The post KAITO Coin Make 22% Surge, Heading To $2.5? appeared first on Coinpedia Fintech News

Key Takeaways

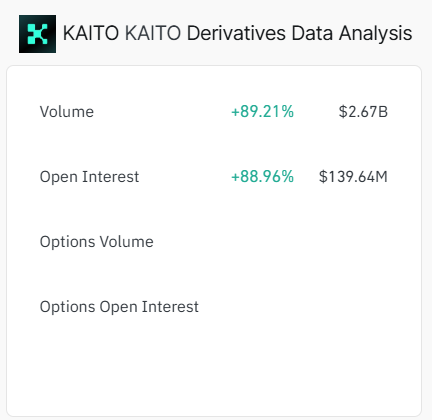

- Kaito’s open interest has jumped 88.96% to $139.64 million, reflecting growing interest in the altcoin.

- The bullish volume signals that most traders expect further price recovery.

- Technical indicators on the 4-hour chart indicate $KAITO may be developing a bullish reversal pattern.

Kaito (KAITO) price surged by 26%, fueled by its listing on Upbit, adding to its growing presence on major centralized exchanges.Unlike the same week when it launched, Kaito token is part of today’s top gainers. In the last 24 hours, the price has reached $1.81 with a market cap of over $435 million.

KAITO Buying Pressure Surges

KAITO reached an all-time high of $2.92 days after the project airdropped tokens to qualified customers. In the last 24 hours, total Open Interest (OI) increased by 89% to approximately $140 million.

The total Open Interest (OI) is the value of all open positions in a contract. Because every trade involves a buyer and a seller, OI is always split 50/50 between longs and shorts.

It rises or decreases depending on the net open situation. A price increase combined with increased OI does not imply that there are more longs than shorts; rather, it indicates that buyers are more aggressive, which is a positive indicator.

Market Volatility and Bullish Momentum

On the 4-hour time frame, KAITO is forming a double bottom pattern at the $1.55 level, which is a significant bullish reversal pattern. The price has bounced back from the $1.55 support area, suggesting that bulls are fighting to defend lower levels. Nevertheless, the altcoin has stiff resistance at $2.028 indicated by the key indicators.

A break above $2.028 might initiate a rally toward $2.50 and $2.92 resistance levels.

Key Indicators Supporting Price Surge

The KAITO price chart is forming lower highs and lower lows, signaling a slight downtrend around $1.5536. The price may hold above $1.70, there is a chance of a reversal bounce towards $2.0.

Currently, it is approaching the 20-day moving average (BB Middle Band) of $1.90, which serves as modest resistance. The 50-day Simple Moving Average (SMA) around $2.02 is an important resistance zone. A breakout over this level could spark additional gains.

The price increase is accompanied by increased volume, reinforcing the positive trend. The $2.028 zone acts as immediate resistance, while a breakout could push prices toward $2.50, which is a 38% increase from the current price.