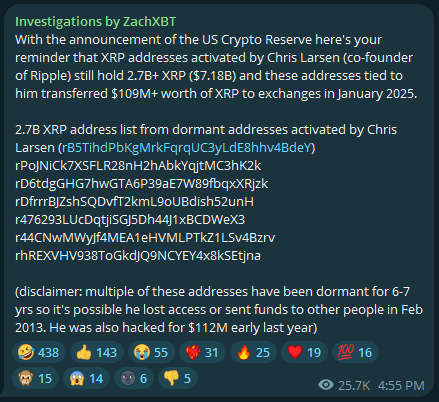

A blockchain investigator discovered a series of dormant XRP wallets linked to Ripple co-founder Chris Larsen, which had over 2.7 billion XRP. These holdings are worth around $7.18 billion. Some of these wallets had been idle for six to seven years before unexpectedly reactivating in January 2025.

Old Wallets Begin Moving Large Amounts

The once-idle wallets did not remain quiet for long, crypto sleuth ZachXBT disclosed. More than $109 million in XRP transactions were registered, with cash going to prominent exchanges such as Coinbase, Bitstamp, and Bybit. This unexpected activity has prompted doubts regarding the timing and purpose of the transfers.

Some in the cryptocurrency world worry if Larsen lost access to the wallets and only recently regained control. Others suspect that the money changed hands a long time ago, possibly as early as 2013. ZachXBT remarked that it is unclear whether Larsen still has direct control over all of these wallets.

XRP: Market Impact And Price Surge

The timing of these wallet activations coincided with a key announcement by US President Donald Trump. He outlined ideas for a strategic cryptocurrency reserve that comprises XRP, Bitcoin, Ethereum, Solana, and Cardano.

This revelation caused a sharp price uptick in XRP: from $2.23 to a peak of $2.93 and then to $2.60, translating to an 18% increase. Investors and traders paid attention, with some conjecturing that the value increase was connected to the wallet movements.

Previous Transfers Add More Questions

Larsen’s transactions have made headlines before. Back in September 2020, he transferred approximately 500 million XRP, worth $115 million at the time, to an unidentified address. He later explained that the move was to NYDIG for security purposes.

Nonetheless, others in the cryptocurrency field suspected that there could have been other motivations, although there was no substantial proof to corroborate those assertions.

What Comes Next?

Discussions have resurfaced in response to recent developments. Is this just ordinary fund management, or is there something bigger going on? The answers are still unknown.

As the XRP community monitors these wallets, speculation persists. Will there be other significant transfers? Could this have a further impact on the XRP market price? While no one can say for sure, one thing is certain: when billions of XRP start moving, people will know and start to make some noise.

Featured image from Pexels, chart from TradingView