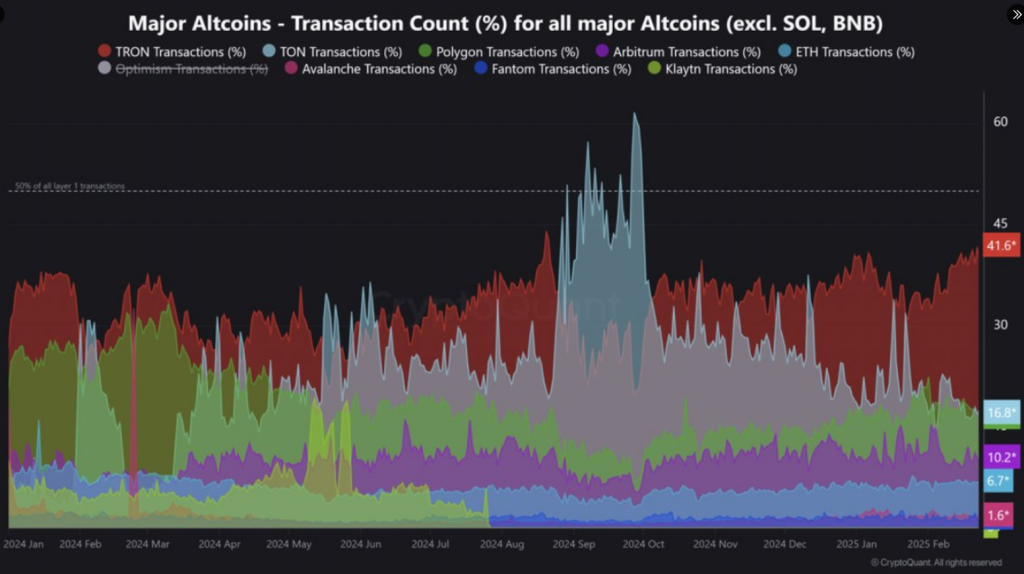

Tron (TRX) is demonstrating its status as a dominant force in the realm of altcoin transactions. The network has established itself as one of the busiest blockchain networks by capturing a significant 42% proportion of all altcoin transactions. Tron’s dominance is becoming increasingly apparent due to its expanding role in decentralized finance (DeFi) and its efficient system for managing Tether (USDT) transfers.

Tron’s Position In The Altcoin Market

Tron has established itself as the foundation for stablecoin transfers, processing millions of transactions each day. The blockchain is a critical factor in the growth of its market share, as it processes a substantial portion of USDT transactions. For merchants and investors seeking to efficiently transfer funds, Tron is an appealing option due to its low fees and high transaction speeds.

TRON Leads Altcoin Transactions with 41.6%, Driven by USDT and DeFi Growth!

“This chart shows the transaction percentage of major altcoins (ex. SOL and BNB) over time. Tron Network has the highest share, staying around 40%. In recent days, it reached 41.6%.” – By @JA_Maartun pic.twitter.com/Eeq0JylaxV

— CryptoQuant.com (@cryptoquant_com) February 26, 2025

Tron’s domination extends beyond the realm of small-scale activity, according to a research by CryptoQuant. The fact that the network currently controls 70% of all USDT transfers is a clear sign that users prefer the network over competitors such as Ethereum and Binance Smart Chain. Because of this, Tron’s entire USDT supply share has climbed to 43%, which is on the verge of reaching its highest level ever recorded.

A Closer Examination Of The Data

The statistics are the foundation of Tron’s strength. The network processes more than 14 million USDT transactions per week, according to recent statistics. The volume alone is sufficient to establish it as a leader among the majority of altcoins, demonstrating its increasing importance in the cryptosphere.

Even though there are still a lot of transactions going on, Tron’s price has been holding steady. In the past day, TRX has gone up 7.7% and now trades at about $0.23. Even though this may not seem like a big step, the network’s steady growth shows that its strong base is helping to keep its value.

What Does This Mean For The Price Of TRX?

The big question remains—will Tron’s transaction dominance lead to a surge in TRX’s price? Market analysts believe that increased network usage could push TRX to higher levels. Some predictions even suggest the token could hit $1.11, representing a 444% gain from its current price.

However, history has demonstrated that many transactions do not immediately result in price increases. Investors sentiment and the overall health of the market are only two of the several other factors that will impact TRX’s price trajectory.

Featured image from Vocal, chart from TradingView