The post XLM Price Crash Alert! 35% Drop Incoming as Daily Chart Flashes Bearish Signal appeared first on Coinpedia Fintech News

With the ongoing market decline, XLM, the native token of Stellar, has turned bearish and is poised for a significant price drop. The primary reason for this bearish outlook is the current market sentiment and the price action XLM has formed on the daily timeframe.

Current Price Momentum

XLM is currently trading near $0.297 and has experienced a price drop of over 12% in the past 24 hours. However, during the same period, its trading volume jumped by 120%, indicating heightened participation from traders and investors compared to the previous day.

This jump in trading volume is potentially caused by the shift in market sentiment and XLM’s bearish outlook.

XLM Technical Analysis and Upcoming Level

According to expert technical analysis, XLM appears bearish as it has broken through the crucial support level of $0.311, which the asset tested multiple times in recent days. Additionally, it closed a daily candle below this level, partially confirming that the price is poised to continue its decline.

With this breakdown and candle closing, there is a strong possibility that the asset could drop by 35% to reach the $0.189 mark in the coming days. Meanwhile, during the price drop, XLM may find temporary support at the $0.25 mark before reaching $0.189.

Despite the breakdown of the crucial support, XLM’s price remains above the 200 Exponential Moving Average (EMA) on the daily timeframe, which currently acts as a support level. If the asset breaches the 200 EMA and falls below it, there is a high possibility that XLM’s price will continue declining smoothly to that level in the coming days.

$6.75 Million Worth Bets on Short Side

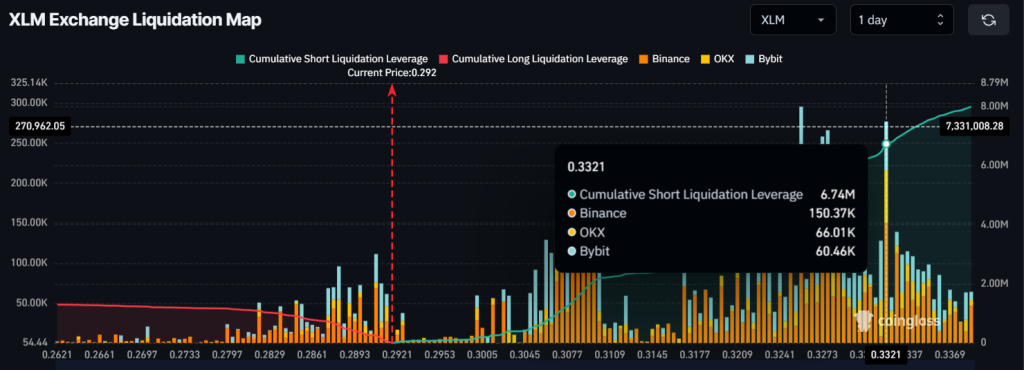

With the notable price drop and recent breakdown, sentiment has completely shifted as intraday traders appear to be strongly backing short positions, according to on-chain analytics firm Coinglass.

Data from the XLM exchange liquidation map shows that bears, or traders betting on short positions, are currently dominating the asset. Meanwhile, with the recent price drop, traders betting on long positions seem to be exhausted.

Based on recent data, $0.3321 is a level where traders betting on short positions are over-leveraged, holding $6.75 million worth of short positions. Meanwhile, $0.2821 is another level where traders betting on long positions are over-leveraged, holding $1.10 million worth of long positions.

This liquidation data and over-leveraged positions indicate that bears are currently dominating the asset and could push XLM’s price toward the $0.189 level soon.