Since the general crypto market entered a volatile period, Bitcoin has faced persistent heightened selling pressure from investors and traders in the past weeks, causing BTC’s price to drop sharply toward the $93,000 support level. After a period of bearish behaviors, optimism seems to have returned to the market as evidenced by a reduction in selling pressure.

Long-Term Bitcoin Holders Tighten Grip

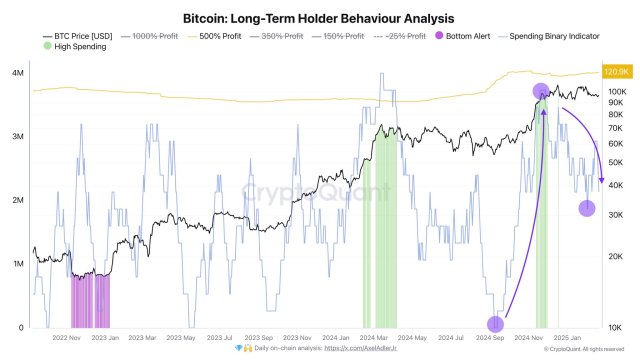

As the crypto market continues to wane, an on-chain expert at CryptoQuant Axel Adler Jr. has identified an encouraging shift in investors’ sentiment toward Bitcoin. In the post on the X (formerly Twitter) platform, Axel Adler highlighted that Bitcoin’s long-term holders have significantly reduced their spending activity, signaling a change in market dynamics.

The expert revealed the development after thoroughly examining the Bitcoin Long-Term Holder Behavior Analysis metric. This decline implies that these long-term investors are choosing to hold onto their coins in spite of recent price fluctuations, which may be a sign of confidence in BTC’s future performance.

A reduced spending activity by long-term BTC holders usually comes with periods of huge accumulations and fading selling pressure. As a result, Bitcoin’s price might be bolstered by this trend in the long run, allowing the asset to reclaim key resistance levels.

Data shared by Axel Adler shows that these investors have cut down their spending by over 60% compared to the level of spending around the $90,000 and $100,000 threshold. Furthermore, the reduction reflects a drop from more than 80,000 BTC to 40,000 BTC being sold on a daily basis.

It is important to note that the recent selling pressure by long-term holders was cited close to the $100,000 mark. Thus the expert has pointed out the next potential target where these seasoned investors might start to sell their coins again at a significant pace, which is the $120,000 level.

According to the expert, these investors will be forced to sell regardless of market conditions once this threshold is exceeded since they will have secured a 500% profit by then. In the meantime, watching this trend is crucial as traders anticipate the move toward new all-time highs.

BTC Set For A Potential Rebound Soon?

Looking at BTC’s recent price action, the flagship asset appears to be poised for a notable rebound shortly, raising traders’ optimism. Captain Faibik, a technical expert and investor has predicted a price recovery to the $106,000 level.

Captain Faibik’s forecast is based on an impending breakout from the Falling Wedge chart pattern in the 1-day time frame. A falling wedge formation is considered a bullish indicator for a price reversal toward the upside after a period of downward movements.

Once BTC successfully breaks out of the pattern, the analyst expects BTC to reclaim the $106,000 barrier in the upcoming days. With a strong market sentiment, the asset’s price could further increase, reaching a new all-time high.