According to an X post by crypto analyst Ali Martinez, Bitcoin (BTC) is witnessing a decline in sell-side pressure, indicating that a local market bottom may soon form for the premier cryptocurrency.

Bitcoin Local Bottom On The Horizon?

Bitcoin continues to trade just below the psychologically significant $100,000 level, hovering at $98,650 at the time of writing. However, the top cryptocurrency by market capitalization is witnessing a notable drop in sell-side pressure.

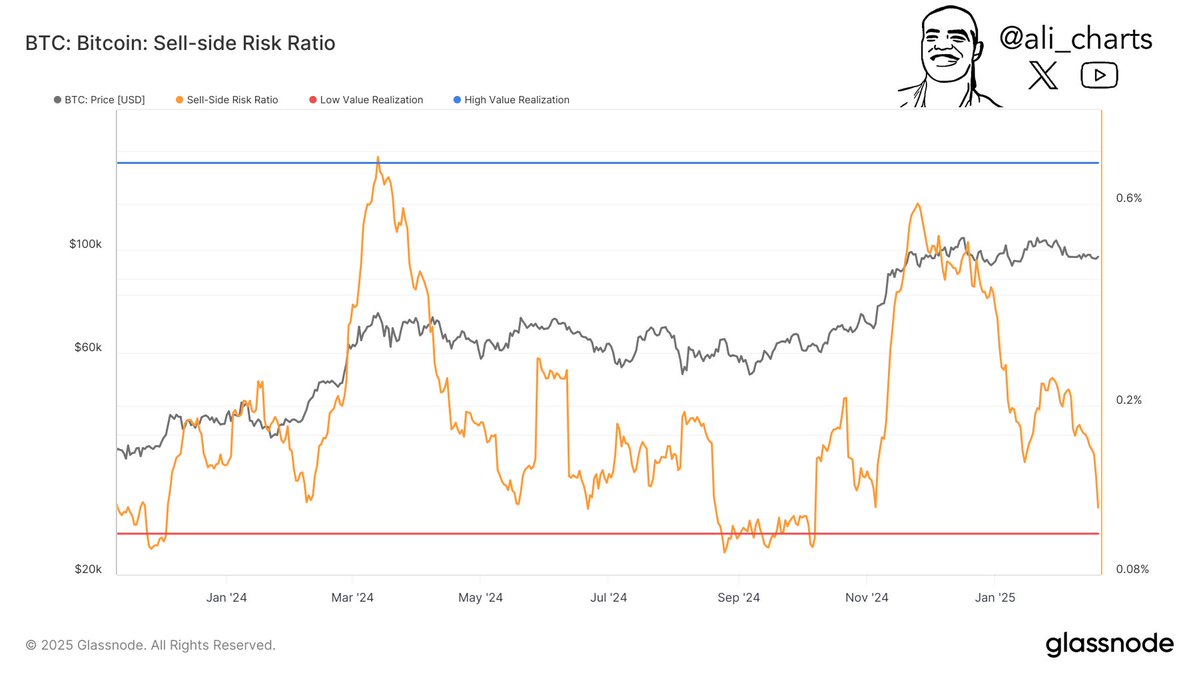

Martinez shared the following Bitcoin Sell-Side Risk Ratio chart from crypto analytics platform Glassnode, highlighting a sharp decline in the metric since mid-January 2025. This drop suggests that BTC may be forming a local price bottom, potentially leading to a new accumulation phase.

For those unfamiliar, a declining sell-side risk ratio typically indicates that investors are holding onto their BTC rather than selling, signalling the early stages of an accumulation phase where prices may stabilize or begin to rise.

Martinez’s analysis aligns with broader crypto market cycle theories, which suggest that market bottoms are often followed by an accumulation phase. This phase, in turn, paves the way for a potential price increase.

However, BTC must hold above key support levels to confirm this outlook. Crypto analyst Rekt Capital weighed in on Bitcoin’s price action, emphasizing the importance of a weekly close above $97,000 to maintain its higher low as support.

The analyst shared a Bitcoin weekly chart, noting that while BTC has seen multiple wicks below its symmetrical triangle structure, the overall bullish pattern remains intact. However, failure to close above $97,000 on the weekly timeframe could increase the risk of further downside.

Similarly, fellow analyst Daan Crypto Trades shared a bullish perspective, pointing out that BTC recently had a “solid break” from a descending channel structure. The analyst added:

Just need to see the continuation now into the weekend to get a good base going into next week. $98K is key in the short term.

Is BTC Primed For A New All-Time High?

While Martinez suggests that BTC may be forming a local bottom, other analysts believe the cryptocurrency is gearing up for a move beyond $108,000, potentially reaching a new all-time high (ATH). Analyst Kevin, for instance, predicts that a short squeeze could propel BTC to $111,000.

Similarly, recent analysis by Rekt Capital highlights that BTC is showing early signs of a bullish divergence which could break the digital asset’s bearish price momentum. At press time, BTC trades at $98,650, up 0.1% in the past 24 hours.