Many people wonder about the length of Bitcoin’s rollercoaster journey that its price increase has been on. The bull run may persist until at least April 2025, argues CryptoQuant CEO, Ki Young Ju. Should this be the case, it could signal the longest ever Bitcoin bull cycle.

Variations In Bitcoin’s Growing Rate

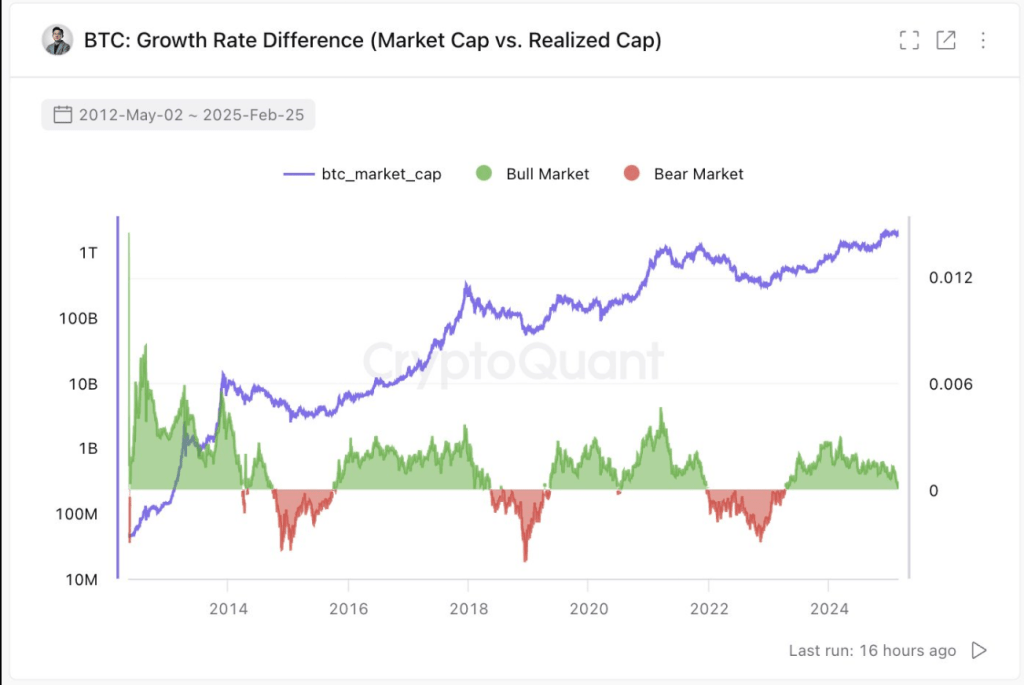

Ju created a Bitcoin growth rate difference statistic for May 2024 that formed the foundation for his projection. Monitoring the long-term market movements of the crypto helps one to ascertain whether the asset is still in a growth phase or overheated.

Right now, Bitcoin is in what he refers to as a “critical zone,” in which market signals combine bullish and bearish patterns. Whether Bitcoin keeps on its ascent or begins to lose vigor will depend mostly on the next few weeks, or months.

#Bitcoin on-chain indicators are at the bull-bear boundary.

I expect this to be the longest bull run in history, but I could be wrong. We need at least another month of data to confirm whether we’re entering a bear market. If demand doesn’t recover, indicators may fully signal a… https://t.co/QkaZx7wmAt pic.twitter.com/4iHbuitW4o

— Ki Young Ju (@ki_young_ju) February 27, 2025

Market Fluctuations And Past Corrections

Investors are beginning to have jitters about Bitcoin’s price as it has lost 30% of its value in the last few days. But Ju is not bothered. According to him, severe pullbacks like these are not uncommon during a bull cycle phase.

Historical records support his assertion; earlier bull runs show price losses of up to 52% before recovery. Should history be the barometer, Bitcoin might still have some surprises in its sleeves and carry out strong upward moves in the face of a volatile market.

The BlackRock Bitcoin Selloff

Movement in Bitcoin price is much influenced by institutional investors. BlackRock lately sold roughly $70 million in ether and $440 million in bitcoin. These big sell-offs could cause temporary devaluations and change investor mood. These events could change the price direction of Bitcoin in the next months even if Ju is optimistic.

What’s Next For The Alpha Coin?

Meanwhile, Bitcoin is not in good form as we speak: it is languishing in the $79,900 level, to the delight of those who’ve been waiting to buy the dip. Bitcoin is trading 7% below its most recent closing. It peaked at $86,990 then fell to a low of $79,490. The bulls can only wish it was the other way around.

Ju’s research shows that although some investors worry about possible future dips, the bull run is far from over. Since April 2025 is just a month away, traders and experts are still captivated by Bitcoin’s long-term trend and what the coming days will bring on the table.

Ju’s observations offer a data-driven viewpoint even if nobody can exactly predict the market. Whether Bitcoin follows past patterns or creates new ground, investors will be closely observing it. Anything can happen in the crypto space.

Featured image from Gemini Imagen, chart from TradingView