The Bitcoin (BTC) market has been highly volatile in the last week and under a strong bearish influence. In this period, Bitcoin has crashed by over 15% falling as low as $80,000. Interestingly, blockchain analytics firm Glassnode has provided an in-depth analysis of investors’ behavior amidst this price decline highlighting the cohort with the largest realized losses.

BTC 1-Day To 1-Week Holders Lead Market Liquidation Pressure

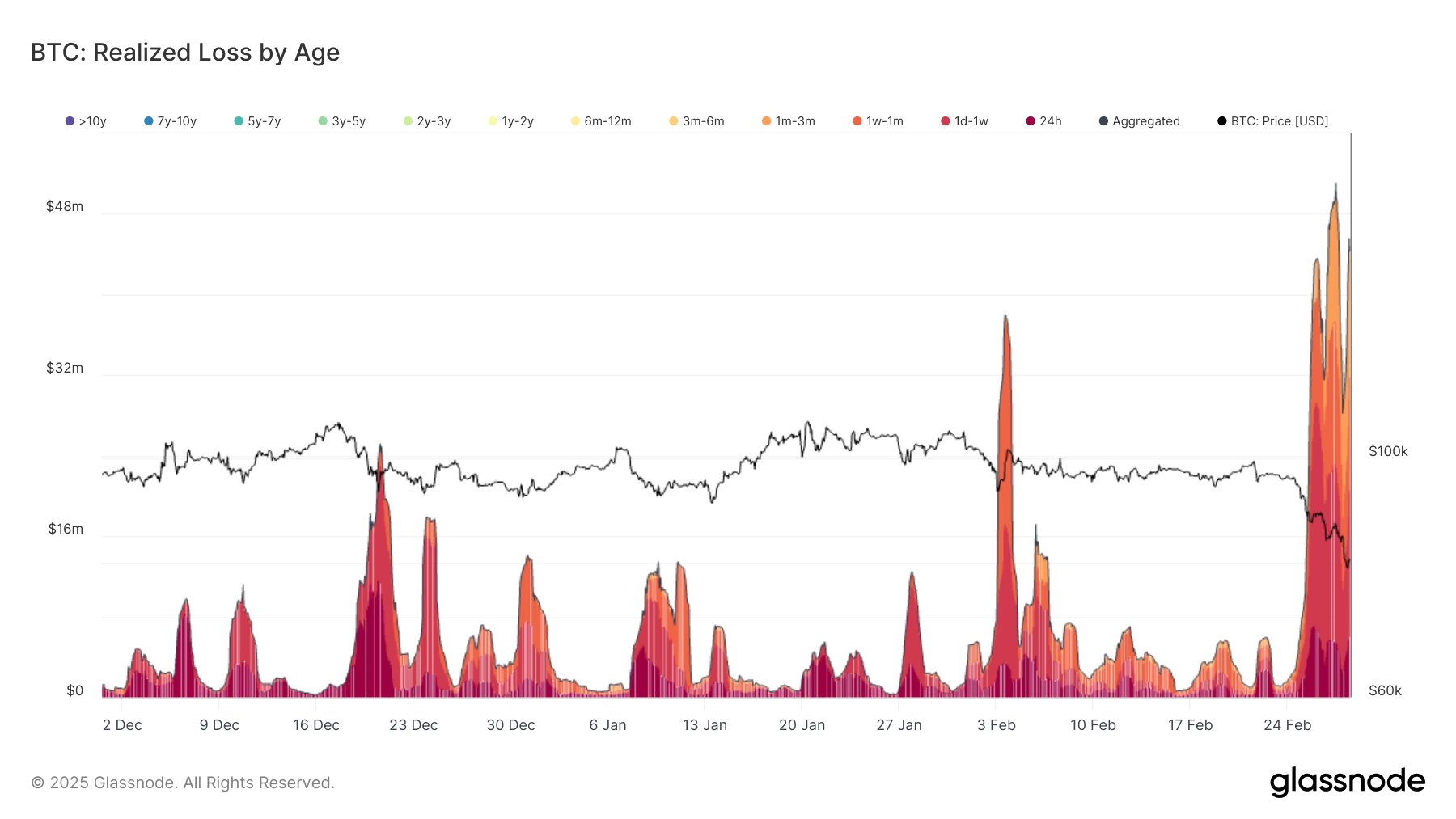

On Friday, February 28, Bitcoin dipped below $80,000 reaching a price level last seen in November 2024. In response, the BTC market recorded $685 million in realized losses in addition to the initial $2.16 billion between February 25-27. In a recent X post, Glassnode analysts dived into the market sell-off on Friday, indicating that this recent capitulation is primarily concentrated among short-term holders (STH) who are realizing losses at a much higher rate than long-term holders.

From Glassnode’s report, the most affected cohort of STH has been new market entrants over the past week as indicated in the following data: 1-day to 1-week holders with $238.8 million in losses,1-week to 1-month holders ($187.6 million), 1-month to 3-month holders ($132.4 million) and 24-hour buyers ($104.9 million). However, it’s worth noting that holders from the past 3-6 months also experienced a significant spike in realized losses. This group recorded $ 12.7 million in realized losses on Friday, representing a 95.4% gain from the previous day.

Looking further, Glassnode’s report also realized the price dip on Friday also pushed the Bitcoin loss realization average rate to $57.1 million per hour. The realization speed per cohort of the STH – who account for the majority of the market losses is as follows: 1-day to 1-week holders with $19.9 million/hour, 1-week to 1-month holders ($13.9 million/hour), 1-month to 3-month holders ($14.2 million/hour) and 24-hour buyers ($8.04 million/hour).

As expected, the 1-day to 1-week cohort is the dominant force in driving liquidity pressure with a loss realization rate almost double the next largest group.

Bitcoin Long-Term Holders Stay Resolute

According to more data from Glassnode’s report, Bitcoin long-term holders from the last 6-12 months have shown minimal, negligible loss realization despite a widespread market capitulation.

This development indicates that the longer-term investors are largely unbothered by the recent sell-off and price correction with strong confidence for a market rebound. At press time, Bitcoin trades at $85,200 following some price recovery on Friday. However, its weekly losses remain at 11.34% indicating the current bearish move in the market.