Once more drawing attention in the crypto scene, Dogecoin (DOGE) has market researcher XforceGlobal speculating that the joke coin still has 10 times potential for a price increase. This optimistic forecast has attracted interest as investors consider whether DOGE may provide large returns in the face of continuous market swings.

Historical Performance And Cyclical Patterns

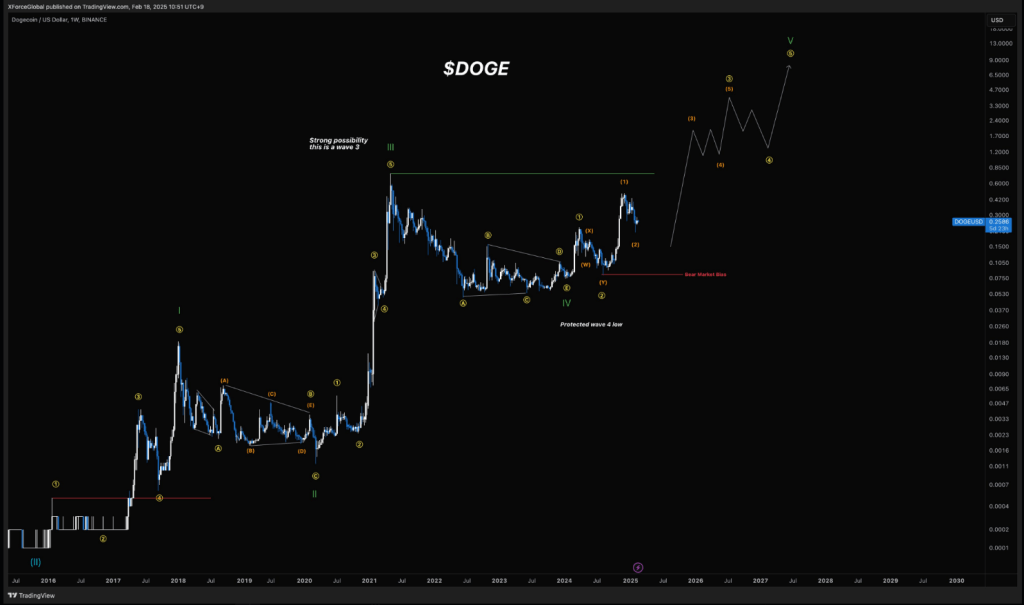

Dogecoin has shown tremendous expansion accompanied by dramatic corrections. The memecoin has followed a cyclical pattern over the years, according XForceGlobal, whereby each significant surge has been preceded by a protracted accumulation phase. Should history repeat itself, the present state of affairs may be preparing the ground for yet another notable climb.

“Dogecoin still has a window of opportunity to be the only memecoin for a possible 5-10x,” XForceGlobal said in an X post. “Remember, history is key as it provides a significantly lower margin of error for pattern confirmation, market psychology insights, and wave count validation,” the analyst said.

Dynamics Of The Current Market

Dogecoin is trading at over $0.2539 as of February 19, 2025, a small increase from its previous closing. Reflecting resilience despite general market volatility, the trading range for the day has varied from $0.2426 to $0.2550. Based on XForceGlobal’s analysis of these price swings, depending on market mood and outside triggers, DOGE could be getting ready for a breakout.

$DOGE

Primary Macro Analysis#Dogecoin still has a window of opportunity to be the only memecoin for a possible 5-10x. Remember, history is key as it provides a significantly lower margin of error for pattern confirmation, market psychology insights, and wave count validation. pic.twitter.com/slWVi5jskX— XForceGlobal (@XForceGlobal) February 18, 2025

Market Sentiment And External Influences

The development of new technology, regulatory changes, and macroeconomic factors are some of the external forces that could still affect the broader cryptocurrency industry. According to XforceGlobal, positive news regarding the meme coin and the increasing acceptance of blockchain technology can speed up its possible growth. However, as adverse market dynamics could halt advances and lead to more consolidations, prudence is advised.

Investor Considerations

Although a tenfold rise in the value of Dogecoin excites investors, they should consider the risks, of course. The market for cryptocurrencies is known for its intrinsic volatility; although past patterns offer some clues, they cannot ensure future performance. Diversification, risk management, and thorough examination remain as the key principles for navigating this unpredictable crypto landscape.

Dogecoin’s ability to deliver another major rally hinges on several factors, but XForceGlobal’s analysis suggests that the window for substantial gains is still open. As always, investors should stay informed and approach the market with a balanced perspective.

Featured image from Gemini Imagen, chart from TradingView