Despite the recent positive momentum in the market, the AAVE price seems to be back under bearish pressure over the past day. As a result of the dwindling sentiment, the price of AAVE has dropped beneath the psychological $200 level in the last 24 hours.

However, a prominent crypto analyst on social media platform X has suggested that the DeFi token won’t be down for long. According to the crypto pundit, the AAVE price could begin a new bullish rally, with its sights on the $360 mark.

AAVE Price Prediction: Analyst Forecasts 80% Surge

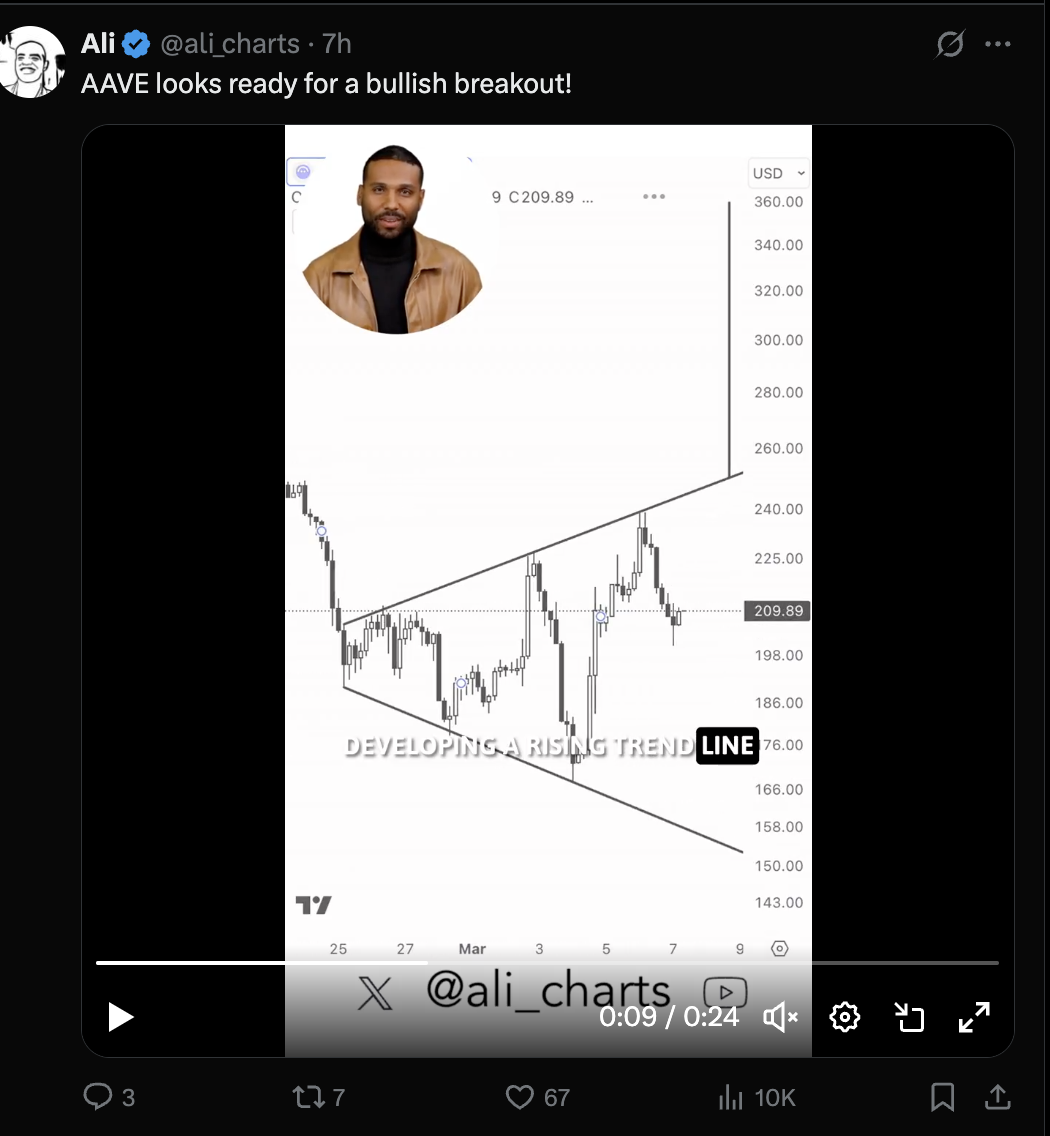

Popular crypto trader Ali Martinez took to the X platform to share a video, explaining AAVE’s potential path to return to its former price highs in the current cycle. This optimistic prediction is based on a developing “broadening formation” on a medium-term timeframe of the AAVE price chart.

For context, a broadening formation is a price pattern in technical analysis characterized by two diverging trendlines; a rising upper trendline (connecting a series of higher highs) and a falling lower trendline (connecting lower lows). This pattern is often associated with a period of increasing price volatility (or significant price action).

Typically, broadening patterns are bearish chart formations for most asset prices, as they are often correlated with rising volatility without a clear indication of the next direction. However, the current formation appears to be bullish and could prove a pivotal turning point for the AAVE price.

According to Martinez, the DeFi coin looks primed for a bullish break out of the developing broadening pattern. However, the AAVE price would need to breach the crucial resistance level of around $250 before this bullish breakout can be confirmed.

If AAVE successfully closes above this $250 resistance zone, investors could see its price travel to as high as $360 over the next few weeks. This would represent an over 80% surge from the current price point.

Can Whales Push AAVE To $250?

As of this writing, the price of AAVE is hovering around the $200 mark, reflecting an over 6% decline in the past 24 hours. According to CoinGecko data, the AAVE price is up by 4.3% on the weekly timeframe.

While the DeFi coin is far away from the critical $250 mark, the appropriate positive catalysts might be all it needs to cross this level in a few days. One such catalyst that could prove crucial is the rising activity of AAVE whales in recent days.

Data from Santiment shows that the AAVE token saw the largest increase in the amount of $100,000 whale transactions over the past week. The number of these large transactions skyrocketed by more than 267% in the highlighted period.