Bitcoin has plunged below the $80K level, setting fresh lows and sparking fear across the market. The recent downturn has erased over 18% of BTC’s value since last Sunday, leaving investor sentiment at extremely fearful levels. This sell-off has led to concerns about whether the bull market is coming to an end or if this is just another major correction within a long-term uptrend.

According to CryptoQuant insights, a staggering 4.4 million BTC from the total supply have now moved into a loss. This metric reflects the number of coins that were bought and are now worth less than their purchase price, primarily from traders who entered the market around the $95K level. Historically, these phases have led to either panic-driven capitulation or strong bounce-backs, depending on market reaction in the coming days.

As Bitcoin hovers near fresh lows, all eyes are on whether bulls can reclaim key levels or if further declines will follow. With sentiment at extreme fear, the next few trading sessions could be crucial in determining if Bitcoin is in for a prolonged correction or setting up for a rebound.

Bitcoin Faces Sharp Correction

Bitcoin has experienced a major correction, plunging to its lowest level since early November 2024. This unexpected drop has shaken the bullish outlook that many investors had for BTC and altcoins, casting doubt on the potential for massive returns in 2025. The sharp decline has led to increased fear across the market, with investors growing anxious about a possible shift into a bear market.

The market is now in extreme fear, as further selling pressure could drive BTC to even lower levels. With sentiment at its lowest point in months, traders are watching closely to see if Bitcoin can stabilize or if a deeper correction is on the horizon. Historically, major sell-offs have been followed by either strong bounces or extended consolidation phases, making the next few trading sessions crucial.

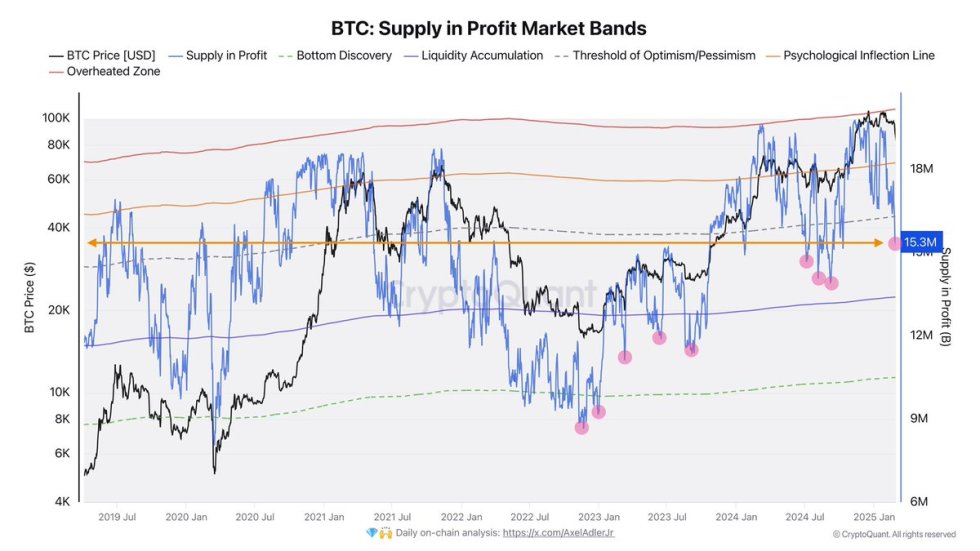

Top analyst Axel Adler shared insights on X, revealing that currently, 4.4 million BTC from the total supply have moved into a loss. This metric represents the number of coins bought and sold around the $95K level, reflecting how many traders are now holding BTC at a loss. Additionally, the supply in profit has dropped from 19.7 million BTC to 15.3 million BTC, indicating that a significant portion of holders are underwater.

With Bitcoin now trading below key support levels, the market must decide whether this correction marks the start of a bearish phase or is just another pullback before a rebound. If BTC fails to hold its current levels, a further drop could be imminent, but if bulls regain control, this could be a strong buying opportunity for long-term investors.

Bitcoin Struggles at $80K Amid Bear Market Fears

Bitcoin is trading at $80,190 after experiencing days of relentless selling pressure and rising fear that a new bear market could be unfolding. The cryptocurrency has lost over 18% of its value since last Sunday, shaking investor confidence and bringing BTC to its lowest level since early November 2024.

Bulls now face a critical challenge as they must defend the $80K mark and push BTC back above $85,500 as soon as possible. This level is crucial because it aligns with both the 200-day moving average (MA) and the 200-day exponential moving average (EMA)—two key indicators of long-term trend strength. Failing to reclaim these levels could signal further downside pressure, making a bearish continuation more likely.

If BTC fails to react positively at current levels, the next key support zone sits around $75K. Losing this level could trigger even more panic selling, further confirming a bearish shift in market structure. On the other hand, a quick recovery above $85,500 could restore confidence, setting the stage for a potential bounce toward $90K in the coming weeks. The next few trading sessions will be crucial in determining Bitcoin’s short-term trajectory.

Featured image from Dall-E, chart from TradingView