Dogecoin (DOGE) has once again captivated the crypto market, as significant investors have initiated transactions that suggest a potential price increase.

DOGE billionaires have amassed approximately 110 million tokens in the past 48 hours, indicating a significant level of interest in the meme-inspired cryptocurrency.

Although some analysts interpret this as a positive sign, technical indicators show the path ahead may not be as smooth as some might expect.

Whales Make A Splash With 110 Million DOGE

Wealthy buyers has recently loaded up their bags with millions of Dogecoin tokens. Although this buying has led to rumors of a possible breakout, it is common for whales to gather assets before big price changes.

The price of DOGE is about $0.244862 right now. Its high point for the day was $0.247588 and its low point was $0.243102. It looks like whales are getting ready for a possible upswing during this accumulation phase, but it’s not clear if this will lead to a continuous rise.

Key Resistance And Support Levels In Focus

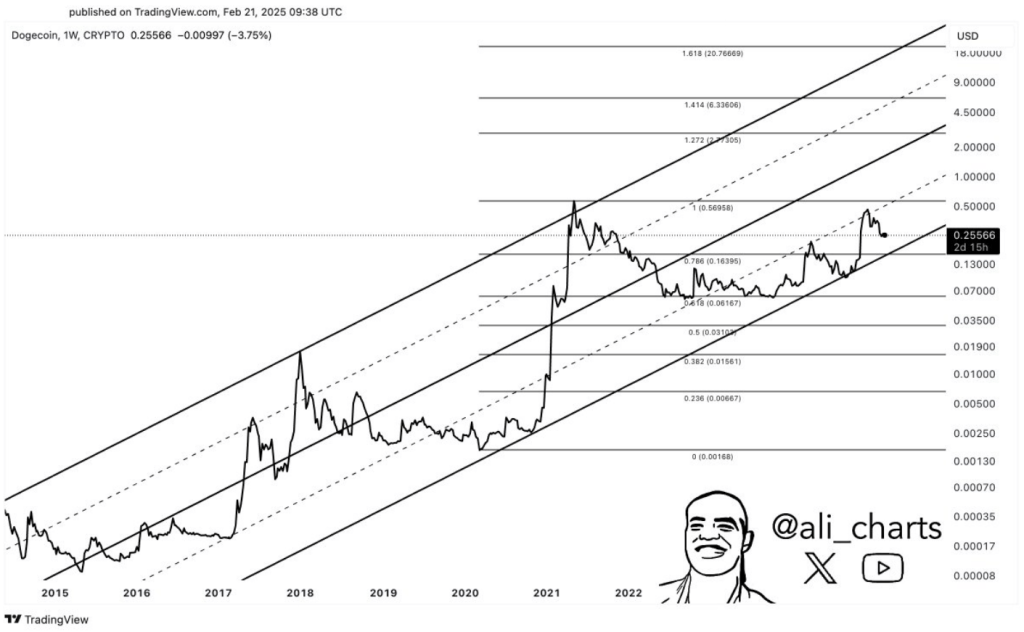

A technical study shows that Dogecoin is now facing strong resistance between $0.2556 and $0.2650. If the bulls break through these levels, a bigger rise could start. Even so, the fact that it failed to break through support could lead to a retracement or more stabilization.

The most critical support zone for #Dogecoin $DOGE is between $0.19 and $0.16. If this level holds, the $3 target remains a strong possibility. pic.twitter.com/VZyqSM2p8U

— Ali (@ali_charts) February 22, 2025

DOGE’s weakness is that it needs strong support at $0.19 and $0.16. According to crypto analyst Ali Martinez, it is very important for the meme coin to stay above these support zones in order to keep any positive progress going.

If this support doesn’t cave in, the $3 target for the meme coin remains a strong possibility, Martinez said. But, if DOGE drops below these values, a more severe correction may be on the way.

Technical Indicators & Mixed Signals

Despite the buildup of whales, technical signs suggest a more cautious stance. At the moment, the Relative Strength Index (RSI) is close to neutral. Meanwhile, the Moving Average Convergence Divergence (MACD) is showing signs of bearishness, indicating that there can be pressure to the downside.

In order to ascertain whether whale activity will be enough to reverse the present negative momentum, traders are keeping a careful eye on these indications. Because of the contradicting messages, it is unclear what DOGE will do next.

Could Dogecoin Ever Make It To $3?

The idea of Dogecoin hitting $3 has the cryptocurrency community excited, but this is still only a theoretical goal. Although considerable accumulation indicates confidence among large participants, the feasibility of such a price hike will ultimately depend on market conditions and technical resistance levels.

Featured image from Pexels, chart from TradingView