Bitcoin (BTC) continues to face strong resistance below the $85K mark, with volatility and fear dominating market sentiment. After losing the critical $90K level, BTC experienced a sharp decline, briefly dropping below the $80K mark last week. Bulls have since attempted to stabilize the price, but selling pressure remains high, preventing any sustained recovery.

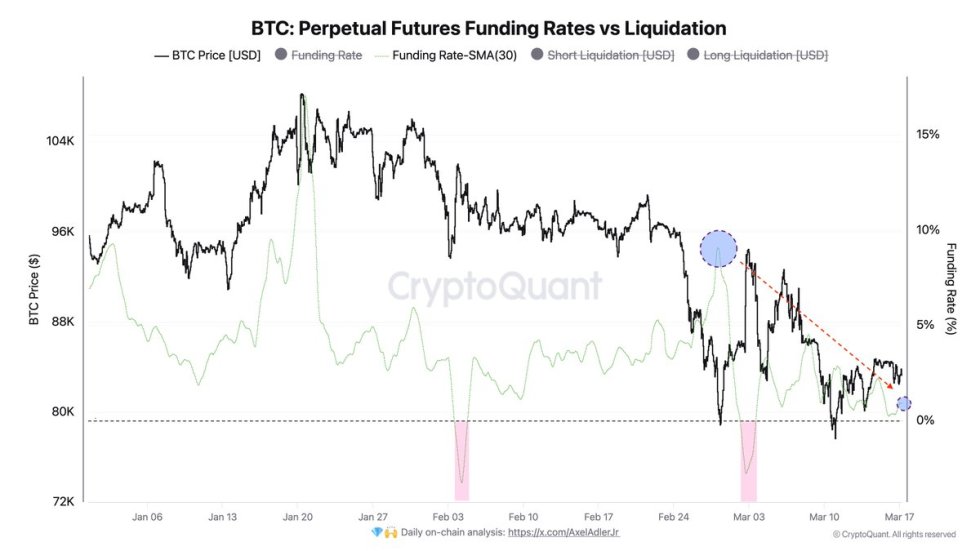

CryptoQuant data reveals that the average Funding Rate SMA (30) has decreased by 9% since the beginning of March. This trend indicates that negative sentiment continues to dominate as traders increasingly bet on further downside. A declining funding rate suggests that short positions are gaining traction, confirming the bearish speculation that has driven the market for weeks.

With BTC failing to reclaim lost ground, macro uncertainty and investor caution continue to weigh on the market. For Bitcoin to reverse its downward trend, bulls must regain control and push the price back above key resistance levels. If the bearish trend persists, BTC could face even lower levels, reinforcing concerns about the sustainability of the current cycle. The coming days and weeks will be critical in determining Bitcoin’s next major move.

Bitcoin Faces Bearish Trend As Market Struggles with Uncertainty

Bitcoin (BTC) is now trading at its lowest levels since late 2024, adding to concerns that this cycle may not deliver the expected gains. Many investors anticipated a rapid and strong rally this year, but instead, BTC has faced persistent selling pressure. Trade war fears and macroeconomic uncertainty have heavily impacted both the crypto and stock markets, leading to a prolonged downturn across risk assets.

Since the start of the month, Bitcoin is down nearly 20%, and there are no clear signs of a reversal yet. The bearish trend appears to be gaining momentum as BTC continues to struggle below crucial price levels. Despite this negative sentiment, Bitcoin’s fundamentals remain strong, with ongoing institutional adoption and US President Trump’s plans for a strategic Bitcoin reserve providing potential catalysts for a recovery in the long term.

Top analyst Axel Adler shared insights on X, revealing that the average Funding Rate SMA (30) has decreased by 9% since early March. According to Adler, if this trend continues throughout the week, funding rates could turn negative, signaling growing bearish sentiment and increased short positioning.

For Bitcoin to reverse this trend, bulls must reclaim key price levels, push BTC back above $90K, and regain momentum. Otherwise, continued negative funding rates and weak market confidence could drive further downside in the coming weeks.

BTC Trades Below Key Moving Averages As Bears Maintain Control

Bitcoin (BTC) is currently trading at $83,600, facing strong resistance at key moving averages. BTC has struggled to reclaim the 200-day moving average (MA) at $84,100 and the 200-day exponential moving average (EMA) at $85,500, keeping bulls on the defensive.

For BTC to regain bullish momentum, buyers must push the price above the $86,000 level and reclaim the crucial $90K mark. Breaking above these resistance levels would confirm a potential recovery phase, shifting sentiment away from the bearish outlook that has dominated the market.

However, if BTC fails to reclaim these levels, the risk of further downside increases. Losing the $83K–$84K range could result in a breakdown below $80K, potentially triggering another wave of sell-offs. With macro uncertainty still weighing on the market, bulls need to regain control soon to prevent further losses. The next few trading sessions will be critical in determining Bitcoin’s short-term direction.

Featured image from Dall-E, chart from TradingView