The post HBAR Poised for 20% Rally, Chart Flashing Buy Signal appeared first on Coinpedia Fintech News

Amid the ongoing bearish market sentiment, HBAR, the native token of Hedera, is poised for an impressive rally as it has broken out of a bullish price action pattern. On February 28, 2025, following the opening bell of the U.S. market, most assets began experiencing a price rebound.

HBAR Bullish Breakout

HBAR has witnessed an upside momentum of 7.5%, and with this price surge, the asset has reached a crucial resistance level of $0.20 and is poised for a breakout. Currently, HBAR is trading near $0.21 and has gained over 6.5% in the past 24 hours.

During the same period, its upside momentum has driven a surge in trader and investor participation, resulting in a 70% jump in trading volume.

HBAR Technical Analysis and Upcoming Level

According to expert technical analysis, HBAR appears bullish as it has broken out of a bullish double-bottom price action pattern formed on the four-hour timeframe. Based on historical price momentum, if the altcoin closes a four-hour candle above the $0.21 level, there is a strong possibility it could soar by 20% to reach $0.25 in the coming days.

Bullish On-Chain Metrics

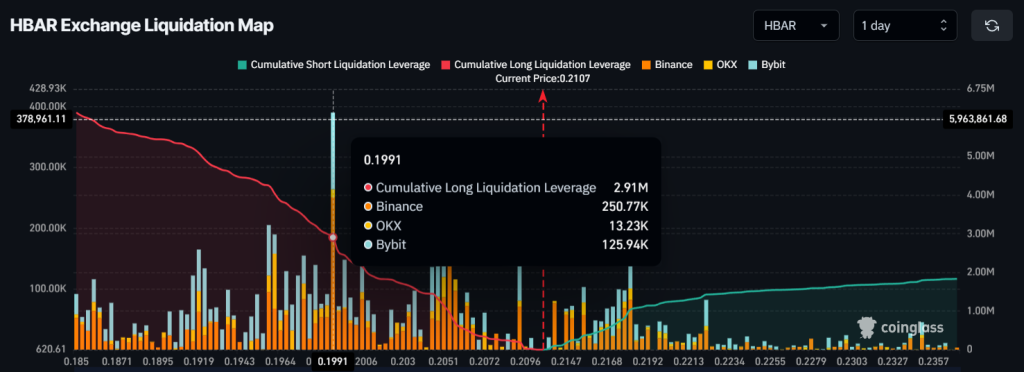

Following the breakout, sentiment appears to be shifting toward the positive side. Traders are betting on the bullish side, while investors are accumulating tokens, as reported by the on-chain analytics firm Coinglass.

Data from spot inflow/outflow reveals that exchanges have witnessed an outflow of $2.50 million worth of HBAR in the past 24 hours, indicating potential accumulation, which could drive buying pressure and an upside rally.

In addition to the bullish outlook of investors and long-term holders, intraday traders also seem to be increasing their bets on the bullish side, with bulls currently dominating the asset.

At press time, traders betting on the long side are over-leveraged at $0.1999, where they have built $3.10 million worth of long positions. Meanwhile, $2.18 is another over-leveraged level where traders betting on the short side have built $1.34 million worth of short positions.

Combining these on-chain metrics with technical analysis, it appears that bulls are currently in control, and HBAR could soon skyrocket.