Crypto analyst Ali Martinez has revealed a bearish on-chain metric for Dogecoin, sparking a negative outlook for the foremost meme coin. Based on this, DOGE could be at risk of suffering further price declines.

Dogecoin’s Activity Levels Crash To 4-Month Lows

In an X post, Martinez revealed that Dogecoin’s network activity has dropped to its lowest level since October 2024, with just 66 whale transactions and fewer than 60,000 active addresses daily. Bitcoinist had also recently reported that DOGE’s large transactions had dropped by 88% since the end of last year.

This drop in Dogecoin’s network activity coincides with the price crash that the foremost meme coin has experienced since it reached a local high of around $0.46 in December. The whales massively influence DOGE’s price action, and the decline in whale transactions provides a bearish outlook for the meme coin.

With Dogecoin whales choosing to remain on the sidelines, the DOGE price could experience further declines. The meme coin has already dropped around 50% from its local high recorded in December, sparking concerns that its bull run has ended. Besides the drop in whale transactions and active addresses, DOGE’s open interest has also sparked concerns.

As Bitcoinist reported, Dogecoin’s open interest has dropped to December 2024 levels. DOGE witnessed a price crash back then as it fell from its local high. As such, the foremost meme coin is again at risk of suffering a price crash that could send it below the $0.2 psychological price level.

With such a bearish outlook, Dogecoin is at risk of testing the $0.19 price level. This level is significant as Martinez has before now suggested that a break below this level would suggest that DOGE’s bull run is over. However, he affirmed that as long as it holds above this level, then the foremost meme coin could still rally to as high as $4 in this cycle.

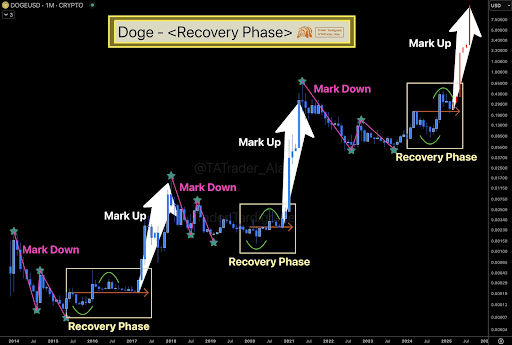

Final DOGE Pullback Before Next Leg Up

In an X post, crypto analyst Trader Tardigrade suggested this might be the final Dogecoin pullback before the next leg up. He remarked that DOGE may have completed the recovery phase. The analyst added that the meme coin’s markup phase is coming soon. His accompanying chart showed that Dogecoin could rally to as high as $7 when this markup phase occurs.

Meanwhile, in another X post, Trader Tardigrade stated that Dogecoin had reached the same retracement angle from the previous top. In line with this, he remarked that this might be the final DOGE level of the current pullback.

At the time of writing, the Dogecoin price is trading at around $0.23, down almost 5% in the last 24 hours, according to data from CoinMarketCap.