The market intelligence platform IntoTheBlock has revealed how Pepe & other memecoins are currently going through a decline in on-chain activity.

Pepe Has Seen A Notable Drop In Active Addresses Recently

In a new post on X, IntoTheBlock has talked about how the smaller tokens and memecoins in the cryptocurrency sector have compared against the Layer 1 networks in terms of activity recently.

The on-chain indicator of relevance here is the “Active Addresses,” which keeps track of the total number of addresses participating in some kind of transaction activity on a given network every day. The metric takes into account for both senders and receivers.

When the value of this indicator is high, it means a large number of addresses are taking part in transfers on the blockchain. Such a trend suggests user interest in the asset is high.

On the other hand, the metric being low implies not many investors may be paying attention to the cryptocurrency as only a few them are displaying activity on the chain.

It would appear that the Layer 1 networks (that is, the blockchains that can function independently from any other) have seen the former type of trend in the Active Addresses recently. “Despite downward price trends, on-chain activity for Layer 1s like Ethereum, Avalanche, and Litecoin remains robust,” explains the analytics firm.

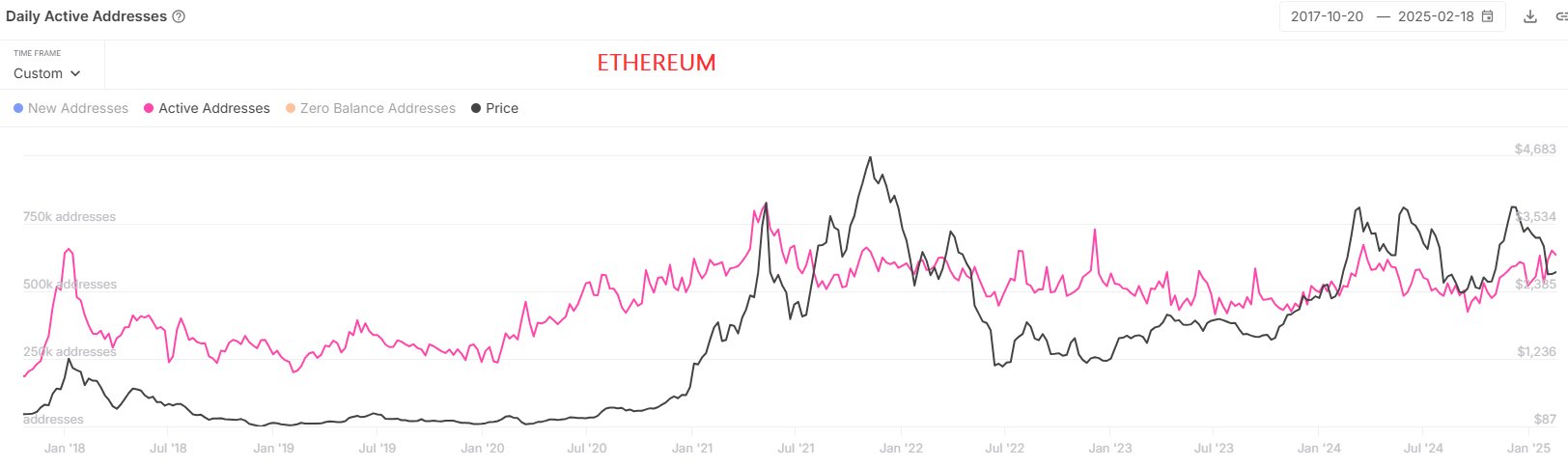

Here is a chart that shows the trend in the indicator’s value for Ethereum over the last few years:

As is visible in the above graph, the Active Addresses metric has been climbing for Ethereum recently, meaning that the blockchain is continuing to receive more activity from the users even with the declining price.

While ETH and other Layer 1s have enjoyed this on-chain growth, the smaller tokens haven’t been so fortunate. As IntoTheBlock notes, “smaller tokens & memecoins are losing steam quickly as fewer new users enter the space, highlighting the contrast between networks with strong fundamentals and those driven primarily by hype.”

Below is the chart for the Pepe Active Addresses, which showcases this trend.

From the graph, it’s apparent that the Active Addresses peaked for PEPE in November of last year and has since been following a downward trajectory. The decline in the indicator has coincided with the bearish action in the memecoin, so it would appear that the price drawdown may be what has scared users away from the network.

PEPE Price

At the time of writing, Pepe is floating around $0.0000093, down almost 4% in the last seven days.