Ethereum (ETH) has officially lost the $2,000 mark, trading below this key level for the first time since 2023 and reaching its lowest point since October 2023. The price plummeted as low as $1,750, marking a dramatic drop from its December 2024 high of $4,100. This staggering 57% decline has created a difficult environment for bulls, as Ethereum struggles to find stability amid growing selling pressure.

The broader crypto market downturn, driven by macroeconomic uncertainty and risk-off sentiment, has left ETH in a vulnerable position, with traders unsure whether a bottom has formed or if further downside is ahead. The sharp decline in Ethereum’s value has intensified bearish sentiment, making it one of the worst-performing major altcoins over the past few months.

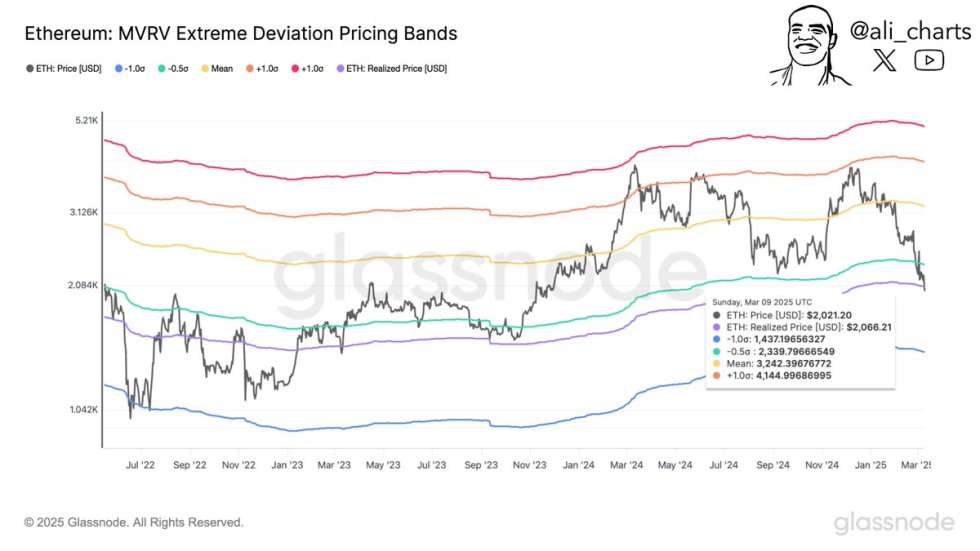

According to Glassnode data, Ethereum is testing key levels below $2,000 and above $1,800 based on the MVRV Pricing Bands. Historically, this range has acted as a major support zone, and its ability to hold will be critical in determining Ethereum’s short-term price direction. If ETH fails to stabilize, the market could be in for another wave of selling, potentially pushing prices even lower.

Ethereum Tests Critical Support As Market Struggles

The entire crypto market has suffered a major breakdown, mirroring the decline in U.S. stock markets as trade war fears and uncertainty surrounding U.S. President Trump’s policies weigh heavily on investor sentiment. Macroeconomic instability and volatility have been the primary market drivers since the U.S. elections in November 2024, and current conditions suggest that this trend is far from over.

Rising global trade war concerns and erratic decision-making by the U.S. administration have further fueled fear and uncertainty, sending the U.S. stock market to its lowest levels since September 2024. This risk-off environment has translated into increased selling pressure across the crypto market, with Ethereum (ETH) struggling to hold critical support levels.

Top analyst Ali Martinez shared insights on X, highlighting that Ethereum is now testing key levels based on the MVRV Pricing Bands. According to on-chain data, ETH’s Realized Price currently sits at $2,060, a level that has acted as crucial support in previous cycles. If Ethereum fails to hold above this mark, the next major downside target is around $1,440, which would represent a substantial drop from current levels.

With market conditions still fragile, the next few trading sessions will be crucial in determining Ethereum’s short-term trajectory. If ETH can hold above $2,060, it may have a chance to stabilize and attempt a recovery. However, if selling pressure intensifies, the market could see Ethereum test significantly lower price levels, adding to the growing uncertainty among investors.

ETH Struggles Below $2,000

Ethereum is currently trading at $1,900, following days of heavy selling pressure that have led to significant losses. ETH has failed to hold key levels, with the price dropping as low as $1,750 just a few hours ago, marking one of its lowest points in months. With the market under continued bearish control, bulls are now racing to reclaim the $2,000 mark in an effort to stabilize price action and shift momentum toward a potential recovery phase.

For Ethereum to regain strength, it must hold above current levels and push past $2,000 quickly. A break above this key resistance zone would indicate renewed buying interest, reducing selling pressure and allowing ETH to attempt a more sustained recovery. However, if ETH fails to reclaim $2,000, the market is likely to see a continuation of the downtrend, with further declines expected.

With Ethereum in a fragile position, the next few days will be crucial in determining whether bulls can step in to reverse the trend or if ETH will slide into deeper correction territory. Traders are closely watching price movements, as Ethereum remains at risk of further downside if key levels are not regained.

Featured image from Dall-E, chart from TradingView