According to data from CoinMarketCap, the Binance Coin (BNB) recorded a trading week with no significant events, resulting in a net gain of 1.78%. Amidst much uncertainty in the crypto market, the altcoin has experienced a major dual price trend in February resulting in a price change of <1% in this period. Following recent developments, the BNB market is in a precarious position hinting at a possible price slide.

BNB Deviation Could Trigger A Drop To $380 Or Lower

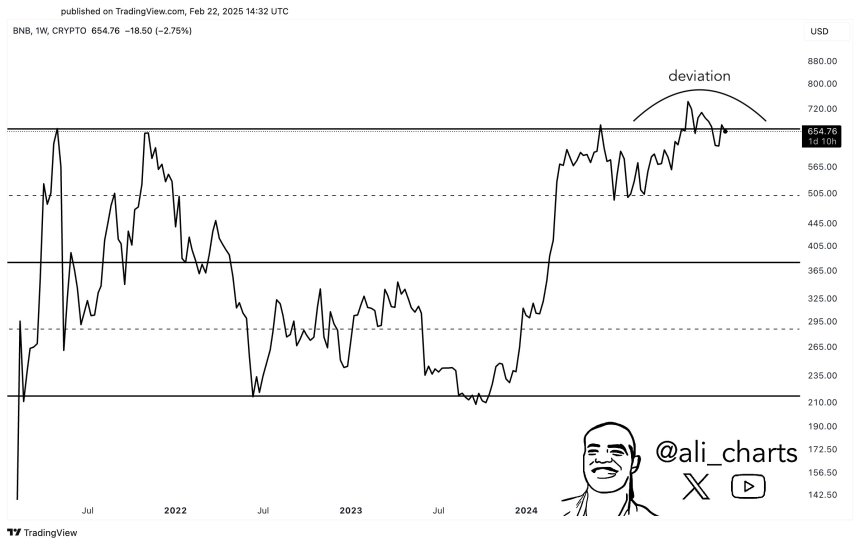

In an X post on Saturday, crypto analyst Ali Martinez provided valuable insight into the Binance Coin price structure. During a price rally in mid-February, BNB rose by over 34%, breaking past the $720 resistance zone to reach a local peak of $723. However, the asset failed to hold above $720 and has since dipped as low as $650.

Following this price pattern, Martinez postulates that if BNB is displaying a deviation, the altcoin could soon experience significant losses. For context, a deviation occurs when an asset’s price breaks above a key resistance level but fails to sustain this move reversing back into its previous price range. A deviation can indicate a market strength suggesting a lack of momentum in the absence of a clear price breakout.

According to Martinez, if the Binance Coin is undergoing a deviation, market prices are likely to plummet with initial support zones set around $505. However, the first major support level for BNB bulls would be at $380, which represents the midpoint of the asset’s current parallel trading channel.

Notably, in the presence of strong selling pressure, likely due to expectations for BNB to complete a range-bound movement, the token could fall to as low as $214 representing a potential 73% decline from current market prices. To invalidate this bearish sentiment, BNB would need to quickly reclaim $720, which would suggest sufficient buying momentum to sustain an uptrend.

BNB Price Overview

At the time of writing, Binance Coin exchanges hands at $668 after a 3.43% price increase in the past day. As earlier stated, weekly gains stand at 1.78% reducing the overall decline in the past 30 days to 3.13%.

According to its daily chart, BNB’s price has failed to break above its 100-day Simple Moving Average (SMA) suggesting a downtrend in the short term. However, the asset’s Relative Strength Index is at 54.40 and heading upwards indicating potential for some immediate price growth before entering the overbought zone (70).

With a market cap of $95.22 billion, BNB is ranked as the fifth largest cryptocurrency in the crypto market.