On March 2, US President Donald Trump announced the inclusion of Bitcoin, Ethereum, XRP, Solana, and Cardano in a newly formed Crypto Strategic Reserve, an initiative designed to integrate these digital assets into the country’s broader economic and monetary plans. The immediate market reaction was significant: prices for many of the mentioned cryptocurrencies spiked, reflecting both investor excitement and speculation.

Nonetheless, the decision to add a variety of altcoins alongside Bitcoin quickly ignited debate among industry leaders and financial experts, many of whom questioned the wisdom and long-term ramifications of such a broad approach.

Bitcoin, Not Altcoins

Criticism was swift from Jeff Park, Head of Alpha Strategies at Bitwise, who described Trump’s move as “a huge political miscalculation” and warned that of the risk the assumption of inside dealing.” Park further elaborated that BTC’s unique status as the premier digital store of value deserved standalone consideration, cautioning that political optics could shift unfavorably if the Strategic Reserve featured cryptocurrencies with uncertain regulatory and technological foundations.

Park stated: “Huge political miscalculation by Trump in underestimating just how crucial it was for the Strategic Reserve to focus solely on Bitcoin. Sad! Political opportunities are calculated by marginal wins of new votes vs loss of old votes. This is why Elizabeth Warrens’ anti crypto army made no sense. Gain 0, lose 100. Trump is about to understand in crypto land what Bitcoin—and only Bitcoin—represents.”

He also highlighted the potential for voter backlash, drawing parallels to past missteps by politicians who attempted to court new constituencies without fully weighing the cost of alienating existing supporters. “Big problem here is optics. When you include altcoins whose use case is too nascent to be deemed ‘nationally strategic,’ you risk the assumption of inside dealing even if it were patently false. This is politically negative, even among a subset of crypto enthusiasts,” he added.

Hunter Horsley, CEO of Bitwise, concurred with Park, stating on X that he had initially “imagined a Strategic Reserve would be just Bitcoin” and that “Bitcoin is the undisputed store of value for the digital age.” Although Horsley noted the administration’s openness to crypto as a positive step, he argued that the term “reserve” implies a focus on stability and global recognition—two features that have largely been attributed to BTC rather than newer assets.

By adding altcoins, he suggested, the White House might undermine the underlying principle of having a national reserve in the first place. “Many crypto assets have merits, but what we’re talking about here isn’t a US investment portfolio — we’re talking about a reserve, and BTC is the undisputed store of value for the digital age. Of course, I’m grateful the new administration is so constructive on the space. Look forward to learning more about the thinking here,” he remarked.

Notably, other leading figures from the crypto industry which can also not be considered “Bitcoin maximalists,” agree with both Bitwise execs. Brian Armstrong, CEO of Coinbase, also suggested that “just Bitcoin would probably be the best option—simplest, and a clear story as successor to gold,” while acknowledging an alternative: a market-cap-weighted index for broader crypto exposure. “If folks wanted more variety, you could do a market cap weighted index of crypto assets to keep it unbiased But probably option #1 is easiest,” Armstrong stated.

Others approached Trump’s announcement from a more philosophical angle. David Marcus, CEO and co-founder of Lightspark, bluntly remarked, “Mixing the only code-driven asset with human-run ones is a mistake,” signaling a belief that Bitcoin’s decentralized, algorithmic approach to supply and governance is crucial for a true reserve asset.

In turn, longtime gold advocate and Bitcoin skeptic Peter Schiff delivered a surprising partial endorsement for Bitcoin, saying, “We have a gold reserve, and Bitcoin is digital gold. But what’s the rationale for an XRP reserve?Why the hell would we need that?”

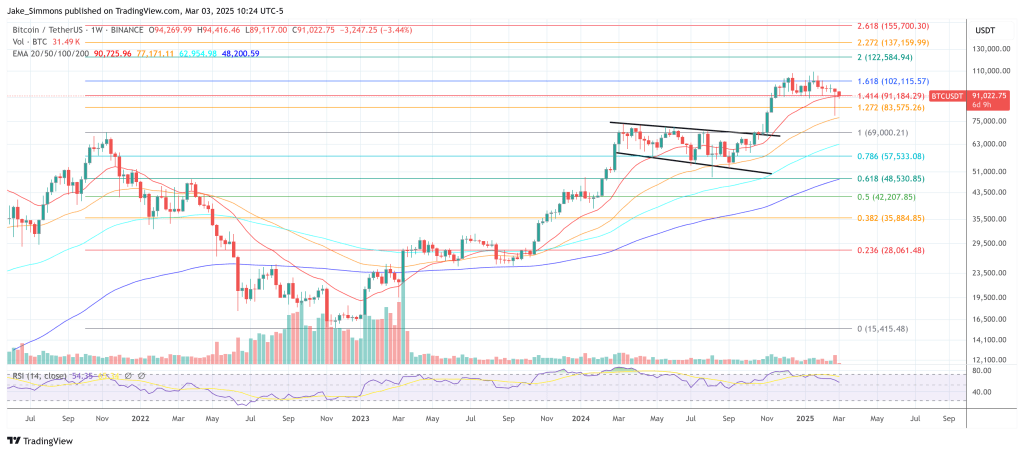

At press time, BTC traded at $91,022.