Bitcoin’s price fell to $86,099 on February 26th, wiping out almost $1.06 billion from crypto’s market cap and sending ripples across the industry. According to Coinglass tracking, around 230,000 positions have been liquidated for the day.

As a sign of bearish sentiment, the digital asset’s open interest has dipped to 5%, reflecting deleveraging among investors and holders. On-chain data also suggests that exchange inflows surged to 14.2%, potentially suggesting panic selling among holders. Furthermore, funding rates are now in negative territory, indicating investors’ sentiments have shifted.

Massive Losses For Holders As BTC Tests $86K

As the world’s top digital asset, Bitcoin’s adverse price action caused plenty of ripples in the industry. With its price testing below $90k, thousands of positions were liquidated, and strong withdrawals from spot Bitcoin ETF funds were recorded. According to multiple reports, the five-day outflow for ETFs amounted to $1.1 billion, with $516 million lost on February 24th.

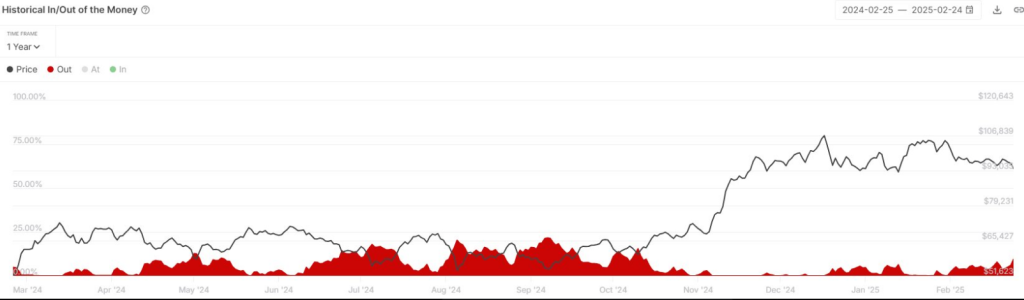

In a Twitter/X post, InTheBlock noted that around 12% of all BTC addresses are in the red. The post added that it’s now the highest unrealized loss percentage for Bitcoin since October 2024.

With Bitcoin briefly dropping below $90k, roughly 12% of all Bitcoin addresses are holding at a loss.

This is the highest unrealized loss percentage since October 2024 pic.twitter.com/pngLz4G4wc

— IntoTheBlock (@intotheblock) February 25, 2025

Crypto-Related Stocks Fall

Aside from individual holders, crypto-related stocks suffered from Bitcoin’s recent drop. Michael Saylor’s Strategy is one of the biggest victims, with its stock price dropping 11% in the past 24 hours. The company’s stock has been declining since its peak in November and has now fallen 55% from its high.

Strategy boasts a portfolio worth over $43 billion, including 499,096 Bitcoin. With Bitcoin’s price falling, many crypto observers speculate where Strategy will sell some of its assets. However, some experts have shot down this idea, saying it’s doubtful that a company will fully commit to crypto.

Other crypto-related stocks also tumbled, with Robinhood (HOOD) dipping by 8%, Coinbase (COIN) suffering a 6.4% decline, and Marathon Digital (MARA) and Bitcoin miners Bitdeer (BTDR) dropping 9% and 29% respectively.

Traditional Stocks Also Suffered

Bitcoin’s underperformance was also felt in the broader market, with declines in the traditional financial markets. The Nasdaq Composite dropped by 2.8%, and the S&P 500 surrendered 2.1% of its market cap. Observers also noted the sudden strength of the US Dollar Index, suggesting that many investors are looking for “safety havens” for their investments.

On-chain data also indicates a recent surge in crypto whale activities. Bitcoin whales have sold over $1.2 billion worth of digital assets.

According to analysts, Bitcoin’s decline is caused by macroeconomic conditions. The market is still reeling from US President Donald Trump’s tariff announcement, and geopolitical tensions between China and the United States are pushing some investors to rethink their long-term plans.

Featured image from Gemini Imagen, chart from TradingView