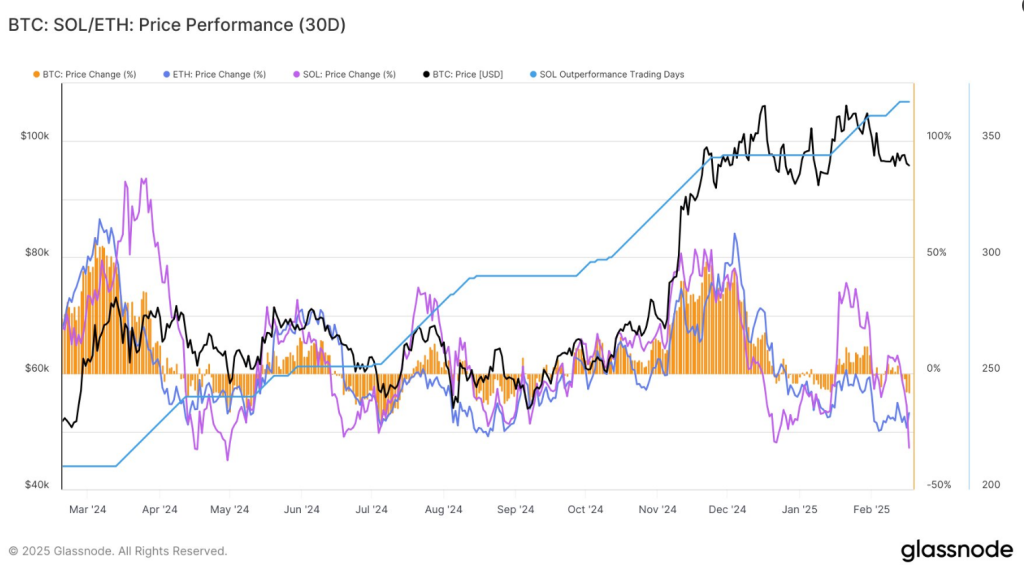

Meanwhile, Glassnode data indicates that Solana surpassed Ethereum on 23 of 49 days since the beginning of the year. Nonetheless, Solana has demonstrated greater susceptibility to market declines.

Since the beginning of the year, #Solana outperformed #Ethereum for 23 out of 49 days. However, $SOL has been more sensitive to recent drawdowns, with 30D price change clocking in at -32% as of Feb 17 (#ETH: -17%, #BTC: -8%) https://t.co/7p1xFARDLD pic.twitter.com/GE7WaV4hBi

— glassnode (@glassnode) February 18, 2025

Negative Impact On Network

Solana’s appeal as a low-cost, high-speed blockchain has attracted traders who are interested in leveraging speculative ventures. The proliferation of meme coins that resemble scams has, however, prompted grave apprehensions.

Currently, numerous analysts are cautioning that Solana is at risk of becoming a breeding ground for pump-and-dump schemes, rather than an ecosystem that fosters sustainable development.

Congestion issues on the network is also another big issue. Because meme currencies are so popular, the system has seen a drop in transaction speeds and occasional spikes in fees. This has caused some users to be frustrated and has made many wonder if Solana can sustain spikes in activity without slowing down.

Bitcoin And Ethereum Exhibit Resilience

Bitcoin and Ethsereum have weathered the latest slump with comparatively little damage, while Solana is having trouble. Bitcoin has fallen by 10% in the last month, whereas Solana has fallen by 33%. Even while it is still in a better position than before, Ethereum, which has also been under selling pressure, has seen a 17% drop.

During periods of uncertainty, investors are progressively gravitating toward established assets. Bitcoin and Ethereum have been able to maintain a higher level of market confidence by primarily avoiding the chaos that has been caused by meme coin implosions, in contrast to Solana.

Featured image from Gemini Imagen, chart from TradingView