The post Can Bitcoin Solve the US Debt Crisis? VanEck’s Tool Provides Insights appeared first on Coinpedia Fintech News

The tool, provided on the VanEck website, allows users to calculate whether BTC could help resolve the US debt crisis.

The two prime components of the tool are the US National Debt Value calculator and the Bitcoin Treasury Reserve Value calculator.

Currently, the US debt stands at $36 Trillion. The US National Debt Value calculator shows that if the debt grows at a compound annual growth rate of 5%, it will reach $116 Trillion by 2049.

As of now, the price of Bitcoin stands at $98,269. The US Treasury Reserve Value calculator shows that if the BTC price surges by a compound annual growth rate of 25%, the value of a 1M BTC reserve will become approximately $21 Trillion by 2049 – which is roughly 18% of the expected 2049 US Debt.

The overall calculation suggests that if the US establishes a BTC strategic reserve as directed by the BITCOIN Act, it would be able to offset over 18% of its total national debt by 2049.

The BITCOIN Act and Its Proposal: What You Should Know

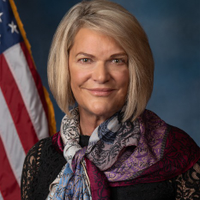

The BITCOIN Act was presented to the US Senate by Senator cynthia lummis

cynthia lummis

Cynthia Lummis is a senator from Wyoming, United States. She has a net worth ranging from $20 million and $75 million. On her son-in-law's advice, she purchased Bitcoin and became the first U.S senator to possess cryptocurrency. She possesses no less than $230,000 worth of Bitcoin. She adopted office on January 3, 2021, the term terminates on January 3, 2027. She has always been focused on advocating for Wyoming's future. She struggled her entire career fighting for Wyoming families, communities, businesses, and values. Beginning at the halls of the Wyoming House to the Halls of the U.S. House.

Lummis was born on September 10, 1954, and graduated from the University of Wyoming, earning a bachelor's degree in animal science, and biology. She also achieved a Juris Doctor from the University of Wyoming College of Law. Her career experience comprises working as general counsel to previous Wyoming Governor Jim Geringer, Wyoming House of Representatives, as a treasure of Wyoming, and in the United States House of Representatives from Wyoming's at-large congressional district.

In 1990, she also worked as the chair of Mary Mead's gubernatorial campaign and Ray Hunkins's gubernatorial campaign, in 2006, also served on Bob Dole's presidential steering committee in Wyoming. Through her firmly beneficial crypto position, she developed the reception and fair guidelines of computerized resources in the United States. She voluntarily organized a great foundation for herself as a significant Bitcoin financial backer. She is professed to continue encouraging the developing cryptocurrencies industry in the United States and all over the world in 2022. Her urge for transparency on cryptographic forms of money and stable coins in U.S. regulation will maintain on becoming tremendous. She had been always looking for a store of value, and she believes bitcoin specifically is a great store of value and knew that scarcity will protect its value going into the future, unlike the U.S. dollar that they are printing more of every single day.

Investor

The act proposes to establish a strategic Bitcoin reserve to serve as an additional store of value to bolster America’s balance sheet and ensure the transparent management of Bitcoin holdings of the federal government.

While presenting the bill, Lummis said: “Bitcoin is transforming not only our country but the world, and becoming the first developed nation to use Bitcoin as a savings technology secures our position as a global leader in financial innovation.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.