The post HBAR Price Explodes After ETF Filing, 50% Rally Loading? appeared first on Coinpedia Fintech News

Despite massive price drops across the crypto market, HBAR, the native token of Hedera, is making waves with its impressive price performance. Today, March 4, 2025, the asset has soared over 10% in the past 24 hours and is currently trading near $0.24, seemingly reclaiming its crucial support level of $0.25.

Why is HBAR Price Rising?

The potential reason behind HBAR’s impressive price rally is the recent Spot Exchange-Traded Fund (ETF) filing by the asset management giant Grayscale. Additionally, Nasdaq assisted the asset manager with the filing process.

HBAR Sees $12 Million in Exchange Outflows

With the filing, investors and long-term holders have shown strong interest, as reported by the on-chain analytics firm Coinglass.

Data from the spot inflow/outflow revealed that exchanges have witnessed an outflow of over $12 million worth of HBAR in the past 24 hours. This substantial outflow from exchanges has the potential to create buying pressure and fuel an upside rally, which explains today’s HBAR gains.

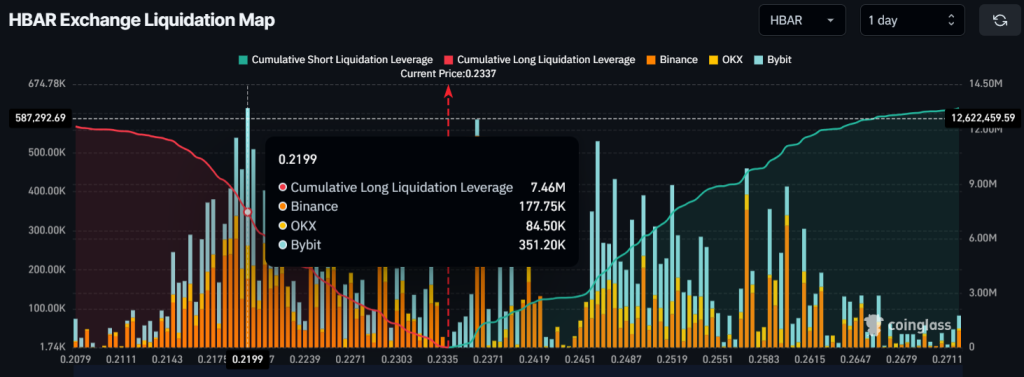

In addition to investors’ bullish outlook, intraday traders seem strongly positioned on the bullish side.

Major Liquidation Levels

At press time, the major liquidation levels are at $0.22 on the lower side and $0.246 on the upper side, with traders over-leveraged at these levels. Data further revealed that traders betting on the bullish side have built $7.50 million worth of long positions at the $0.22 level, whereas $3.85 million in short positions have been placed at the $0.246 level.

These liquidation levels and over-leveraged positions by traders show that bulls are currently dominating and could support the asset’s upcoming upside momentum.

HBAR Price Action and Upcoming Level

With today’s gain, HBAR seems to be regaining its crucial support level of $0.25, which it lost during the recent price decline. According to expert technical analysis, HBAR is reclaiming this key level. Based on recent price action and historical momentum, if the asset successfully reclaims the $0.25 level, there is a strong possibility it could soar by 50% to reach $0.38 in the coming days.

Despite ongoing market uncertainty, HBAR has maintained itself above the 200 Exponential Moving Average (EMA) on the daily timeframe, indicating that the asset is in an uptrend.