The post Bitcoin and Ethereum Funds Lost $876 Million Despite Trump’s Strategic Crypto Reserve Announcement appeared first on Coinpedia Fintech News

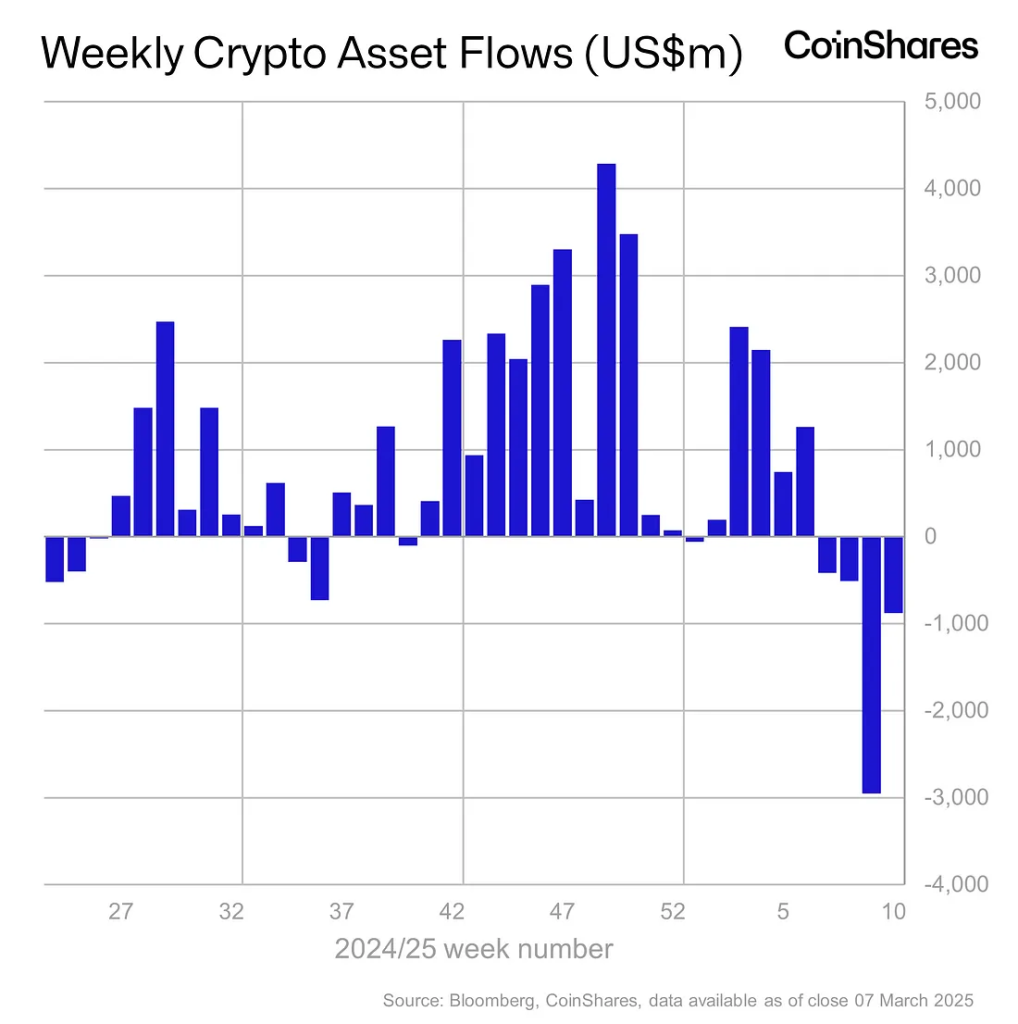

Despite President Trump implementing several crypto-friendly measures, such as creating a strategic crypto reserve, the market did not see an increase in buying demand. Last week, the crypto market experienced a decline, with major losses across Bitcoin, Ethereum, and other crypto exchange-traded products. According to a CoinShares report, crypto ETPs have collectively lost $4.75 billion over the past four weeks. Last week alone, $876 million was withdrawn from these funds.

Market Struggles Despite Strategic Crypto Reserve

Following President Donald Trump’s executive order to establish a strategic bitcoin reserve for the United States, the crypto market has seen a sharp decline. In the past week, there has been a significant exodus from crypto-related funds.

Investment products in the global crypto market, managed by major asset managers like BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares, experienced net outflows of $876 million last week. This decline was triggered by Trump’s decision to impose more tariffs.

This marks the fourth consecutive week of outflows, with a total loss of $4.75 billion during this period, reducing the year-to-date inflows to $2.6 billion. James Butterfill, CoinShares Head of Research, noted in recent report, “Although this indicates a slowdown in the pace of outflows, investor sentiment remains bearish.”

It’s probably not surprising to hear that U.S. investors withdrew $922 million from crypto funds, as mentioned in the report. This is happening at the same time President Donald Trump is raising a trade war with major trading partners like Canada, Mexico, and China.

Also read: Why Crypto Market is Crashing? Trump’s Tariff War Wipes Out $800 Billion

Also, last week, President Trump followed through on his promise to set up a national Bitcoin reserve and a stash of other cryptocurrencies. However, the way it was done seems to have disappointed many traders.

Assets under management at these funds have shrunk by $39 billion from their peak, bringing the total down to $142 billion. This is the lowest level observed since just after the U.S. presidential election in November.

High Inflation Boosts Market Decline

In the last month, outflows from ETFs have resulted in a 10% drop in the total cumulative inflows. This shows rising investor fear and suggests that many investors may have already filled their intended cryptocurrency allocations.

Besides tariffs, the rising US inflation is playing a key role in the recent crypto market crash. Given the U.S. jobs report released on Friday, the sentiment turned toward challenging weekend in the crypto markets. The report showed a rise in unemployment to 4.1%, putting the Federal Reserve in a tough spot to choose between focusing on economic growth or managing inflation, according to statement.

The Federal Reserve’s Open Markets Committee is scheduled to announce its decision on inflation on the upcoming March 19th. As of now, based on the CME FedWatch Tool, investors believe there’s approximately a 3% chance that the FOMC will decide to lower interest rates.