The post Solana Whale Moves $20M Off Binance, Bullish Signal or Trap? appeared first on Coinpedia Fintech News

As the overall cryptocurrency market hints at signs of price recovery, a crypto whale identified Solana (SOL) as an ideal asset and placed a significant bet.

Whale Buys $20 Million Worth Solana (SOL)

Today, February 19, 2025, the blockchain-based transaction tracker Lookonchain posted on X (formerly Twitter) that a whale wallet address “AA21…VxH9” moved 123,500 SOL worth $20.80 million from Binance.

This substantial SOL transfer from Binance during market recovery appears to be a potential accumulation, which could create buying pressure and drive further upside momentum. However, Solana (SOL) has not reacted significantly, as its price remains unchanged.

Solana’s Current Price Momentum

At press time, the asset is trading near $169, experiencing a modest 1% upward momentum in the past 24 hours. However, during the same period, its trading volume dropped by 20%, indicating that traders and investors are still hesitant to participate in the asset.

Solana (SOL) Technical Analysis and Key Levels

The potential reason behind this fear is the recent breakdown of the crucial support level at $180, which SOL failed to hold. Additionally, it has fallen below the 200 Exponential Moving Average (EMA), indicating that the asset is in a downtrend.

Based on recent price action and historical patterns, it appears that SOL is bearish, with a high probability of staying between $160 and $180 until it crosses the $190 mark. However, if the bearish sentiment and price decline continue, and SOL falls below the $160 level, there is a strong possibility it could drop another 20% to reach $120 in the future.

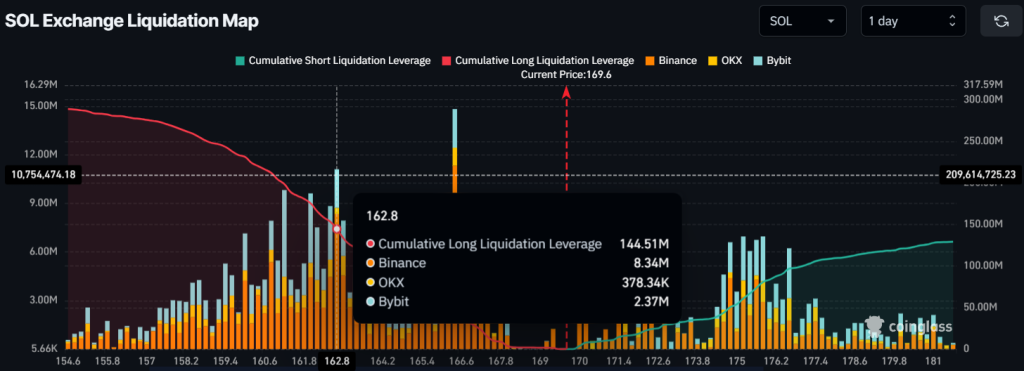

Traders’ $145 Million Worth Long Bet

Despite this bearish outlook, traders and investors seem unaffected, as they continue accumulating and betting on the token, according to on-chain analytics firm Coinglass.

According to the data, traders betting on the bullish side are currently dominating the asset, as they are over-leveraged at the $162.8 level and hold $145 million worth of long positions. This over-leveraged level suggests that traders believe SOL’s price won’t fall below this point, which currently acts as strong support.