The post Hong Kong Investment Firm HK Asia Holdings Sees 103% Surge After Bitcoin Buy appeared first on Coinpedia Fintech News

Last week, HK Asia Holdings Limited, a Hong Kong-based investment company, officially entered the league of the public companies, which follows a Bitcoin investment strategy. Since February 16, the day when the company purchased its first BTC, the share price of HK ASIA HLDGS LTD has surged by 103.13%. It seems that the company has hugely benefited from the new investment strategy. Curious to know more? Read on!

HK Asia Increases Bitcoin Holdings

On February 16, the Hong Kong-based investment company purchased one BTC token. On February 20, the company added at least 7.88 more BTC tokens in its holdings. Currently, the total BTC holdings of HK Asia remains at 8.88 BTC tokens.

HK Asia Price Surge After Bitcoin Purchase

On the day when the first BTC purchase was made by HK Asia, the stock price of the firm was around 3.19 HKD.

On February 17, the first working day after the purchase, the price marked an exceptional single-day surge of 72.1%.

Since Feb 17, the HK Asia price has experienced an impressive growth of 103.13%.

Currently, the price stands at 6.50 HKD.

Could HK Asia’s Stock Hit a New High?

At the start of this year, the price of HK Asia was nearly 0.295HKD. Since then, the market has recorded a rise of 2137.29%. Between February 13 and 17 alone, the market has grown around 290.07%.

The market has broken above its June 2019 ATH of 6.50 HKD. Experts believe that if the current price holds, the market can close above the ATH.

Yesterday, the closing price of HK Asia was 6.30 HKD, although at one point, the same day, the market could touch as high as 7.18HKD.

Right now, the market remains at least 2.94% below the opening price of the day.

Why is HK Asia Buying Bitcoin?

On February 23, the board of HK Asia approved the BTC investment plan.

The plan follows a recent trend of publicly traded firms buying BTC tokens to boost earnings.

The growth achieved by the HK Asia market post the company’s first BTC purchase may have influenced the board to approve the aggressive BTC investment strategy.

Strategy, the public company which holds the highest number of BTC tokens, is the most vocal advocate of this strategy. Late last year, it called for top public companies, including Microsoft, to consider the strategy.

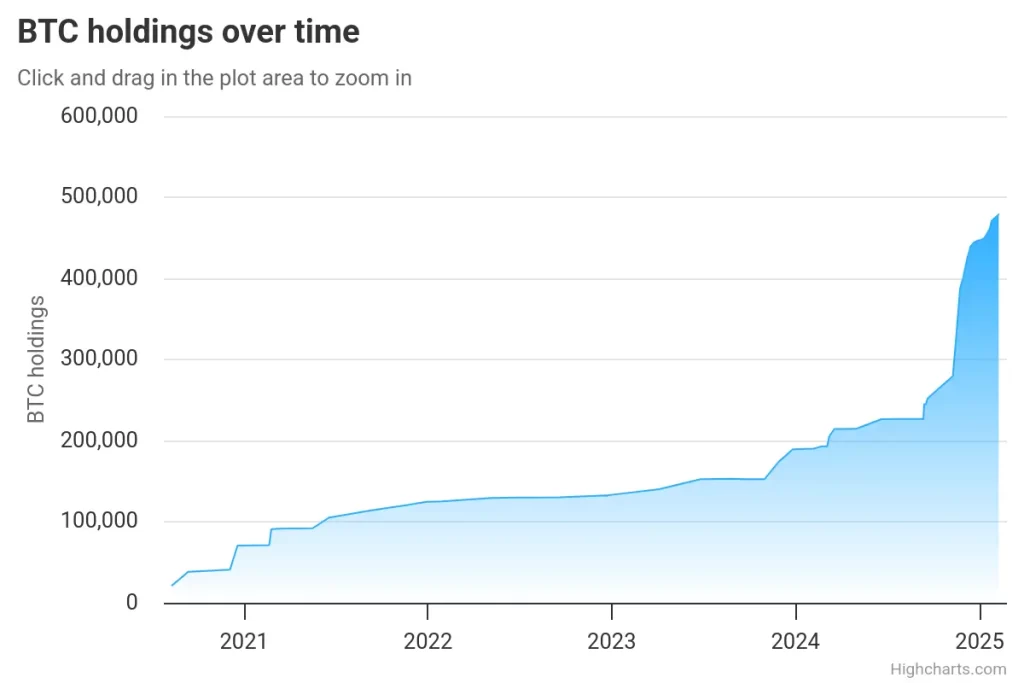

MSTR currently has no fewer than 478,740 BTC tokens, worth at least $45,763,580,032.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.