Bitcoin has extended its consolidation below $100,000 since the beginning of February. This price lag has been compounded by a slowdown in bullish sentiment among investors and a slowing euphoria regarding the crypto-positive influences of Trump’s new administration in the US.

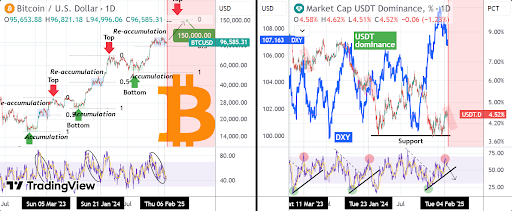

Despite this rally slowdown, technical analysis continues to support a bullish long-term outlook for Bitcoin. The current stagnation appears to be a re-accumulation phase for bullish investors; a pattern observed multiple times before major upward moves this cycle. Furthermore, analysis shows that the USDT dominance is going to play a crucial role in triggering the next Bitcoin rally toward $150,000.

Bitcoin’s Re-Accumulation Phase And The Role Of USDT Dominance

According to a technical analyst (TradingShot) on the TradingView platform, Bitcoin is currently exhibiting an interesting accumulation trend alongside the USDT dominance. The USDT dominance reflects the percentage of the total crypto market capitalization in USDT, indicating whether traders favor stablecoins over riskier crypto assets. A high USDT dominance typically signals low buying pressure in cryptocurrencies. Conversely, a declining USDT dominance often suggests that traders are rotating funds back into Bitcoin and other cryptocurrencies.

Interestingly, the USDT dominance has had a crucial simultaneous occurrence with Bitcoin’s preparations for rallies this cycle. Two notable re-accumulation periods have occurred after Bitcoin bottomed in November 2022, with each leading to significant price rallies. The first accumulation period spanned from January 2023 to March 2023, while the second occurred between November 2023 and February 2024. Both of these re-accumulation phases took place at the 0.5 Fibonacci extension level from an earlier accumulation phase. Additionally, these phases shared common characteristics, including a peaking 1-day RSI structure in the USDT dominance chart and a pullback in the Dollar Index (DXY).

Now, Bitcoin appears to be mirroring the same conditions again, with USDT dominance and the DXY pulling back with the current re-accumulation phase, which has been playing out since December 2024. If the pattern continues to unfold as expected, this could indicate that Bitcoin is on the verge of its next major rally.

USDT To Send BTC To $150,000

If Bitcoin follows the pattern observed in previous rallies this cycle with the USDT dominance to the core, the re-accumulation phase could end within the next one or two weeks and eventually cause another rally to new all-time highs.

In terms of a target, the analyst noted a potential $150,000 target for the Bitcoin price, at least before another major correction and a subsequent accumulation phase. However, Bitcoin must overcome key resistance levels, particularly the psychological $100,000 mark, which has served as a major hurdle in recent weeks.

At the time of writing, Bitcoin is trading at $97,175, up by 1.6% in the past 24 hours. A move to $150,000 will represent a 54% increase from the current price.