The post Ethereum (ETH) Poised for 15% Rally, Eyes on $2,200 appeared first on Coinpedia Fintech News

Ethereum (ETH), the world’s second-largest cryptocurrency by market cap, has been gaining significant attention from crypto enthusiasts. Today, blockchain analytics platform Lookonchain made several posts on X (formerly Twitter), revealing that a whale has liquidated 160,234 ETH worth $306.85 million.

Crypto Insider Have Liquidated $306 Million Worth ETH

However, the buying level for this substantial ETH holding was around $1,900, with a liquidation level of $1,805. As the price fell below the liquidation level, the whale’s $306.85 million position was liquidated.

At press time, ETH is trading near $1,908, having registered a price surge of over 0.50% in the past 24 hours. However, during the same period, its trading volume dropped by 35%, indicating lower participation from traders and investors, potentially due to ongoing market uncertainty and significant price fluctuations.

Ethereum (ETH) Technical Analysis and Upcoming Levels

According to expert technical analysis, ETH appears bullish as it has regained momentum above the $1,900 level. Historically, this level has acted as a strong price reversal zone and a key area where assets experience buying pressure.

Based on recent price action and historical patterns, if ETH holds above the $1,800 level, it could surge by 15% to reach $2,200 in the coming days or even higher. At press time, the asset’s Relative Strength Index (RSI) signals a potential price reversal, as it has formed a higher high while ETH was making a lower low.

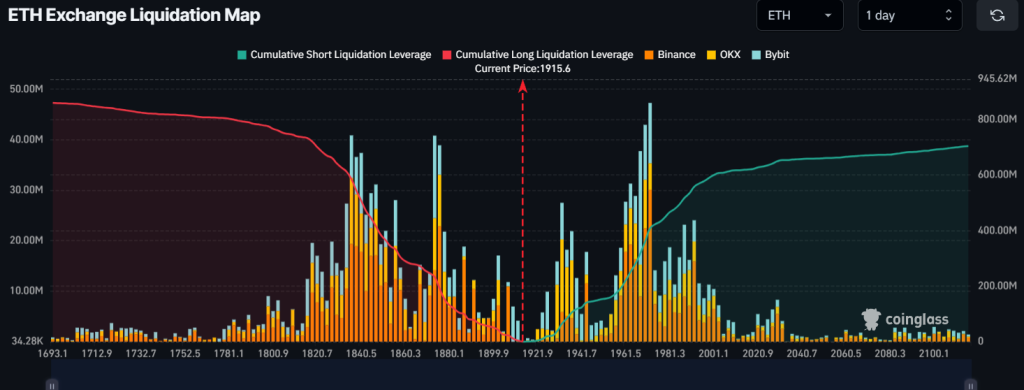

Major liquidation Level

At press time, the major liquidation levels are near $1,835 on the lower side and $1,970 on the upper side, with traders being over-leveraged at these levels, as reported by the on-chain analytics firm Coinglass.

Data further reveals that traders hold $585 million worth of long positions, while at the $1,970 level, they hold $410 million worth of short positions, indicating that bulls are strongly dominating the asset and could help it maintain itself above the crucial $1,800 support level.